Grayscale Analysis simply printed its Q3 2025 record of Property Underneath Consideration, detailing the tokens it’d embrace in a future funding product. Sadly, the agency didn’t clarify any of its decisions right here.

This record consists of 31 altcoin candidates, a decrease stage than its final three quarterly updates. Many altcoins have been both culled outright or changed with new candidates, and asset re-categorization makes a full account much more convoluted.

Grayscale’s Property Underneath Consideration Checklist

Grayscale, one of many largest Bitcoin ETF issuers, has a various vary of merchandise and different enterprise ventures. Periodically, its analysis arm publishes lists of promising altcoins and sector-specific funding suggestions.

The agency simply launched the Q3 2025 model of its “Property Underneath Consideration” record, containing a piece of helpful insights:

In comparison with Grayscale’s Q2 2025 record, this spherical of Property Underneath Consideration makes a number of substantial modifications. Whereas the earlier incarnation confirmed curiosity in 40 altcoins, at this time’s record solely contains 31.

That is fewer than each the Q1 2025 and This autumn 2024 lists, displaying a considerably narrowed window.

So, which altcoins appear most promising? Grayscale did a whole lot of trimming to make this record; for instance, the Q2 model had 12 altcoins within the “Good Contracts” class, whereas this one solely has seven. “Utilites & Companies” had 13, and this shrank to 4.

A full account of eliminated altcoins proceeds as follows: Babylon, Berachain, Celestia, MOVE, TRON, VeChain, Mantra, ELIZA, Immutable, Akash, FET, Arweave, Eigen Layer, Geodnet, Helium, and Sentient. Various cuts.

Comparatively, solely a handful of earlier Property Underneath Consideration acquired included in Grayscale’s present product choices.

Granted, Grayscale made a brand new class for AI tokens, and some members of the earlier record now be part of this class. Nonetheless, there are only some actual upsets.

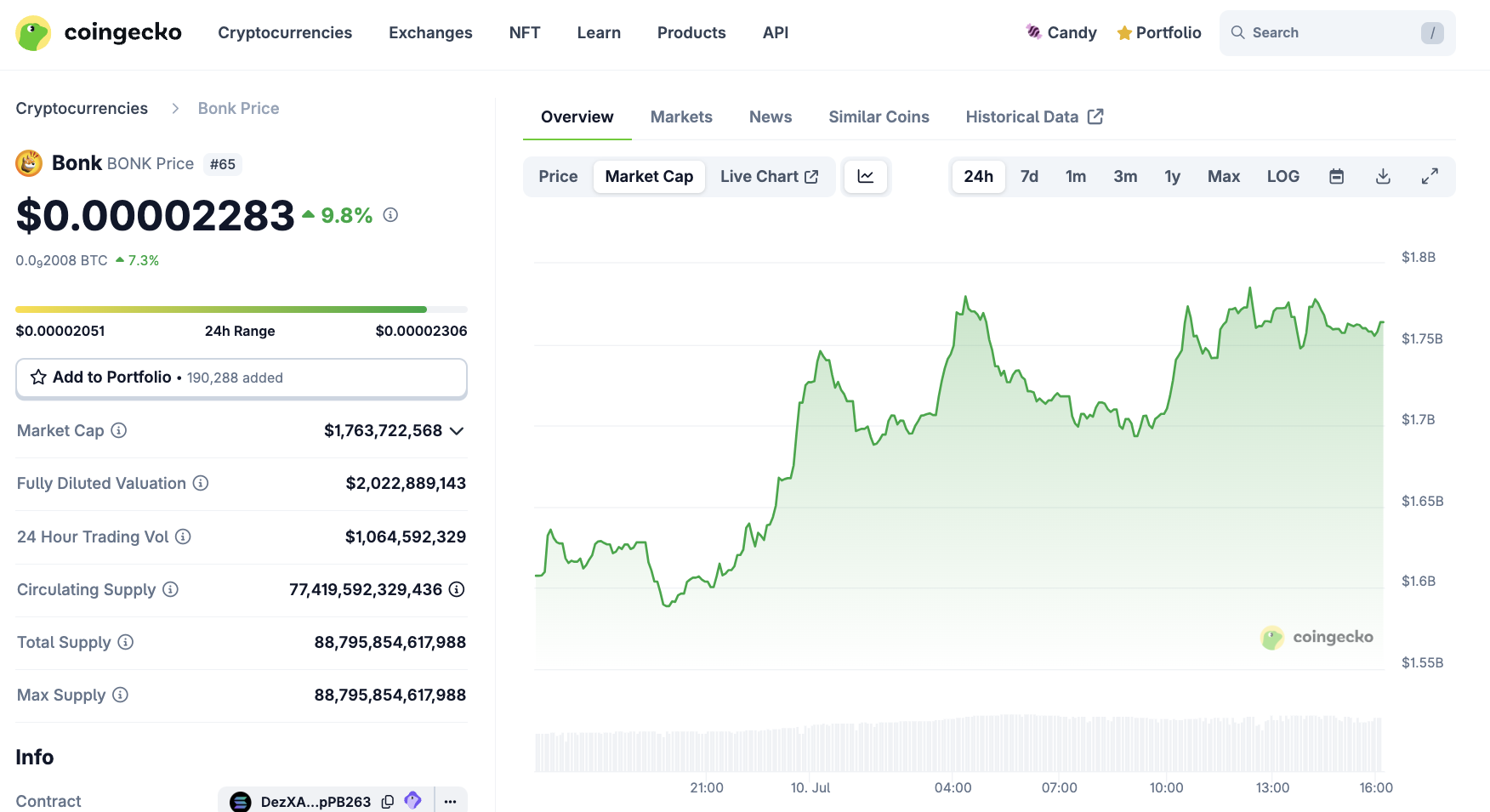

BONK, for instance, joins the record after every week of robust efficiency, persevering with to rise dramatically at this time:

Sadly, Grayscale didn’t present any particular rationale behind this set of modifications to its record. MegaETH, Monad, Lombard, Playtron, Prime Mind, and Story (IP) have an unsure standing, as Grayscale claims that these tokens don’t match into one among its most important asset classes.

The agency supplies detailed explanations in its High 20 lists, however Property Underneath Consideration all the time consists of uncooked information. It’s troublesome to utterly perceive Grayscale’s logic for all of those alterations.

Disclaimer

In adherence to the Belief Undertaking pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nevertheless, readers are suggested to confirm details independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please word that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.