Analysts voice considerations that MicroStrategy, the biggest company holder of Bitcoin (BTC), could also be sitting on a monetary time bomb that would ripple by all the crypto market.

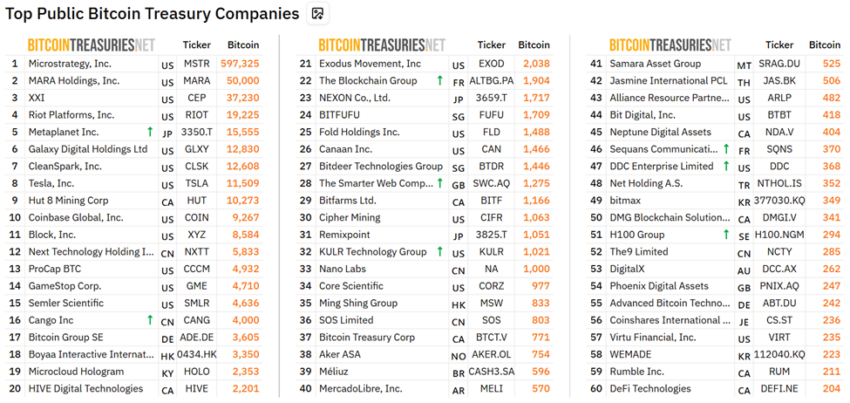

With over 597,000 BTC, equal to three% of Bitcoin’s whole provide, the enterprise intelligence company-turned-Bitcoin proxy now poses what some name “crypto’s greatest liquidation threat.”

MicroStrategy’s $71 Billion Bitcoin Wager Raises Systemic Threat Considerations

Bitcoin hit one other all-time excessive (ATH) on Sunday, steadily edging in the direction of the $120,000 threshold. This time, nonetheless, the surge comes amid institutional curiosity somewhat than retail shopping for momentum.

Chief amongst them is MicroStrategy (now Technique), which holds 597,325 BTC, value over $71 billion as of this writing.

Leshka.eth, a KOL and funding strategist, laid out the size and fragility of MicroStrategy’s Bitcoin play.

“Everybody’s celebrating whereas this creates crypto’s greatest liquidation threat,” Leshka wrote.

The analyst notes that MicroStrategy’s $71 billion place in Bitcoin has been constructed on prime of $7.2 billion in convertible debt raised since 2020. Its common BTC buy worth sits round $70,982.

If Bitcoin have been to fall beneath that mark, the paper losses might begin making use of actual stress on its steadiness sheet.

Not like spot ETFs (exchange-traded funds), MicroStrategy lacks money buffers or redemption mechanisms.

This implies any downturn in Bitcoin’s worth would instantly hit the corporate’s valuation and will, in an excessive case, power asset gross sales to cowl liabilities.

“This isn’t only a high-beta Bitcoin play—it’s a leveraged wager with little or no margin for error,” Leshka warned.

The Fragile Suggestions Loop Behind MicroStrategy’s Bitcoin Technique

Whereas many retail and institutional traders deal with MicroStrategy inventory (MSTR) as a liquid strategy to acquire Bitcoin publicity, it carries dangers far past these of regulated ETFs.

Leshka defined that MSTR trades at a premium over its web asset worth (NAV), typically as much as 100%. This “premium suggestions loop”—the place rising share costs fund extra BTC buys—can collapse rapidly in a downturn.

If investor sentiment shifts and MSTR’s NAV premium evaporates, the corporate’s entry to recent capital would dry up.

Such an consequence might compel tough selections about MicroStrategy’s Bitcoin holdings.

The put up references the 2022 Terra-LUNA collapse, the place a $40 billion market cap evaporated because of an analogous leverage spiral. This comparability highlights an actual precedent for systemic threat.

The collapse of MicroStrategy’s core enterprise provides to the fragility. Software program income fell to a 15-year low of $463 million in 2024, and headcount has dropped by over 20% since 2020.

The corporate is now successfully a Bitcoin fund with minimal diversification, that means its fortunes rise and fall with the crypto market.

Elsewhere, critics say this stage of centralization poses a menace to Bitcoin’s decentralized ethos.

Leshka agrees, noting that Bitcoin was constructed to keep away from central management, which makes MicroStrategy holding 3% of all BTC a single level of failure.

Nonetheless, not all analysts see the setup as apocalyptic. Convertible bond maturities stretch from 2027 to 2031, with minimal near-term curiosity obligations. If Bitcoin avoids a collapse beneath $30,000, compelled liquidations are unlikely.

Moreover, within the occasion of monetary stress, MicroStrategy might dilute fairness somewhat than promote BTC instantly, giving it optionality.

However, the core concern stays {that a} system depending on relentless optimism and premium-driven capital raises is inherently fragile.

The put up Analyst Says MicroStrategy May Set off a Bitcoin Cascade Worse Than Mt. Gox or 3AC appeared first on BeInCrypto.

(@leshka_eth)

(@leshka_eth)

(@hodlorado)

(@hodlorado)