Bitcoin’s explosive rally to a brand new all-time excessive above $117,000 has triggered a market-wide resurgence in buying and selling exercise, lifting altcoins.

One of many largest beneficiaries of this bullish wave is Ethena’s native token ENA, which has surged 25% prior to now 24 hours. This makes it the highest gainer available in the market in the present day.

ENA Leads the Cost as Spot Demand and Derivatives Exercise Explode

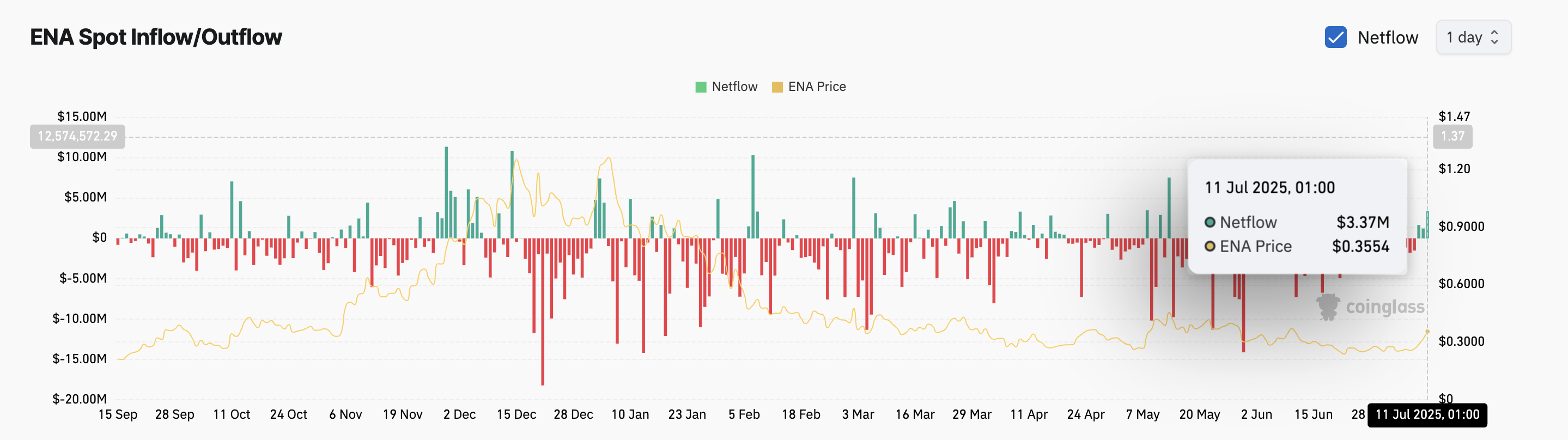

Now buying and selling at its highest degree in 30 days, ENA’s rally comes with a big spike in investor curiosity. Spot inflows into the altcoin have surged to a two-month excessive, signaling a fast enhance in demand from merchants trying to trip the bullish momentum of the previous 24 hours.

In accordance with knowledge from Coinglass, web inflows into ENA spot markets sit at $3.37 million on Friday, marking the token’s highest single-day influx since Might 12. This displays a pointy uptick in investor demand and rising confidence in ENA’s short-term prospects.

Spot inflows sign investor confidence and infrequently affirm the constructive shift in market sentiment towards an asset.

When web influx climbs, there is a rise within the buy of that asset within the spot market, the place transactions are settled instantly. This means an increase in demand for the asset, as consumers are prepared to amass it on the present market worth.

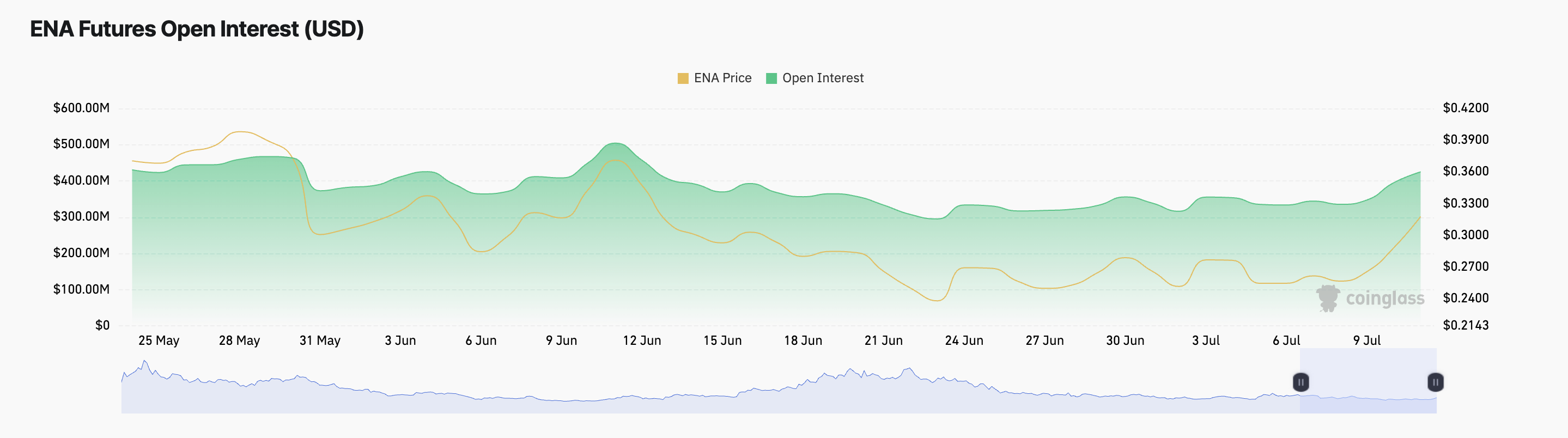

Furthermore, ENA’s futures open curiosity surged 8% over the previous 24 hours. It’s $425 million at press time — its highest degree since June 16.

An asset’s futures open curiosity measures the overall worth of its excellent futures contracts which have but to be settled. When it will increase, new cash is getting into the market.

This confirms the rising conviction in ENA’s upward motion, particularly as merchants place themselves to profit from additional worth appreciation.

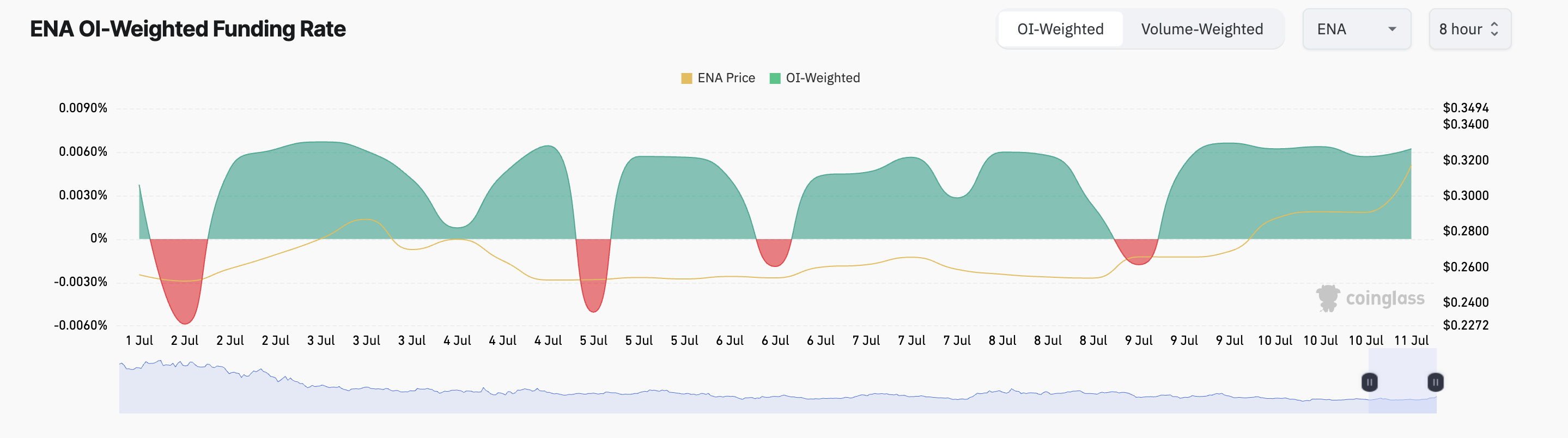

It’s mirrored in ENA’s funding price, which stands at 0.0062% on the time of writing. Funding price is a mechanism utilized in perpetual futures contracts to maintain their costs aligned with the underlying spot market.

ENA’s constructive funding price signifies that long-position holders are paying short-sellers a premium, suggesting a bullish sentiment amongst futures market individuals. It highlights merchants’ willingness to keep up leveraged lengthy positions in anticipation of additional worth good points.

With Bulls in Management, ENA May Break Via to Multi-Week Highs

Readings from the ENA/USD one-day chart present the altcoin buying and selling considerably above its 20-day exponential shifting common (EMA). At press time, this key shifting common kinds dynamic assist beneath ENA’s worth at $0.28.

The 20-day EMA measures an asset’s common worth over the previous 20 buying and selling days, giving weight to current costs. When worth trades above the 20-day EMA, it alerts short-term bullish momentum and suggests consumers are in management.

If this continues, ENA might lengthen its good points and rally towards $0.37. A profitable breach of this resistance degree might drive the altcoin to $0.41.

Nevertheless, if profit-taking strengthens, this bullish outlook shall be invalidated. If promoting stress will increase, ENA might witness a pullback and try to interrupt beneath the assist shaped at $0.32.

Disclaimer

In keeping with the Belief Venture tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.