Briefly

- Bitcoin surged to a brand new all-time excessive after breaking via robust resistance ranges.

- Bitcoin ETFs proceed to soak up promoting strain, appearing as a decided catalyst for upward momentum.

- Technical indicators counsel BTC nonetheless has extra room to run, even within the quick time period.

Bitcoin, the crypto market’s flagship asset, is portray a compelling breakout story, decisively conquering two main buying and selling limitations that had been standing in the best way of a short-term bull run. And with BTC as soon as once more breaking value information and firmly above the $112,000 resistance degree, what ought to merchants count on subsequent?

First, some context: With the S&P 500 and Nasdaq Composite closing at file highs for the third time in 4 classes and gold futures buying and selling at $3,370 an oz., threat belongings throughout the board are catching a bid because the Federal Reserve maintains its affected person stance on financial coverage.

Bitcoin’s momentum additionally coincides with blowout U.S. jobs information, with non-farm payrolls rising 147,000 in June versus forecasts of 110,000. Whereas robust employment information initially despatched Bitcoin under $109,000 on price hike fears, the market rapidly absorbed the promoting and pushed to new native highs.

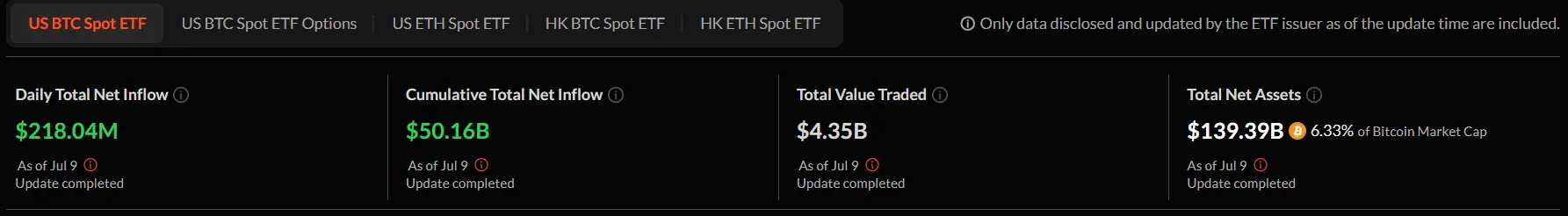

Institutional adoption continues as the first narrative driver. July has already seen Bitcoin ETFs pushing cumulative flows to over $50 billion. This persistent institutional bid gives essential help throughout any pullbacks and validates Bitcoin’s evolution from speculative asset to portfolio allocation.

The convergence of technical breakouts and institutional accumulation has merchants questioning what comes subsequent as Bitcoin has seemingly now crossed the ultimate hurdle on its path into uncharted territory.

Bitcoin charts: Double breakout targets remaining resistance

Bitcoin’s surge to $113K marks new all-time excessive territory and is a decisive technical breakout from two constraining patterns which have capped value motion for weeks.

The 4-hour chart reveals a clear break above a symmetrical triangle formation, whereas the every day timeframe exhibits much less bullish momentum with smaller actions.

That is anticipated in this sort of sample, however such an extended candlestick leaves little room for doubt. The breakout affirmation is obvious—sufficient to show nearly all the important thing indicators to bullish in intraday timeframes.

On the four-hour charts, the Common Directional Index, or ADX, is at 27. This sometimes confirms a trending market. ADX measures pattern energy, no matter path, and when it crosses above 25, it indicators to momentum merchants {that a} sustainable pattern is forming, typically triggering systematic shopping for from trend-following methods.

Nonetheless, the Relative Energy Index, or RSI, at 75 exhibits Bitcoin in overbought territory. Consider RSI as temperature gauge of the market. When it will get too scorching, it indicators to merchants that it might headed for a settle down. On this case, it might level to a necessity for a correction someday quickly after such an enormous spike. That stated, Bitcoin has seen increased RSI ranges whereas preserving its bullish momentum.

The Squeeze Momentum indicator on the every day chart exhibits “off” standing, indicating volatility has already been launched from the latest compression—as anticipated from prior evaluation. This implies the preliminary breakout transfer has performed out, and merchants ought to put together for both continuation or consolidation at these ranges.

Total, costs are displaying bullish indicators. Though a continuation of the bullish pattern is probably going, a correction wouldn’t appear harmful for the pattern because the correction candlesticks have closed with minor actions normally.

The every day chart additionally presents a bullish construction with a number of confirming indicators with Bitcoin escaping a descending bearish channel that has contained costs because the Could highs (the yellow strains on the chart above).

There now seems to be a bullish help in formation (the white line within the chart above) utilizing the every day lows from April’s pullback and late June as reference factors. If that is confirmed, Bitcoin may very well be bouncing round this help, sustaining its bullish momentum with 110K changing into a brand new help by the top of the month.

On the every day charts, the RSI at 67 signifies wholesome momentum with out approaching overbought territory above 70—suggesting room for additional upside. This studying tells merchants that purchasing strain stays robust however hasn’t reached excessive ranges that sometimes precede corrections.

The ADX at 12 on the every day chart exhibits the pattern continues to be creating and there’s nonetheless not sufficient dominance to name it an outlined sample as shorter time period charts typically include a whole lot of noise. Whereas under the essential 25 threshold that confirms robust directional motion, this low studying after a breakout typically signifies the calm earlier than acceleration. Merchants interpret this as accumulation earlier than the following impulsive transfer increased.

Transferring common evaluation reveals Bitcoin buying and selling nicely above each the 50-period and 200-period EMAs on a number of timeframes. The increasing hole between these averages—generally known as transferring common divergence—sometimes signifies robust trending circumstances and acts as dynamic help throughout pullbacks.

Key Ranges:

- Speedy help: $110,197 (breakout retest degree)

- Sturdy help: $105,000-$108,700 (Assist line)

- Projected resistance: $115,000 (measured transfer goal from triangle breakout and the Fibonacci extensions)

What’s subsequent for Bitcoin?

The convergence of technical breakouts, institutional flows, and supportive macro circumstances place Bitcoin for a possible continuation of the bullish pattern previous the all-time excessive resistance. Nonetheless, merchants with a proclivity for technical evaluation ought to monitor the every day ADX for a transfer above 25 to substantiate pattern energy, whereas looking forward to any RSI divergences on failed makes an attempt at new highs.

Merchants on Myriad, a prediction market developed by Decrypt’s guardian firm Dastan, are decidedly bullish on the upward pattern. Myriad customers now place the chances of Bitcoin by no means dropping under $100K all through the month of July at 81%. It is a near-lock, at 90%, that Bitcoin holds above $109,000 by the top of week, with the chances rising by a whopping 40% in a single day.

Likewise, Myriad customers at the moment are extra sure than ever that BTC hits $115K nicely earlier than it drops again all the way down to $95K, the chances rising from 69% to 87% during the last day.

Zooming out, July might nonetheless show unstable for Bitcoin, with Trump administration insurance policies together with the “Massive Stunning Invoice” doubtlessly widening the U.S. deficit by $3.3 trillion—traditionally bullish for scarce belongings like BTC. Moreover, the July 22 deadline for the White Home’s report on crypto government orders, with potential updates on the U.S. Strategic Bitcoin Reserve, looms as a wildcard catalyst.

Disclaimer

The views and opinions expressed by the writer are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Day by day Debrief Publication

Begin daily with the highest information tales proper now, plus authentic options, a podcast, movies and extra.