Ethereum ETFs are exhibiting robust efficiency proper now, with yesterday’s inflows marking the asset class’s eighth-best day in historical past. Relying on at this time’s efficiency, July may be essentially the most worthwhile month for the property in 2025, solely after 11 days.

Company holders are consuming ETH at unimaginable charges, splitting consideration between ETF issuers and common whales. In the meantime, Ethereum’s worth has risen practically 20% in per week, reflecting robust demand after Bitcoin’s all-time excessive.

Ethereum ETFs Increase On Wall Avenue

Ethereum has been doing properly these days, crossing the $3,000 worth level for the primary time since February as company funding surges. This good efficiency is mirrored in ETH’s varied derivatives, that are additionally receiving large money inflows.

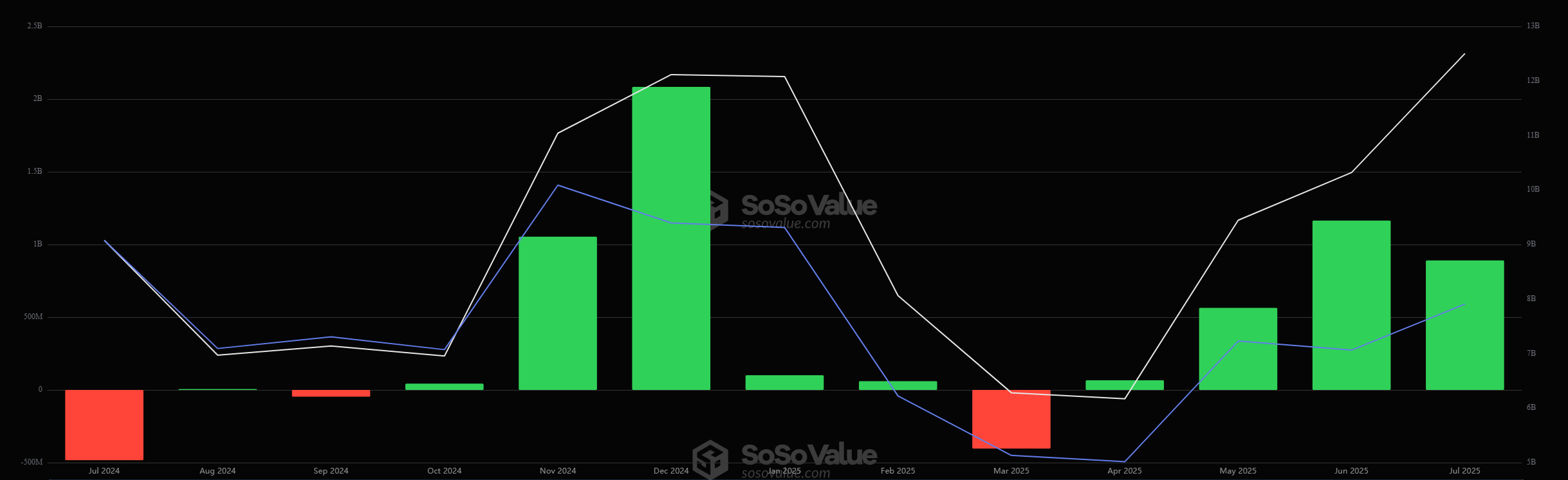

US spot Ethereum ETFs are on a roll proper now, seeing $890 million in month-to-month inflows on high of two straight months of large positive aspects:

Certainly, relying on how these merchandise carry out at this time, July would possibly change into ETH ETFs’ most worthwhile month in 2025. The Ethereum ETFs have existed within the US for lower than a yr, however they’re resurgent proper now.

If this development continues, this asset class will enter its largest bull run since its inception in July 2024.

Most notably, the demand for Ethereum is seemingly outpacing Bitcoin ETFs, which have been the far superior asset selection amongst US institutional buyers.

Over the previous 9 days, ETFs have purchased practically 380,000 ETH tokens, greater than the web newly issued tokens for the reason that 2022 Ethereum Merge.

Moreover, common company holders are shopping for practically the identical quantity, additional working up the demand for ETH.

Moreover, some Ethereum ETF issuers are performing significantly ravenous of their consumption habits. BlackRock alone holds 1.5% of circulating ETH tokens, representing practically $4.5 billion in complete holdings.

BlackRock’s agency dedication is subsequently affecting provide and demand from each ends, consuming all out there tokens to supply extra oblique publicity.

It will likely be attention-grabbing to see how these market dynamics mature within the coming weeks. If these ETF tendencies proceed, it might assist assure a sustainable worth rally for ETH within the quick time period and doubtlessly strengthen the probabilities for an altcoin season in Q3.

The publish US Ethereum ETFs Set For Their Greatest Month Since SEC Approval appeared first on BeInCrypto.