- A parabolic Bitcoin rally to $200K–$300K by Christmas might be in play, says analyst apsk32.

- Falling greenback and potential Fed price cuts might set off a broad crypto surge.

- Bitcoin ETFs have captured 70% of gold’s inflows, signaling rising institutional confidence.

So right here we go once more—Bitcoin is likely to be gearing up for a loopy end-of-year run. In response to an nameless analyst who goes by apsk32, we may see BTC hovering towards the $200K and even $300K vary earlier than Santa exhibits up. Sounds nuts? Possibly. However this isn’t simply hype—it’s primarily based on a cool little mannequin referred to as the “energy legislation.”

Mainly, Bitcoin’s long-term development has this exponential curve it sorta follows. This “energy legislation” trendline exhibits the place BTC ought to be, over time. Proper now? BTC’s value is forward of that curve by about two years. In less complicated phrases—Bitcoin’s shifting quicker than it must be, and that normally means we’re headed for a blow-off high. The type we noticed in 2013, 2017, and 2021.

“79% of the time, BTC’s been decrease than it’s now,” apsk32 identified. “The highest 20%? That’s excessive greed territory.” That zone, between $112K and $258K, is the place issues are likely to go… wild. If the sample holds—and who is aware of if it should—Bitcoin may contact $300,000 by the tip of December. Then? Effectively, we most likely cool off into early 2026.

Macros Level to Extra Gas for Bitcoin

It’s not simply charts and math behind the bullish case. Rails CEO Satraj Bambra chimed in too, telling Cointelegraph that the macro winds are blowing in Bitcoin’s favor. Assume: falling rates of interest, a softer U.S. greenback, and possibly even a brand new face on the Fed. If these issues hit ? We may see a monster rally throughout the risk-on world—with BTC entrance and heart.

Bambra additionally flagged the U.S. Greenback Index slipping under 100 as a key sign. If that occurs, it may imply extra price cuts and stimulus are on the desk. He’s not shy along with his numbers both—he sees BTC doubtlessly pushing all the best way to $500K if issues break good. “Two forces will drive this subsequent wave,” he stated. He didn’t spell them out absolutely, however we are able to guess: macro + momentum.

Spot ETFs? They’re Quietly Catching As much as Gold

Let’s not overlook concerning the spot Bitcoin ETFs. Yeah, the identical ones that had a tough begin to 2025. Now they’ve bounced again—massive time. In response to Ecoinometrics, they’ve captured about 70% of gold’s inflows this yr. That’s an indication. Establishments are lastly getting extra comfortable with BTC as an actual asset—not only a speculative play.

And Bitcoin nonetheless acts like a “risk-on” asset. Over the previous 12 months, it’s moved considerably in sync with the Nasdaq 100. However the actually fascinating bit? Its correlation with gold is low. Identical with bonds. So for portfolio builders, BTC’s kinda in its personal lane.

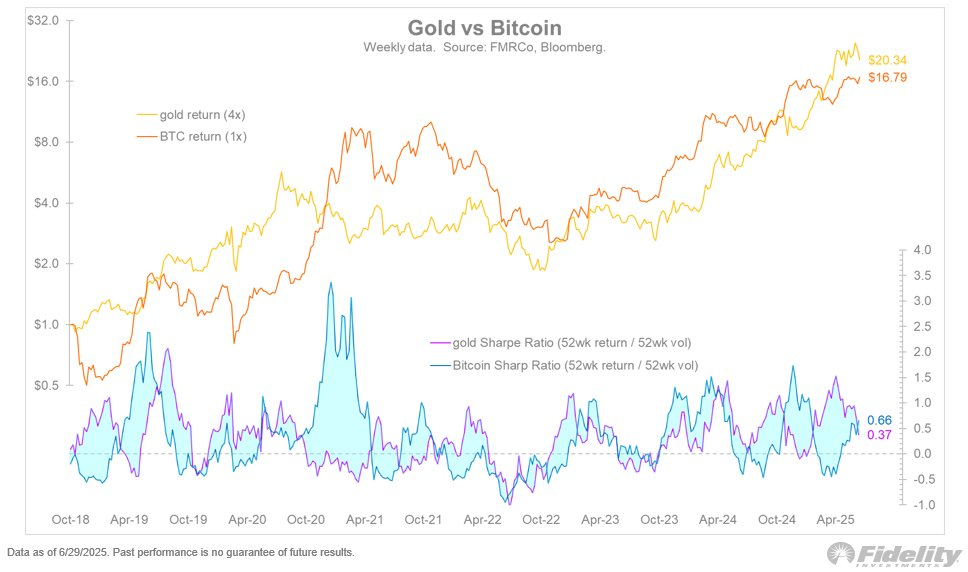

Even Jurrien Timmer from Constancy is on board. He lately stated the “baton” has handed again to Bitcoin. The Sharpe ratio—which measures how a lot bang you get to your danger—is tightening between BTC and gold. BTC’s not fairly there but, but it surely’s catching up. Gold’s at $20.34 in efficiency phrases. Bitcoin? Simply behind at $16.95. Not unhealthy for one thing that was referred to as a bubble yearly since 2013.