- Bitcoin’s shift into the institutional highlight is reshaping the way it’s used and perceived—from speculative insurgent to monetary asset.

- Spot ETFs and lowered volatility are laying the inspiration for broader adoption and real-world use circumstances.

- Institutional cash may drive trillions into Bitcoin, but it surely additionally brings challenges like custodial dangers and

Bitcoin’s journey from web fringe experiment to legit monetary participant has been… properly, sort of wild. It wasn’t precisely straightforward to get Wall Road to concentrate to a decentralized foreign money born out of cypherpunk beliefs. However right here we’re. Bitcoin’s caught round lengthy sufficient to persuade establishments it’s not going away—and so they’re lastly tuning in.

Issues actually kicked into gear with the inexperienced mild for US spot Bitcoin ETFs in January 2024. Abruptly, BTC wasn’t only for crypto bros and chilly storage wallets—it turned out there by means of brokerage accounts, pension plans, and even insurance coverage packages. That shift didn’t simply push the value greater—it gave Bitcoin roots. Actual ones. The sort you want when you’re gonna evolve from a speculative asset to a steady retailer of worth (and possibly sometime, an precise cost software).

Establishments Change the Sport—Sluggish and Regular

Retail traders are kinda in every single place—shopping for the highest, panic-selling the underside. Establishments? Not a lot. They assume long-term, act slightly slower, however after they transfer, they transfer massive. And their habits is already placing a chill blanket on Bitcoin’s often chaotic market.

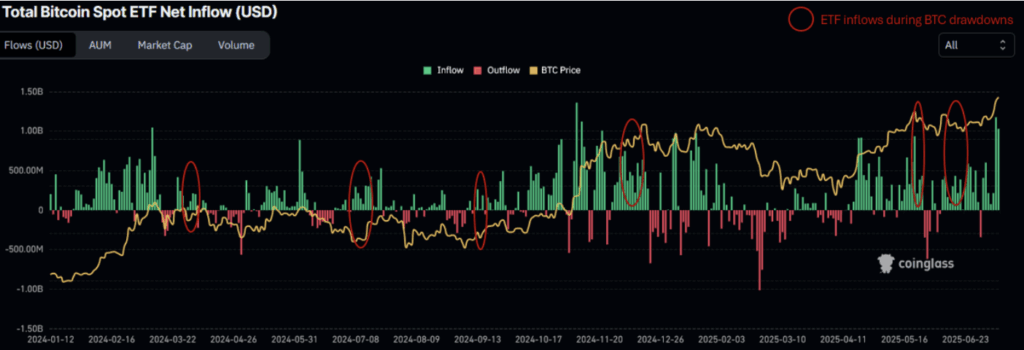

Take a look at ETF flows. Since these spot ETFs launched, we’ve seen internet inflows even when costs dip. Take BlackRock’s IBIT—it stored pulling in capital whereas retail traders sat on their arms. Positive, early 2025 received messy—tariff drama, election noise, normal market panic—however on the entire, massive cash isn’t flinching.

The numbers inform the identical story. Bitcoin’s 30-day rolling volatility? Method down. Again within the 2019–2022 days, it’d spike over 100%, even 150% in the course of the wild bits. However these days? It’s chillin’ round 35%. That’s edging nearer to the likes of the S&P 500 and gold. Fairly wild to consider, proper?

Regular Value = Extra Than Only a Calm Market

Much less volatility isn’t only a win for investor nervousness—it makes BTC simpler to really use. When costs don’t swing wildly each day, retailers would possibly begin giving it a re-evaluation. No person desires to promote espresso for $5 in BTC at some point and understand they simply gave away $9 the subsequent. Predictable pricing issues.

Positive, most on-chain exercise continues to be dominated by long-term holding and good ol’ hypothesis, however that might change. A calmer market opens the door to make use of circumstances we’ve been speaking about for years—however haven’t actually seen. Funds, remittances, microtransactions? All of them want stability to work. We’re not there but, however the groundwork is forming.

Advisors, Pensions, and the Snowball Impact

Right here’s the place issues actually get spicy. Establishments aren’t simply making markets extra steady—they’re unlocking entry. Assume: retirement accounts, hedge funds, monetary advisors providing BTC to purchasers who don’t need to mess with seed phrases or chilly wallets. The barrier’s getting decrease.

In only a 12 months and a half, US spot Bitcoin ETFs pulled in $143 billion AUM. That’s not pocket change. Ric Edelman, a large within the TradFi world, simply dropped a bombshell: his newest steering suggests even conservative of us ought to maintain 10% crypto. Aggressive? Strive 40%. Wild, but it surely’s catching on.

Now take into account this: funding advisers handle $146 trillion (yep, trillion with a “t”). A ten% shift to crypto? That’s $14.6 trillion doubtlessly flowing into the market. Even 1% would imply $1.4 trillion in recent demand—practically half the scale of Bitcoin’s present market cap. That’s not concept. That’s gas.

Pension funds are creeping in, too. Wisconsin and Indiana already dipped their toes into Bitcoin ETFs. And as soon as one thing reveals up in a retirement portfolio, it’s not seen as “bizarre” anymore—it’s simply one other line merchandise. That psychological shift is every little thing.

Bitcoin’s transformation isn’t nearly worth anymore. It’s about legitimacy, entry, and relevance in the true world. However yeah, there’s a price to that.

The extra conventional Bitcoin turns into, the extra it dangers changing into… properly, conventional. Custodial dangers, regulatory pressures, centralization—they’re not small issues. However for now, the tide’s rolling in, and it appears like Bitcoin’s sporting a swimsuit.