- Ethereum surged previous $2,850, signaling a bullish breakout, however is at the moment retesting that stage amid indicators of consolidation after a 20% rally.

- Whale exercise is cut up, with Sharplink shopping for $64M price of ETH whereas leveraged brief positions totaling $143M recommend some merchants are betting in opposition to additional good points.

- Over $206M in ETH outflows from exchanges suggests robust accumulation, although a 35% dip in buying and selling quantity provides uncertainty to short-term route.

Ethereum simply broke previous that cussed $2,850 stage and, for the second, it’s trying fairly bullish. Traditional transfer: it’s now kinda pulling again to retest the breakout zone—a typical play earlier than it kicks larger once more. However maintain on, the value motion isn’t telling the complete story right here.

$64M Lengthy vs $143M in Shorts—Who’s Bluffing?

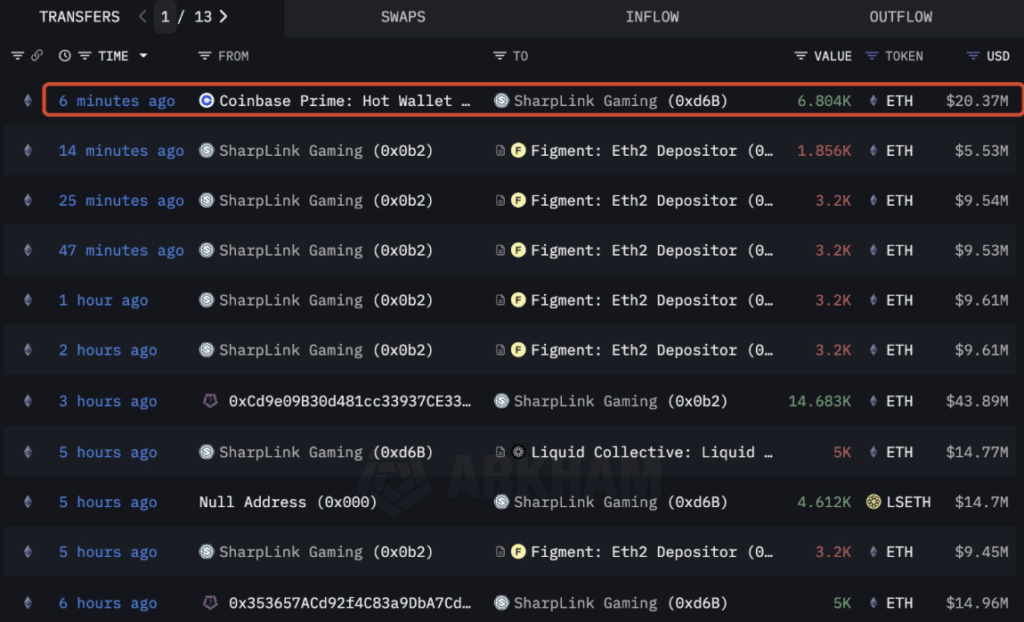

On July 12, Lookonchain noticed one thing fairly wild: Sharplink (yep, the betting platform SBET) scooped up 21,487 ETH price $64.26M. That got here simply after it grabbed one other 10,000 ETH ($25M) straight from the Ethereum Basis. Seems like somebody’s loading up earlier than liftoff.

However not everybody’s feelin’ it.

On the identical time, three wallets began piling on aggressive shorts—leverage as excessive as 25x. In whole? 48,458 ETH shorted, valued at $143.37M, however solely backed by $10.5M in margin. That’s both gutsy or reckless. Relies upon who you ask.

So yeah, bulls and bears are squaring off right here. However with ETH holding above key assist and the broader setup leaning constructive, short-term draw back is likely to be a protracted shot—until one thing sudden hits.

Huge Outflows, Quiet Volumes

Based on CoinGlass, ETH noticed $206M depart centralized exchanges on July 11 alone. That’s often a bullish sign—whales shifting to chilly storage, presumably holding for the lengthy haul.

Nonetheless, there’s a catch. Despite the fact that the outflows look strong, buying and selling quantity has dropped off—down 35% in 24 hours. So yeah, there’s demand… however not a variety of motion proper now. It’s kinda like everybody’s ready to see what occurs subsequent.

Chart Hints: $4K Would possibly Be in Play

Technically, ETH appears robust. It’s sittin’ above its 200-day EMA, which is a inexperienced flag for long-term bulls. After gaining greater than 20% in simply three days, it appears to be cooling off a bit—possibly even consolidating earlier than its subsequent transfer.

If it holds above that $2,850 breakout zone, a 37% rally may push it towards $4,000. Not assured, after all, however the construction’s there. It’s a kind of “watch carefully, don’t blink” sort of setups.