- XRP hit $3 for the primary time in six months, fueled by investor optimism and regulatory readability.

- Analysts level to tokenization, stablecoin developments, and an Ethereum-compatible sidechain as key development drivers.

- Customary Chartered sees XRP reaching $5.50 by year-end if traits like ETF approval and institutional demand maintain.

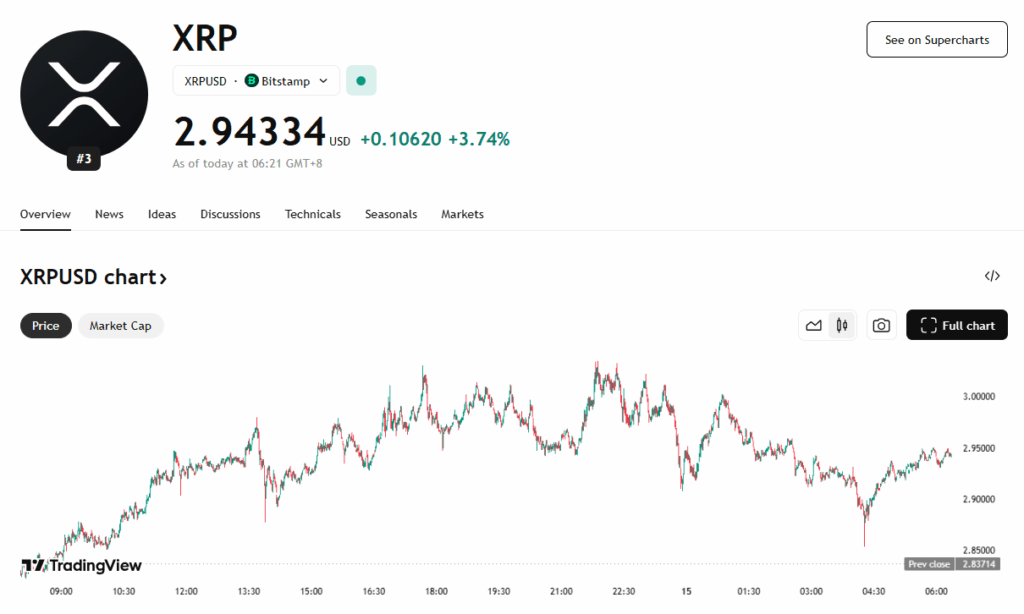

XRP crossed the $3.00 mark for the primary time since January, notching a six-month excessive that’s caught the eye of buyers and analysts alike. It’s up 27% up to now week, transferring in sync with Bitcoin’s record-setting momentum. The rally comes as regulatory winds shift and new use instances for tokenization proceed to achieve traction. In accordance with Messari’s Matt Kreiser, XRP’s newest rise echoes the market’s confidence after Trump’s reelection—fueling optimism for crypto-friendly insurance policies.

As of Monday, XRP is floating close to $2.92 after tapping above $3.00 briefly. Kreiser identified that XRP Ledger’s built-in compliance options make it well-suited for tokenizing real-world property like shares and bonds. This places it in a great place as monetary establishments start exploring on-chain illustration of conventional property.

Tokenization, Regulation, and a Doable ETF

One of many huge components behind XRP’s current raise is the rising curiosity in real-world asset tokenization. Kreiser famous that XRP’s compatibility with these traits, particularly with good contract assist and an Ethereum-compatible sidechain on the horizon, might result in deeper institutional adoption. Stablecoin laws transferring ahead within the U.S. provides one other layer of assist, giving XRP some regulatory respiration room.

With the SEC lawsuit lastly within the rearview, Ripple’s outlook has brightened significantly. The tip of authorized uncertainty has opened doorways for partnerships just like the one with BNY on stablecoin reserves. Ripple CEO Brad Garlinghouse says this might increase belief within the broader system—one thing XRP may benefit from if stablecoins take middle stage in finance.

Customary Chartered’s $5.50 Prediction

Customary Chartered isn’t holding again in its outlook. The financial institution believes XRP might hit $5.50 by the tip of the 12 months, citing components like stablecoin integration, tokenization, and a possible XRP-based ETF within the U.S. These are huge catalysts, and if any one in all them goes via, XRP might be on monitor for a historic breakout.

Retail curiosity is climbing too. In accordance with GSR’s Carlos Guzman, buyers are circling again to acquainted names from the 2021 bull run. Tokens like Cardano and XRP are trending once more—not simply due to nostalgia, however as a result of they’re broadly listed and simply accessible.

The Highway Forward

XRP’s current surge is a mixture of good timing and renewed investor perception. With Bitcoin hovering, authorized uncertainty resolved, and tokenization narratives getting louder, XRP would possibly lastly be positioned to reclaim its former glory—and perhaps transcend it. Whether or not it reaches $5.50 or stalls round present ranges, the remainder of 2025 might be essential in defining the asset’s long-term future.