Cardano (ADA) climbed 3.8% over the previous 24 hours, reaching $0.736, as a mixture of technical breakout, Bitcoin momentum, and a high-profile treasury transfer from Enter Output World (IOG) fueled bullish sentiment.

On July 13, ADA broke decisively above the $0.74 resistance degree—a barrier that had held since Could—signaling a possible pattern reversal. The breakout triggered algorithmic shopping for and a cascade of quick liquidations, serving to the value bounce over 27% for the week.

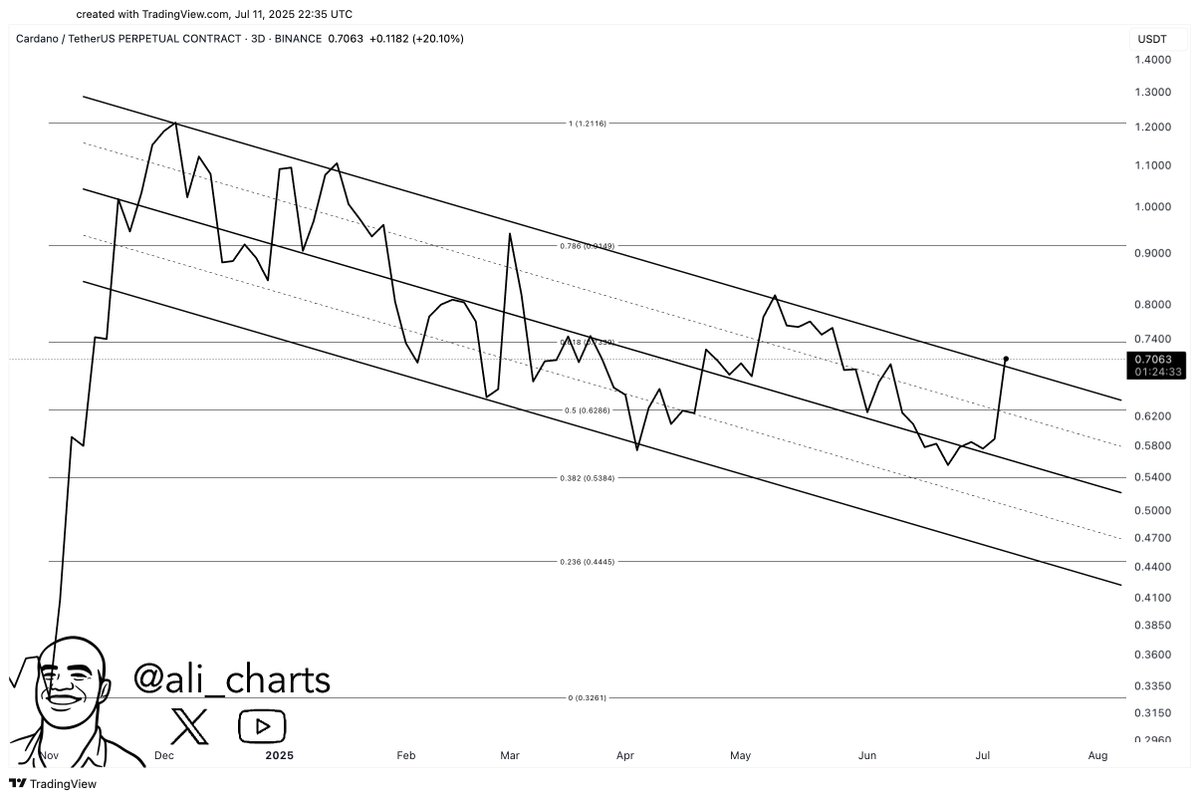

In accordance with crypto analyst Ali Martinez, Cardano is now “breaking by a key resistance degree, opening the door for a rally to $0.90–$1.20.” His chart reveals ADA escaping a months-long downward channel, which had constrained the asset since early 2024. The breakout marks a shift in market construction and will sign the start of a brand new uptrend.

Treasury proposal provides gasoline to rally

Cardano’s ecosystem momentum obtained a lift after IOG proposed changing $100 million value of ADA from the group treasury into Bitcoin and stablecoins to fund DeFi growth. The controversial but forward-looking transfer sparked intense debate however finally signaled proactive treasury administration.

Charles Hoskinson, Cardano’s founder, bolstered group confidence with a mocking response to bearish critics on X, simply days after the proposal. ADA held its good points post-announcement, indicating market help for the initiative.

Broader market sentiment aligns

Cardano’s breakout coincides with Bitcoin’s surge previous $118,000, lifting sentiment throughout main altcoins. ADA’s 24-hour buying and selling quantity stood at $1.43 billion, regardless of a 36% dip from the prior day, suggesting a shift from speculative churn to longer-term accumulation.

The asset’s market cap has now surpassed $26 billion, securing its place because the Tenth-largest cryptocurrency by worth. With a circulating provide of 35.38 billion ADA, merchants are eyeing additional upside if momentum sustains above the $0.74 pivot.

Outlook

If ADA maintains help above $0.74, subsequent upside targets embody $0.90 and $1.00, with resistance anticipated close to $1.20 primarily based on Martinez’s Fibonacci projections. A return of community exercise and institutional confidence might assist maintain the rally, particularly if Bitcoin stabilizes above its all-time highs.