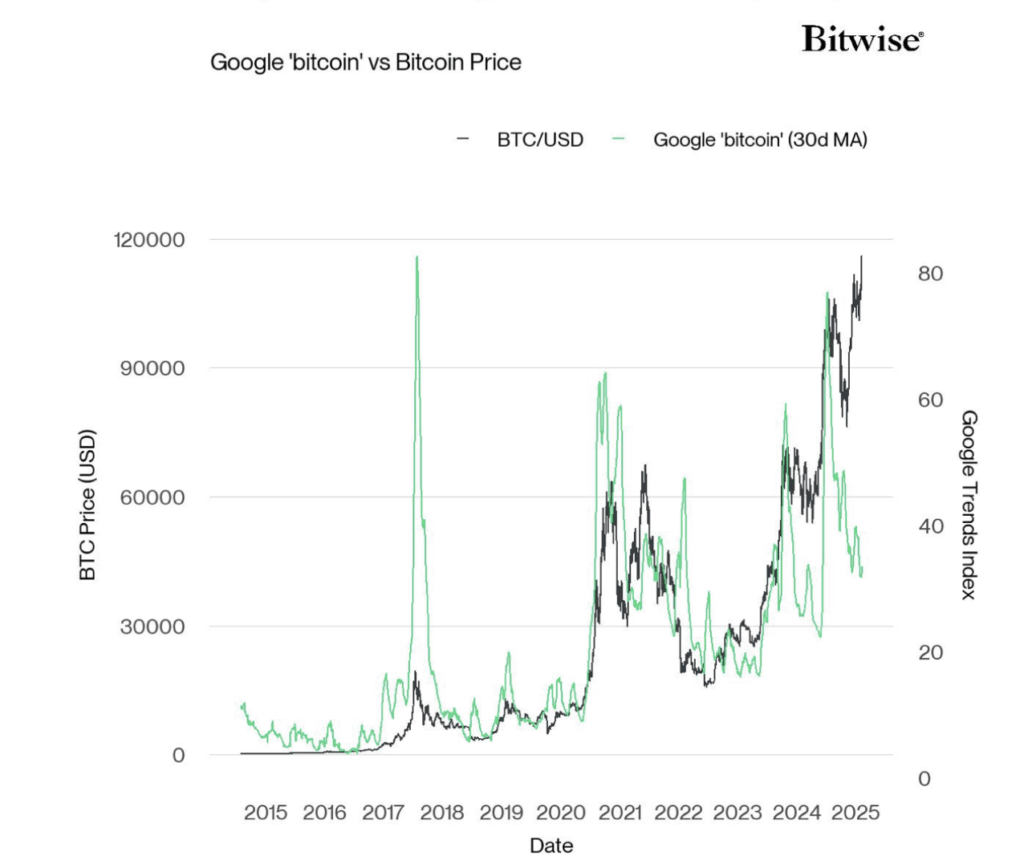

- Bitcoin hit $118K, however Google searches barely moved—retail curiosity stays low.

- Establishments are the primary drivers, with spot ETFs seeing over $2.7B in inflows final week.

- Analysts counsel retail buyers really feel priced out, however others say the bull run is way from completed.

Bitcoin simply smashed via new all-time highs—once more. It’s been a wild week, with the value topping $118K. However oddly sufficient, the same old retail hype? Nowhere to be discovered.

Whereas establishments are pouring cash in like there’s no tomorrow, common people on the road? Kinda quiet. You’d count on engines like google to gentle up. They didn’t.

Establishments Are Driving This One

Bitwise’s head of analysis, André Dragosch, identified one thing bizarre on X—Bitcoin’s value is on hearth, however Google search curiosity barely budged. “Retail is sort of nowhere to be discovered,” he mentioned. “Newest leg up is generally pushed by establishments.”

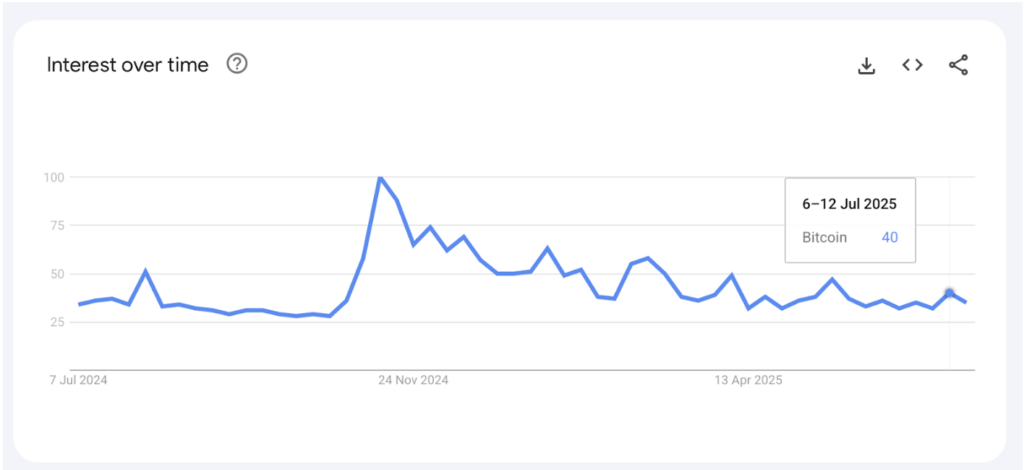

He’s not fallacious. Information from Google Developments confirmed solely an 8% bump in international search curiosity for “Bitcoin” through the week it made these record-breaking strikes. Not unhealthy—however not nice both, contemplating the coin jumped from $111K to $118K in only a couple days.

And get this—search curiosity continues to be 60% decrease than it was again in November, the week after Trump’s win triggered a month-long rally to $100K. Looks like the group that helped gasoline that run is sitting this one out.

Is Retail Simply… Over It?

Some Bitcoiners assume common buyers really feel like they missed their shot. Lindsay Stamp summed it up on X: “I feel a variety of retail people discover out the value of 1 Bitcoin is 117k and assume, nahhh I missed the boat.” Yep, sounds about proper.

Cedric Youngelman from the Bitcoin Matrix podcast added, “At what Bitcoin value do you assume retail wakes up?” His guess? “I don’t assume they’re coming for a very long time.”

And hey, perhaps that’s true. However not everybody’s satisfied the highest is in. Analyst Willy Woo chimed in, saying this run “has loads of legs left.” Translation? We’re not completed but.

ETFs Are Scorching, Even If Google Isn’t

In the meantime, behind the scenes, Bitcoin ETFs are raking it in. Thursday and Friday noticed back-to-back $1 billion+ influx days—first time that’s occurred. Over the complete week? $2.72 billion in inflows, based on Farside.

Some people are actually questioning: if these ETF shares are ending up with retail holders, perhaps we’re underestimating what number of common individuals are shopping for Bitcoin… simply indirectly on-chain.

So yeah, retail could be quieter this time. However with ETFs booming and establishments piling in, the market’s nonetheless very a lot alive.