Ethereum’s current push above $3,000 is going through stress as profit-taking dangers emerge.

On-chain alerts and quantity patterns trace at potential short-term Ethereum worth weak spot until key ranges break.

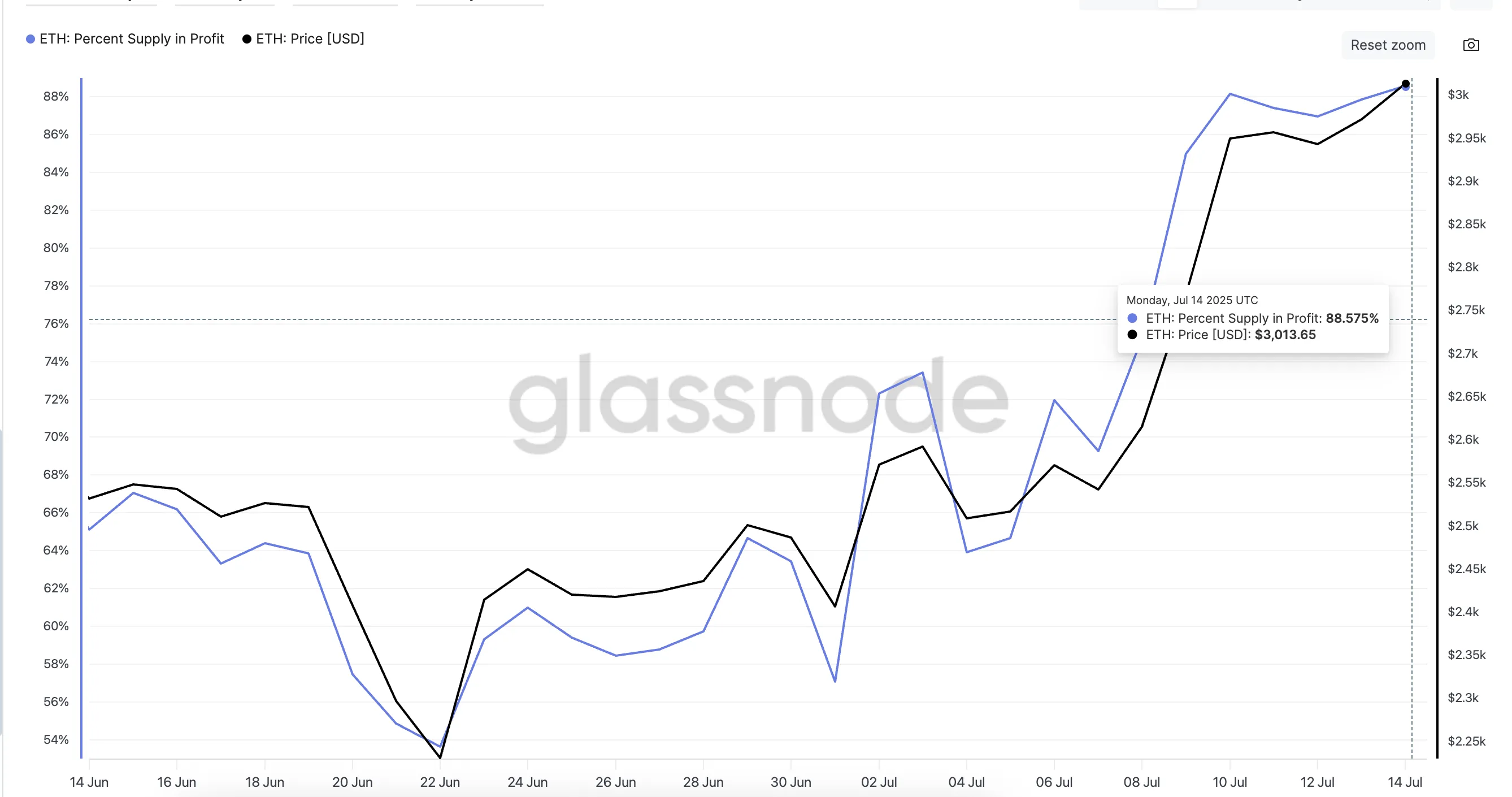

Over 88% of ETH in Revenue May Sign Native Prime

In line with Glassnode, 88.57% of the ETH provide was in revenue as of July 14, with worth hovering close to $3,013. In line with the one-month chart, each time the ETH holders’ revenue proportion surges, short-term corrections are likely to comply with.

The % Provide in Revenue metric tracks the proportion of circulating ETH whose acquisition value is under the present market worth. Spikes on this indicator typically correspond to overheated rallies or post-rally exhaustion zones, one thing ETH is at the moment grappling with.

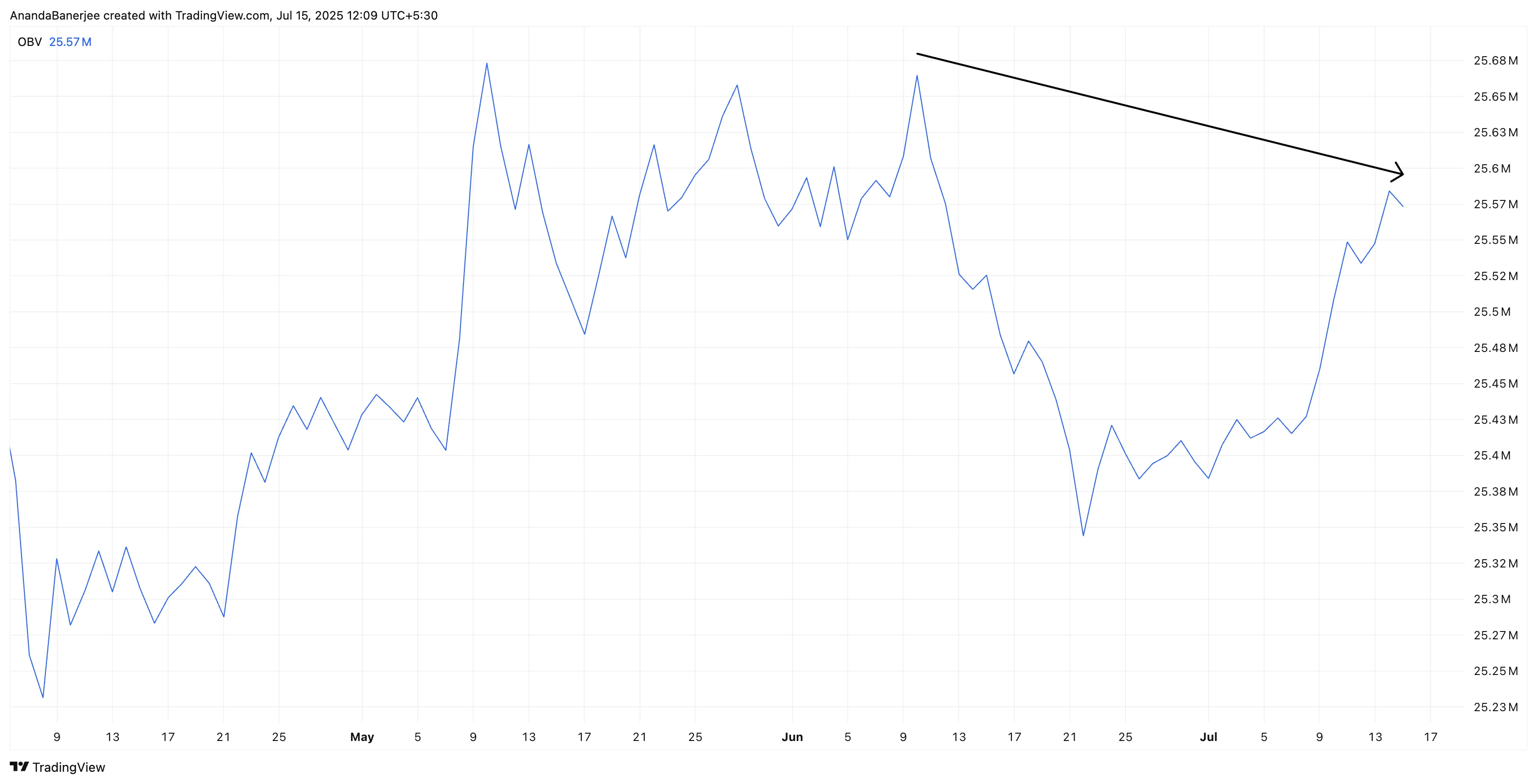

OBV Divergence Undermines Worth Energy

Whereas Ethereum worth continued climbing from June 11 to July 14, On-Stability Quantity (OBV) fashioned a decrease excessive, confirming a bearish divergence. This implies fewer merchants are collaborating within the present leg up, a crimson flag for sustainability. The OBV threat was flagged right here, hinting at a worth correction.

Regardless of the correction taking place, OBV hasn’t risen again and nonetheless poses one other correction risk within the brief time period.

OBV measures quantity circulate by including quantity on up days and subtracting it on down days. When OBV fails to maintain up with worth, it suggests weakening accumulation or rising vendor energy behind the scenes.

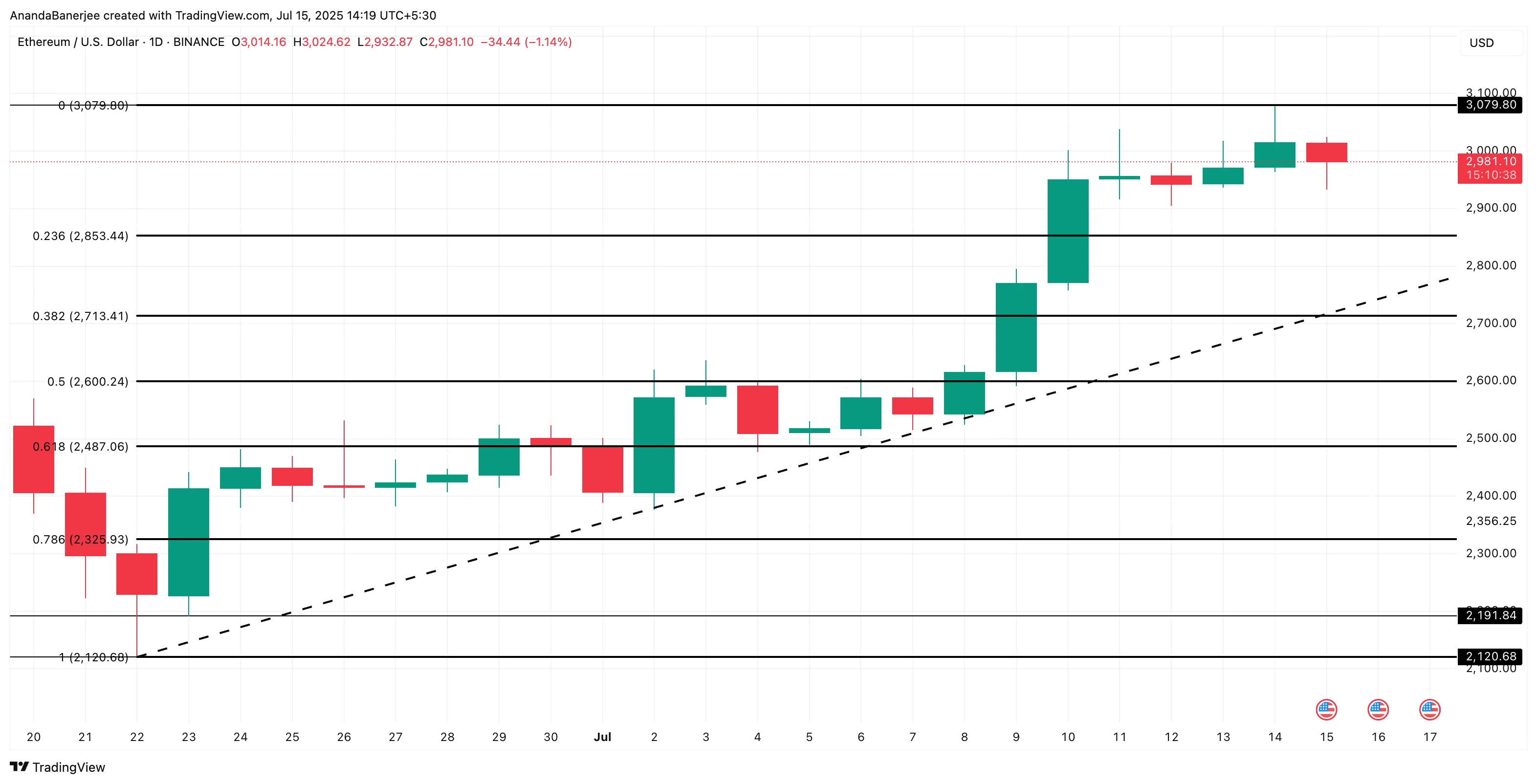

Fibonacci Ranges Supply Key ETH Worth Assist

ETH worth hit resistance at $3,079. After being rejected at this zone, the value is now consolidating round $2,981.

Fast retracement help for ETH lies at:

- 0.236 degree: $2,853

- 0.382 degree: $2,713

Nevertheless, the ETH worth chart means that $2,600 (0.5 Fib degree) and $2,487 (0.618 Fib degree) are probably the most essential help zones. These should be breached for the general construction to show bearish.

The broader bullish construction nonetheless holds so long as Ethereum stays above $2,713, because it coincides with a key breakout candle.

If Ethereum breaks and closes above $3,079 (its current swing excessive), and OBV begins trending upward, the short-term bearish speculation will likely be invalidated. This may sign renewed shopping for conviction and probably open the trail to greater ranges.

Till then, profit-taking and quantity divergence counsel warning, particularly as ETH hovers at a traditionally saturated revenue degree.

Disclaimer

Consistent with the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.