The Bitcoin derivatives market simply set new information as BTC continued its climb, breaking previous $118,000. Bitcoin’s Open Curiosity (OI) reached an all-time excessive, and together with it came visiting $1.25 billion in liquidations in a single day.

This surge highlights rising buying and selling participation. On the identical time, it raises questions in regards to the sustainability of the present development, particularly amid rising warnings of potential lengthy liquidations.

Extra Than $1.25 Billion Liquidated, 90% Had been Quick Positions

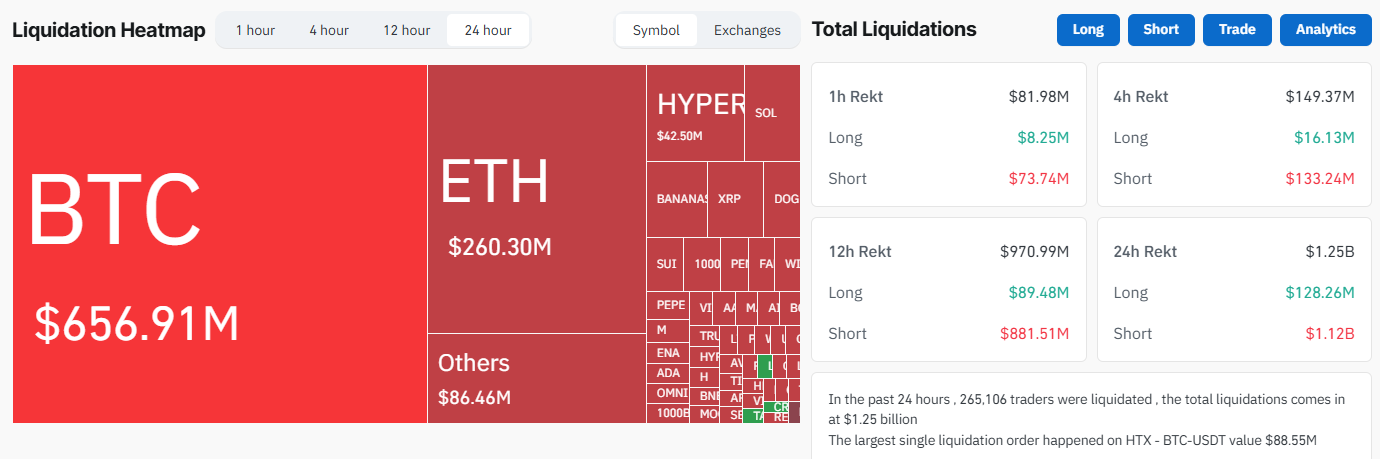

In accordance with liquidation knowledge from CoinGlass, complete market liquidations exceeded $1.25 billion over the previous 24 hours. Out of that, $1.12 billion got here from brief positions. Bitcoin alone noticed over $656 million in liquidations.

“Previously 24 hours, 265,106 merchants had been liquidated. The entire liquidations are available at $1.25 billion,” CoinGlass reported.

This means that merchants had closely guess on a market correction as soon as Bitcoin handed $112,000. However that correction by no means occurred.

One clear instance is James Wynn, a widely known dealer who regularly makes use of excessive leverage on Hyperliquid. In accordance with Lookonchain, Wynn’s leveraged brief place on BTC was totally liquidated in below 12 hours, and he misplaced $27,921.63.

As well as, Byzantine Common, an advisor at Velo, reviewed knowledge from a number of exchanges and concluded that this could be the most important brief squeeze on Bitcoin in years.

“That is the most important BTC shorts liquidation occasion in years,” he mentioned.

Extra Liquidations Could Be Coming as Open Curiosity Hits ATH

Liquidations may develop even bigger within the coming days. Open Curiosity (OI), which displays the full worth of futures contracts, simply reached a brand new all-time excessive this July.

Whole crypto market OI has now surpassed $177 billion, the very best stage on file. Bitcoin’s OI alone has hit $78.6 billion, one other file. This exhibits intense curiosity from merchants within the present market.

These new highs point out that the market is in a particularly delicate part. Excessive OI exhibits that many merchants are utilizing heavy leverage. Even a small value swing in Bitcoin may set off huge losses.

Dealer Sentiment Shifts from Quick to Lengthy

Market sentiment can be shifting. As BTC value rises, merchants are more and more transferring from brief positions to lengthy ones, betting that the rally will proceed.

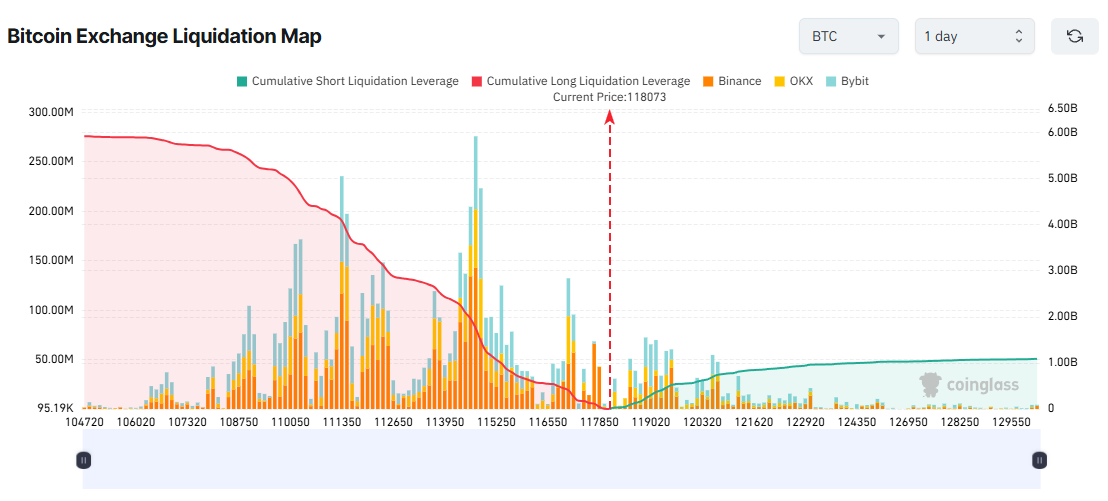

Coinglass liquidation heatmap exhibits that cumulative lengthy liquidations (proven in crimson on the left) on main exchanges now outweigh brief liquidations (in inexperienced on the precise). Analyst Joe Consorti warned of dangers on this setup.

“Lengthy liquidation leverage now outnumbers brief leverage 10:1 on this vary. Watch out on the market,” Consorti mentioned.

This shift means that Bitcoin and altcoins’ current rally has satisfied merchants to vary their expectations. Nevertheless, this optimism comes at a price. A shock information occasion or sudden volatility may nonetheless set off main losses.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.