Treasured metals fanatic Peter Schiff has sounded the alarm on silver’s rally, dismissing Bitcoin’s newest highs as nothing greater than a distraction. His feedback come as silver reclaims ranges not seen in over a decade, reigniting debates about the place true worth lies.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise, or different supplies on this web page.

For crypto traders, this highlights the continuing conflict between digital property and conventional shops of worth. As markets weigh Bitcoin’s record-breaking surge in opposition to silver’s underappreciated potential, deciding which asset holds extra long-term worth turns into essential.

This dialog additionally opens the door to discussions about the perfect crypto to purchase now. Silver is a utility-driven asset, whereas Bitcoin is essentially seen as a “retailer of worth.” The most effective crypto picks at the moment may be those who mix real-world utility with the viral momentum that helped Bitcoin go mainstream.

Schiff Takes Jabs at Bitcoin, Bets Huge on Silver’s Path to $50

Treasured metals advocate and entrepreneur Peter Schiff has been casting a highlight on silver’s latest power, whereas taking pointed digs at Bitcoin, dismissing it as a “distraction.” As Bitcoin blasted previous its all‑time highs this 12 months, Schiff highlighted that silver surged above $37 per ounce up virtually 2% in a single session, but silver mining shares barely budged.

He argued that after silver breaks above $40, a speedy transfer to $50 may observe, and that equities tied to silver extraction should not reflecting this close to‑time period upside. Schiff’s longstanding disdain for Bitcoin stays undiminished; whilst Bitcoin climbed to a file $118,839, he insisted that solely a wholesale shift to pricing every part in BTC would power him to rethink.

On the next buying and selling day, Schiff doubled down, noting silver flirting with $38 the very best worth since March 2012 and observing that silver and gold mining shares had been nonetheless muted regardless of bullion positive factors. His chorus was clear: “Traders are being distracted by Bitcoin.” Schiff views the sluggish response in treasured‑steel equities as a clue that the market is underestimating silver’s breakout potential.

But as Bitcoin continues to set contemporary information and draw institutional capital, his tunnel imaginative and prescient on metals might overlook crypto’s broader structural maturation. By underestimating blockchain’s disruptive attain and overestimating the value of conventional property, Schiff paints Bitcoin as a passing fad somewhat than a reputable monetary innovation.

Bitcoin Value Evaluation

Regardless of criticism from figures like Peter Schiff, Bitcoin continues its spectacular rally, lately breaking out of a two-month consolidation section late Thursday. This surge coincided with former President Trump saying new commerce insurance policies that rattled conventional inventory markets. The cryptocurrency soared previous $118,000 for the primary time, with some optimistic choices merchants even concentrating on ranges as excessive as $150,000.

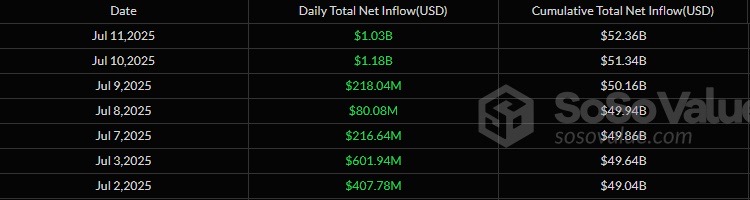

Bullish momentum is clearly constructing. Making waves, Bitcoin ETFs shattered their 2025 influx file on Thursday, June eleventh, attracting a large $1.03 billion as the value surged to new all-time highs.

At present hovering above $117,700 and pushing in the direction of $118,000, Bitcoin’s rise has considerably boosted the theoretical wealth of its nameless creator, Satoshi Nakamoto. Satoshi now ranks because the eleventh wealthiest particular person globally, simply forward of Michael Dell, Dell Applied sciences’ founder and CEO.

The following essential problem is the psychological $120,000 resistance degree; breaching that is key, although sellers would possibly emerge there. On the flip aspect, the $109,000 space proved dependable short-term assist throughout consolidation round July 8-10, the place patrons stepped in decisively earlier than the present breakout.

This transfer strongly resembles a breakout from the $109,000 assist base, characterised by strong inexperienced candles and growing buying and selling quantity – clear indicators of bullish power. A sustained shut above $120,000 would verify the breakout and certain gasoline additional positive factors. Conversely, falling again beneath $109,000 would point out a failed breakout and danger a deeper pullback.

With Bitcoin’s present uptrend, many analysts have turned overly bullish. Some, like Jake Brukhman, even argue that institutional traders aren’t bullish sufficient.

Greatest Crypto to Purchase Now

Schiff factors to the distinction between blockchain’s explosive progress and metals’ timeless worth. Bitcoin’s highs get all of the headlines, however silver’s low-key rally shows promise in mainstream markets. Portfolio balancing with each digital shortage and actual property is a components for long-term power. Traders ought to now search for the property that present each progress and stability throughout risky occasions.

Greatest Pockets Token

Greatest Pockets Token gives entry to a safe and dependable platform for managing digital property. The platform’s easy instruments are reportedly designed to supply peace of thoughts, very similar to silver’s regular progress in unsure markets.

Greatest Pockets is a best choice for cellular cryptocurrency customers, providing a safe, non-custodial pockets app for each iOS and Android. It combines comfort and robust safety, storing the non-public key instantly in your system with encryption.

Along with fashionable tokens like Bitcoin, Ethereum, and Dogecoin, Greatest Pockets additionally accommodates secondary tokens akin to ERC20 tokens. These might be added to your stability immediately and with ease.

Greatest Pockets is free for storing and receiving crypto, although there’s a small community payment for outgoing transfers. Customers may also swap tokens instantly by way of decentralized exchanges inside the app.

Past being a non-custodial pockets, Greatest Pockets serves as a full Net 3.0 ecosystem. One should buy cryptocurrencies utilizing native currencies by Visa, PayPal, and different strategies, whereas additionally accessing funding alternatives by its launchpad.

The platform’s intensive options, from token swaps to early-stage investments, make it a high contender for 2025, providing each safety and comfort for cryptocurrency customers.

Snorter

Simply as silver’s surprising rally stunned many, Snorter excels at uncovering undervalued alternatives. Its on-chain analytics establish hidden momentum, revealing breakout potential for Solana-based tokens earlier than the broader market notices. It’s perfect for traders seeking to keep forward.

Snorter ($SNORT) is a brand new crypto presale mission designed for merchants who’re at all times analyzing charts. The mission introduces Snorter Bot, a Solana-based buying and selling bot with low charges and fast execution.

The bot provides unique entry to new tokens, front-running safety, automated sniping, and rug-pull protection. All capabilities are managed by an easy-to-use Telegram interface, eliminating the necessity for a number of instruments.

$SNORT’s bot routinely buys tokens as quickly as they’re listed on exchanges. It can assist each EVM chains and Solana, with a full buying and selling API anticipated in stage 4 of the roadmap.

The mission additionally plans to kind DeFi partnerships, which ought to enhance the utility and recognition of $SNORT. The bot’s security options defend customers from dangers like honeypots and malicious bots. Famend crypto YouTuber 99Bitcoins believes Snorter has the potential to generate 100x returns.

$SNORT serves because the ecosystem’s native token, providing diminished buying and selling charges of simply 0.85% for holders. The tokenomics are designed to encourage long-term neighborhood involvement, with a capped provide of 500 million tokens.

Bitcoin Hyper

When Bitcoin reaches new highs, few tokens seize that momentum like Bitcoin Hyper. Designed for speedy publicity, it leverages Bitcoin’s actions, permitting one to learn from every cycle whereas staying aligned with the community’s long-term potential.

Bitcoin Hyper addresses the constraints of Bitcoin by providing a extremely scalable community with good contract assist. This permits builders to construct decentralized apps (dApps) and opens up new alternatives for Bitcoin yield.

It employs a non-custodial bridge, permitting customers to deposit Bitcoin, which is then wrapped and unlocked on the Layer 2 aspect. This course of makes use of zero-knowledge proof cryptography to make sure safety.

The staking rewards on Bitcoin Hyper change dynamically primarily based on the quantity deposited into the staking pool. This provides an incentive for customers to behave shortly and lock in greater returns.

Bitcoin Hyper addresses key scalability points and governance challenges which have hindered Bitcoin’s programmability. Its revolutionary strategy provides a sensible answer to unlock Bitcoin’s full potential.

Conclusion

Peter Schiff’s relentless give attention to silver versus Bitcoin highlights a deeper debate over which property deserve heart stage. His view displays an everlasting belief in tangible shops of worth, however Bitcoin’s unbroken rally and rising institutional adoption underscore crypto’s rising legitimacy. This has created a worry in Peter, maybe irrational, that voices like his may turn into irrelevant if the cryptocurrency market retains rising.

Nonetheless, it’s this very worry that traders ought to leverage to search out the perfect crypto to purchase now. As extra skeptics come ahead to name crypto’s rise a distraction, extra rebellious traders, pushed by their perception in digital property, emerge, fueling blockchain innovation and unlocking distinctive funding alternatives.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t answerable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, instantly or not directly, for any harm or loss induced or alleged to be attributable to or in reference to use of or reliance on any content material, items or companies talked about.