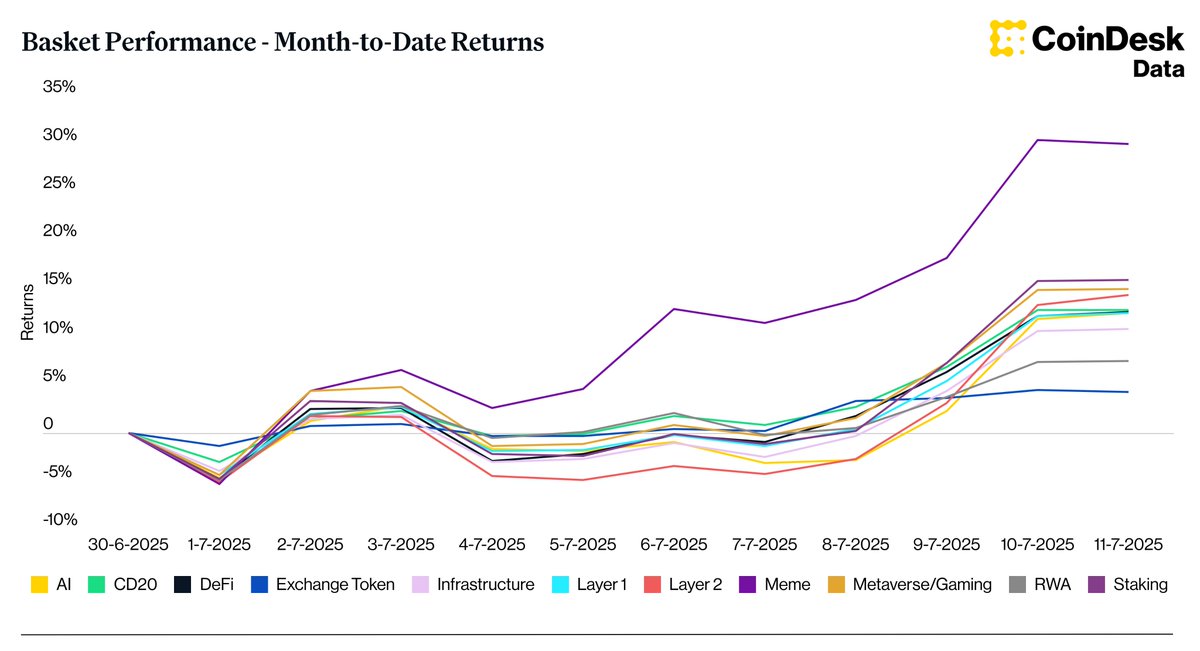

Meme cash are dominating the crypto market in July, outperforming all different sectors with a staggering 30.06% return thus far this month, in line with the newest knowledge from CoinDesk.

The basket efficiency chart highlights robust momentum in community-driven tokens, far forward of different narratives.

Staking, gaming, and Layer 2 additionally surge

Following meme cash, staking tokens have returned 15.83% month-to-date, reflecting rising curiosity in passive yield methods. Metaverse and gaming property are shut behind at 14.93%, exhibiting renewed investor urge for food in digital ecosystems.

Layer 2 options additionally delivered a strong 14.37% achieve, suggesting confidence in scalable blockchain alternate options. Layer 1s carried out barely under with 12.45%, nonetheless a notable rebound amid current market power.

Different robust performers embrace DeFi (12.57%), the CoinDesk 20 index (12.75%), and infrastructure-related tokens (10.80%).

AI suffers sharp decline

In distinction, the AI class is the most important underperformer with a -12.40% return. Regardless of earlier hype round synthetic intelligence integrations, the sector has failed to take care of upward momentum in July.

Trade tokens posted a modest 4.21% achieve, whereas real-world asset (RWA) tokens climbed 7.43%, persevering with their regular ascent in current months.

The chart, which covers efficiency from June 30 to July 11, reveals a transparent divergence in market sentiment—the place meme-driven tokens and staking methods are presently main the cost.