Financial institution of England Governor Andrew Bailey has warned towards permitting main banks to challenge their very own stablecoins.

This clearly contrasts with the US, the place stablecoin adoption stays one of many largest agenda gadgets in Trump’s push to make the US a crypto capital of the world.

Bailey Favors Tokenized Deposits Over Stablecoins to Safeguard Monetary Stability

Bailey cited dangers to monetary stability, lending capability, and the potential for large-scale cash laundering as causes for his choice for banks adopting tokenized deposits.

This implies the BoE chief favors digital variations of conventional cash versus creating or supporting privately issued stablecoins.

His remarks come amid ongoing transformation within the world monetary system, with the strains between conventional banking and decentralized finance (DeFi) more and more changing into blurred.

Bailey’s place displays deep concern throughout the UK’s central banking management that the unchecked rise of stablecoins might undermine the core features of recent banking, that are financial management and credit score creation.

“If stablecoins take cash out of the banking system, banks have much less capability to lend,” Bloomberg reported Bailey’s warning, citing an interview with the Instances.

The BoE governor additionally argued that monetary establishments’ mass adoption of stablecoins might result in disintermediation, liquidity imbalances, and a heightened danger of sudden withdrawals, particularly in periods of market stress.

Notably, such a state of affairs is termed a Financial institution run, akin to what occurred through the FTX collapse.

It aligns with a latest report, the place European officers warned that USD stablecoins threaten euro sovereignty and stability.

In opposition to this backdrop, MiCA rules introduce strict guidelines to spice up euro-backed digital innovation.

Stablecoin Crime Dangers and a Rising UK–US Coverage Divide on Digital Cash

Bailey, who additionally chairs the Monetary Stability Board (FSB), a key world physique overseeing systemic monetary dangers, prolonged his critique to incorporate considerations over monetary crime.

With huge sums doubtlessly shifting by personal stablecoin networks outdoors regulated channels, he stated there’s an elevated hazard of enabling legal actions corresponding to cash laundering, with out ample oversight or safeguards.

This stance places the UK at odds with the US below President Donald Trump, whose administration has taken a much more permissive strategy.

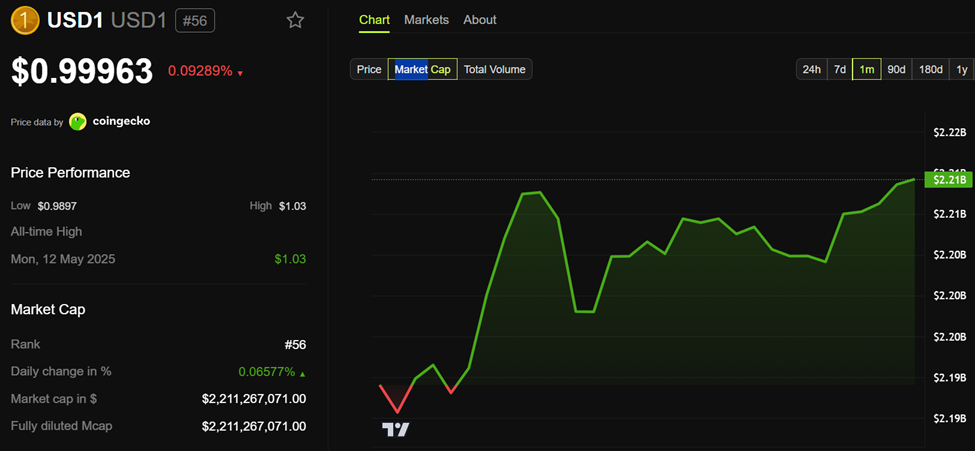

New US laws lays the groundwork for regulated stablecoin adoption below the GENIUS Act. In the identical manner, it units the stage for a Trump-affiliated dollar-backed stablecoin, USD1, which has already amassed a $2.2 billion market cap.

The UK, against this, seems extra cautious, preferring a mannequin that integrates digital finance into current financial infrastructure fairly than bypassing it.

“Because of this rising concern with US stablecoins, the ECB has as soon as once more underscored the necessity for the digital euro as a doable counterweight,” Financial Governance and EMU Scrutiny Unit (EGOV) stated not too long ago.

Bailey’s feedback additionally forged doubt on the prospect of a central financial institution digital forex (CBDC) within the UK. He hinted that issuing a digital pound could also be pointless, calling it “wise” for the UK to focus as an alternative on digitizing business financial institution deposits.

The BoE chief says this mannequin is extra appropriate with the present banking system and fewer disruptive to financial coverage transmission.

In the meantime, his choice for tokenized deposits alerts a broader push to modernize funds and settlement rails whereas preserving banks’ position as credit score intermediaries.

The publish Financial institution of England Chief Sounds Alarm on Huge Financial institution Stablecoin Issuance appeared first on BeInCrypto.