- SUI broke towards the highest of its triangle after gaining 9%—now flirting with the $3.5 breakout line.

- Futures information exhibits sturdy purchaser aggression, and Open Curiosity is rising quick.

- Shorts are getting liquidated arduous, which can add gas to a bigger breakout if bulls preserve stress on.

Sui (SUI) has been caught in a symmetrical triangle for what seems like without end—simply grinding sideways, teasing each bulls and bears. However now? It’s getting fascinating. The chart’s tightening arduous, and the newest value push is bumping proper up in opposition to resistance.

The SUI community simply handed 225 million whole accounts, which, let’s be sincere, is not any small feat. Customers are clearly displaying up. Value-wise, it tapped $3.53 not too long ago—up over 9% in a single day. That’s a clear pop towards the triangle’s higher edge. If it breaks above this degree and holds, issues might transfer shortly.

However like all the time in crypto… nothing’s assured. Momentum’s gotta present up.

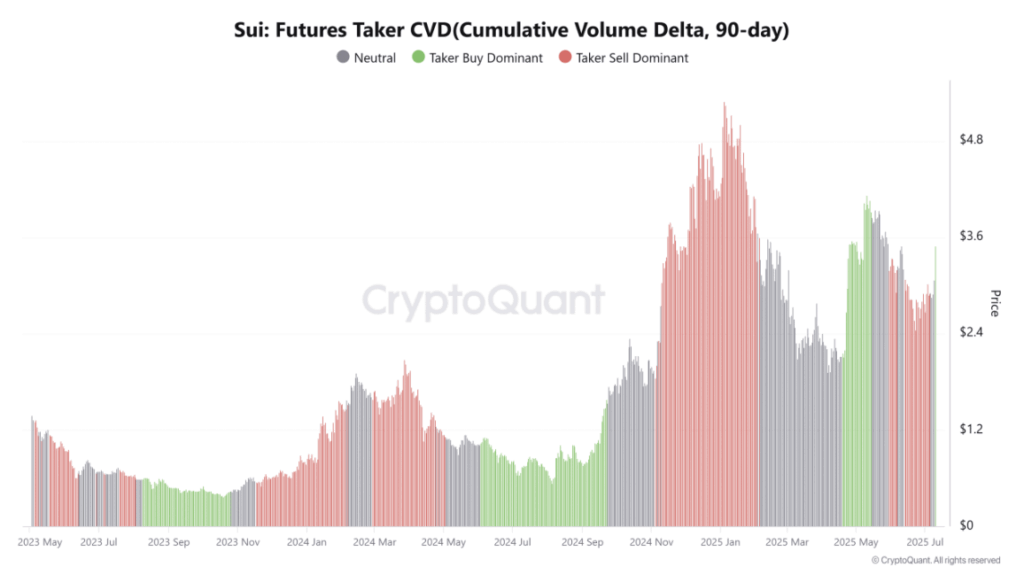

Futures Merchants Are Getting Aggressive

Zooming out a bit, the Futures Taker CVD is flashing some stable alerts. For the previous three months, it’s been leaning bullish—patrons outnumbering sellers, and never simply by somewhat. Takers have been loading up on buy-side orders with regular confidence.

That sort of persistent stress is often no accident. It strains up fairly clear with the latest value motion too. If this tempo retains up, a breakout from the triangle might come sooner slightly than later. However the market wants follow-through. In any other case, it’s simply noise.

Open Curiosity Is Heating Up

Derivatives merchants are additionally entering into the ring. Open Curiosity jumped over 12%, now sitting round $1.59 billion. That’s a decent-sized pile of capital betting on a transfer, a technique or one other.

Usually, rising OI plus stable purchase stress hints at volatility forward—almost definitely to the upside if patrons preserve management. However hey, no stress, proper? If bulls drop the ball, the market might whip again quick and shake out the overleveraged people.

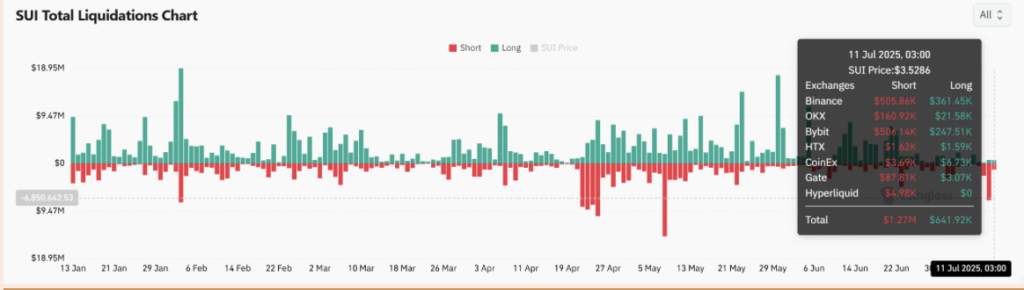

Shorts Are Beginning to Sweat

Talking of leverage, shorts are already feeling the squeeze. Liquidations on bearish bets hit $1.27 million, double the lengthy aspect. That’s a transparent signal that some sellers obtained caught flat-footed throughout this newest push.

And when shorts get liquidated in clusters, costs often spike shortly. That creates what merchants name a suggestions loop—extra liquidations result in extra shopping for, which ends up in much more quick ache.

In brief (no pun), bears are on the again foot. One mistaken transfer they usually’re toast.

Closing Ideas: Can SUI Maintain the Line?

SUI’s technical setup is getting tougher to disregard. Tight sample, purchaser dominance, open curiosity climbing, shorts getting blown out—it’s all there. However now comes the arduous half.

It has to interrupt—and keep—above $3.5. That’s the important thing. With no every day shut above that degree, this might simply be one other fakeout in a protracted listing of fakeouts.

But when the bulls maintain the wheel and sentiment stays optimistic, SUI is likely to be able to lastly rip.