- Solana hit $166 with 12% weekly and 104% yearly positive aspects; momentum is constructing quick.

- Ali Martinez suggests a path to $2,700 if SOL closes above $170 and confirms a cup-and-handle breakout.

- Sturdy fundamentals + ETF potential might make 2025 a breakout yr for SOL.

Solana (SOL) simply jumped one other 3% within the final 24 hours, touchdown round $166 proper as Bitcoin soared to a brand new all-time excessive of $122,838. Yeah, issues are beginning to get spicy once more throughout the board.

Zooming out, SOL’s now up 12% in every week, 16.5% over the previous month, and a strong 104% over the past yr. Not unhealthy for a coin that spent a lot of the yr quietly grinding. And now? Some analysts are eyeing the massive numbers once more—$2,000, perhaps extra. Would possibly sound wild, however with market sentiment flipping and SOL’s fundamentals nonetheless trying sharp, the long-term outlook’s received loads of upside.

Analyst Sees $2,700—If This Stage Holds First

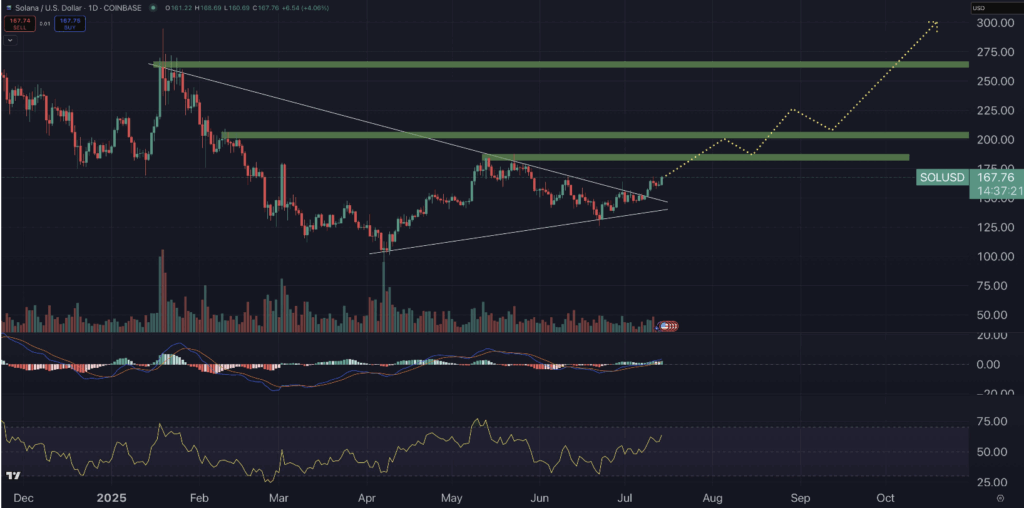

Over on X, analyst Ali Martinez tossed out a daring one: if SOL can shut the week above $170, we might be a breakout all the best way to $2,700. That’s primarily based on a textbook cup-and-handle sample displaying up on the one-week chart—a sample that’s triggered some large strikes prior to now.

Not everybody’s shopping for it although. Some people within the replies have been fast to poke holes within the goal, and truthful sufficient. In any case, Solana’s nonetheless buying and selling 43% under its earlier excessive of $293. That’s lots of floor to cowl. Nonetheless, it’s not fully off the desk. With the proper market situations and a few sustained momentum, SOL might shock individuals earlier than the yr’s out.

Fundamentals Nonetheless Rock-Stable—and ETFs Might Change the Sport

Now right here’s the place it will get attention-grabbing. Solana’s not simply driving hype—it’s additionally the second-largest layer-1 blockchain by way of complete worth locked (TVL). That’s not nothing. And with buzz constructing across the potential for a spot-based SOL ETF within the U.S., the narrative’s solely getting stronger.

Bloomberg analysts say there’s a 95% probability we get a inexperienced gentle on Solana ETFs. Given the SEC already gave Ethereum the go-ahead, there’s not a lot standing in the best way of SOL’s approval both. If or when that hits? Yeah, worth might transfer quick. That type of publicity pulls in capital from locations that sometimes don’t contact crypto.

Technicals Backing the Pattern—$200+ Trying Seemingly

Trying on the chart, Solana’s momentum is actual. The RSI simply climbed above 60—not fairly overbought, however undoubtedly cooking. If it retains trending, we might see that quantity hit 70 and even 80 earlier than a pullback. In the meantime, the MACD simply flipped extra bullish too, with these traces separating properly and inexperienced bars rising once more. All indicators are pointing up… for now.

So what’s subsequent? Properly, if this tempo holds, SOL might push previous $200 someday in August. And by This fall? $300 doesn’t really feel that loopy. $2,700? Okay—perhaps not this yr. But when this rally has legs, don’t rely something out.