In the future earlier than the U.S. CPI print, crypto whales are displaying clear positioning. Whereas Bitcoin stays close to highs, it’s mid-cap altcoins which are drawing consideration from the highest wallets.

Over the previous 7 days, tokens like 1inch (1INCH), Chainlink (LINK), and Curve (CRV) have seen contemporary accumulation, seen via holder steadiness spikes and small alternate outflows. Right here’s a more in-depth take a look at the place the cash’s transferring and what it would imply.

Within the final 24 hours, whale holdings for 1inch rose by 5.65%, pushing the entire steadiness held by these wallets to 9.56 million tokens. On the similar time, the highest 100 addresses nonetheless maintain about 1.26 billion 1INCH, although their share barely dipped, hinting at redistribution fairly than exits.

The steadiness chart reveals a gradual carry from round noon onwards on July 14, indicating contemporary demand whereas the token value hovered between $0.32 and $0.33. In the meantime, good cash and alternate balances barely moved, suggesting the motion was primarily massive pockets accumulation.

Regardless of a 5.65% surge in whale holdings, the 1INCH value dipped by practically 8% day-on-day, suggesting whales could also be positioning early forward of anticipated on-chain quantity spikes, fairly than chasing short-term positive aspects.

Crypto whales could also be rotating into 1inch as a wager on DEX exercise surging if CPI drops and risk-on sentiment returns, boosting on-chain buying and selling volumes.

Chainlink (LINK)

From July 10 onward, LINK noticed a 6.19% improve in whale holdings, now sitting at 2.84 million tokens. Probably the most notable surge got here between July 11 and 12, with a visual bounce in steadiness simply earlier than the token value hit native highs close to $16.

High 100 addresses now maintain 654.73 million LINK, up barely from earlier within the week. Trade balances dropped 1.51%, supporting the view that LINK is transferring to self-custody or chilly wallets. The worth of LINK surged nearly 18% over the previous week, which reveals that crypto whales have been accumulating.

This hints at renewed optimism.

Curve DAO (CRV)

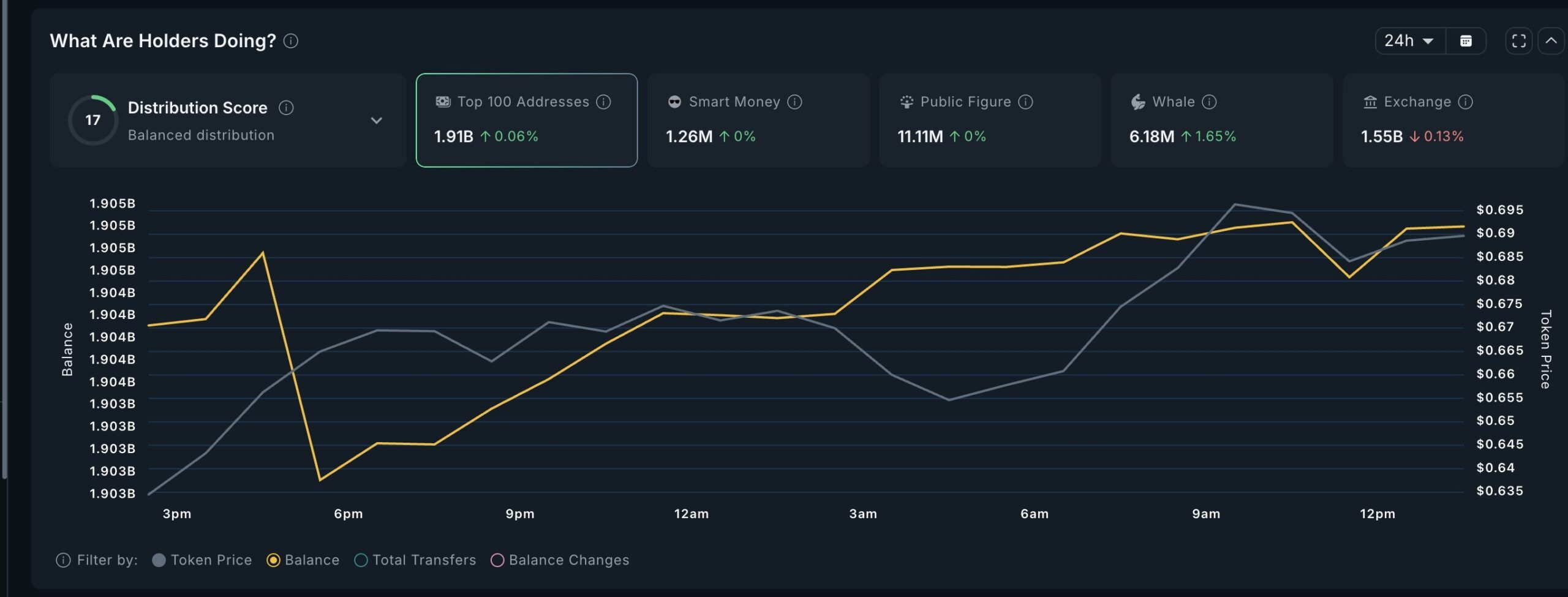

CRV’s crypto whale wallets added 1.65% extra tokens, taking complete holdings to six.18 million. Although the shift is small, the sample is constant throughout the final 24 hours; the yellow steadiness line reveals a gradual climb all through the evening and into the morning of July 14.

The highest 100 pockets holdings elevated barely by 0.06%, suggesting massive holders are regularly re-accumulating. CRV’s value climbed towards $0.69, up nearly 7% day-on-day, consistent with the whale accumulation patterns.

Curve makes a speciality of stablecoin swaps, providing low charges and deeper liquidity: traits that entice massive cash searching for a hedge when inflation knowledge is due, just like the U.S. CPI launch tomorrow.

Honorary Point out: SPX6900 (SPX)

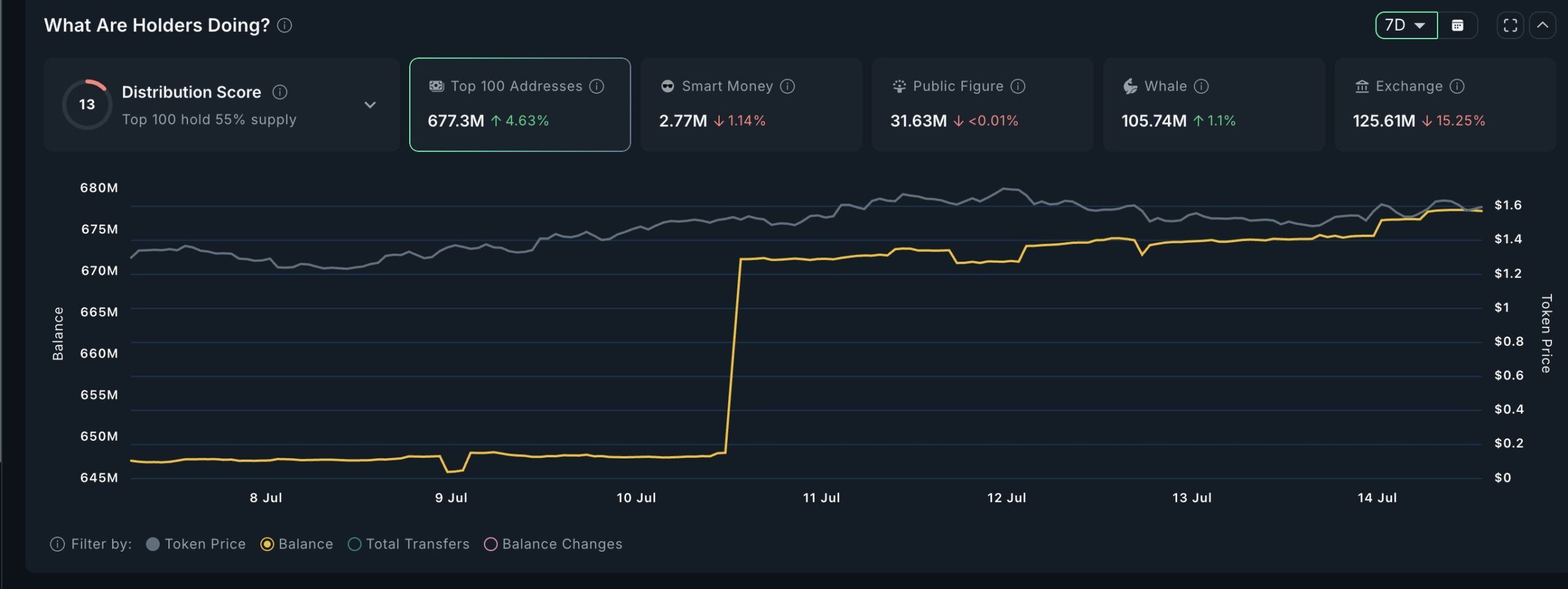

The SPX6900 token, usually seen because the sector index for meme cash, confirmed a 1.1% rise in crypto whale holdings, and high 100 wallets added 4.63% extra tokens this week. Whereas smaller in scale in comparison with the others, the directional stream provides weight to the broader meme coin rotation narrative.

The token value moved nearer to $1.60, and the influx sample from July 10–13 reveals coordinated entry factors.

Even with CPI-driven warning, this quiet uptick in SPX hints that some merchants are nonetheless betting on the meme coin supercycle to proceed, particularly if inflation knowledge favors risk-on sentiment.

Disclaimer

According to the Belief Venture pointers, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary selections. Please notice that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.