- XLM broke out of a 6-year triangle and rallied almost 95% in three days.

- Quantity, DeFi exercise, and buying and selling sentiment all surged alongside worth.

- Pullback underway; key ranges to look at are $0.40 (help) and $0.50 (breakout set off). Targets above embody $0.55 and $0.60.

XLM simply pulled off an enormous breakout, and actually—it’s been a very long time coming. After six years of grinding inside a symmetrical triangle, Stellar lastly snapped free, gaining over 85% in only a few days. Momentum throughout the altcoin market helped, however this transfer felt private. The breakout was clear, highly effective, and left little doubt: one thing’s modified.

That triangle? It capped rally after rally for years. This time, XLM didn’t simply faucet the highest—it exploded by way of it. Within the final month alone, it’s up 75%, which indicators short-term bulls have taken the wheel. And ever since that descending channel bought damaged earlier in July, the every day chart’s been stacking inexperienced candles prefer it’s making an attempt to make up for misplaced time.

Quantity Spikes, Sentiment Shifts

When worth motion seems this aggressive, quantity issues—and it confirmed up. Buying and selling quantity jumped 55.27% in simply 24 hours, hitting $3.31 billion. That type of transfer doesn’t occur with out folks shopping for in arduous. It’s a kind of moments the place momentum, sentiment, and construction line up virtually completely.

That mentioned, even in any case that, XLM continues to be buying and selling 51% under its all-time excessive of $0.9381 (from manner again in January 2018). So whereas this rally is large, there’s nonetheless room. Analysts are beginning to whisper a couple of 2x transfer if momentum sticks round into the approaching weeks.

Traditional Breakout Stuff—And Merchants Took Discover

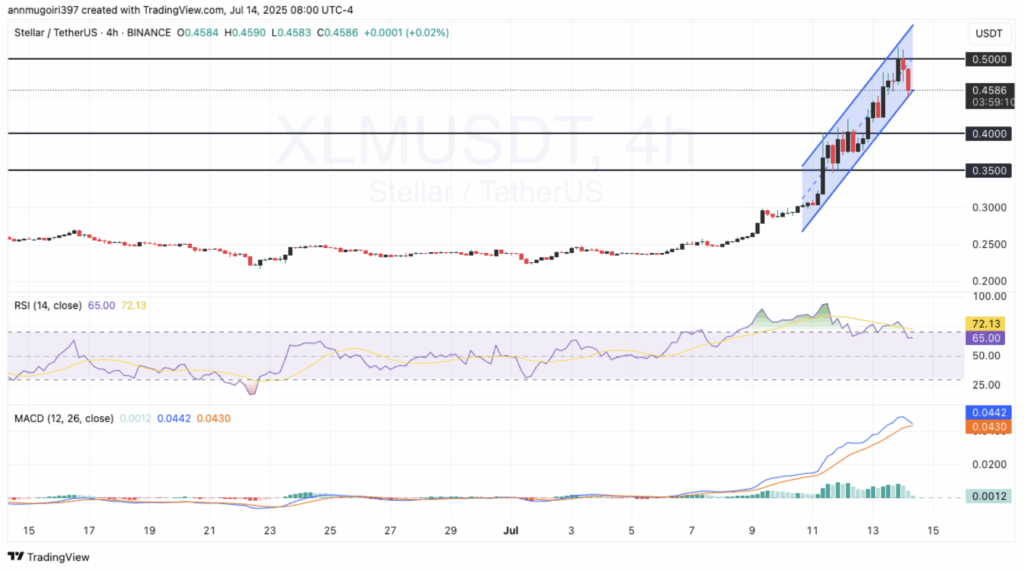

Crypto analysts have known as it loud: XLM simply adopted a textbook breakout play. Costs doubled in a flash—almost 95% in three days—and the charts seem like one thing straight out of a technical analyst’s desires. XLM/USDT went from $0.25 to only below $0.50, slicing by way of resistance that’s been pressuring it for what looks like endlessly.

In accordance with World of Charts, it wasn’t simply noise. The stress constructed slowly, then growth—Stellar broke free. And with it, got here the amount, the hype, and a flood of latest consumers leaping in to trip the wave.

DeFi Exercise on Stellar Picks Up Quick

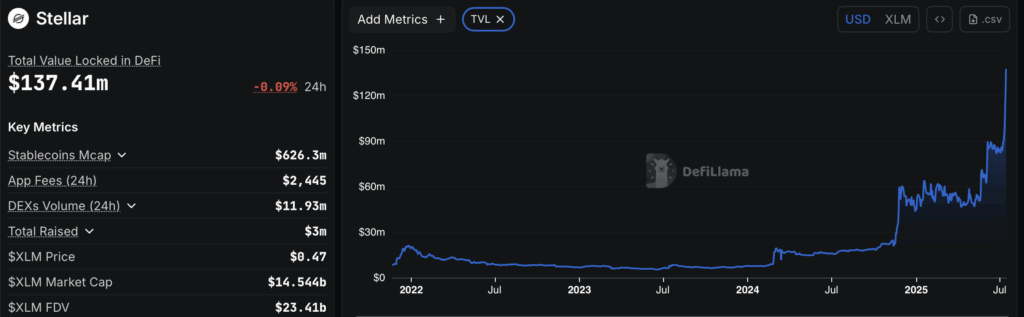

It’s not simply worth motion—Stellar’s DeFi ecosystem is beginning to stir. Whole worth locked (TVL) jumped to $141.71 million, a 15.92% surge in a single day. That’s a severe injection of confidence.

The stablecoin market cap on Stellar is sitting at $627.11 million, giving the ecosystem a stable base to develop from. DEX buying and selling quantity over the past 24 hours hit $16.78 million, displaying clear indicators of rising exercise and enhancing liquidity.

Oh, and application-generated charges? $2,445 in that very same window—not loopy, nevertheless it reveals customers are energetic. The initiatives throughout the ecosystem have now pulled in round $3 million in complete funding, which isn’t headline-grabbing, however regular progress issues right here. It’s gradual… nevertheless it’s constructing.

Worth Pulls Again After Hitting Resistance—Now What?

After tagging $0.4567, XLM bumped into some resistance and began to chill off—dipping greater than 8% shortly after. The RSI backed off from 64, easing out of overbought territory, which might sign the rally wants a breather.

MACD nonetheless seems bullish—barely. The MACD line continues to be above the sign line, however they’re beginning to converge. Momentum’s fading a bit, and that might imply extra sideways motion or perhaps a sharper correction.

If that occurs, watch the $0.40 and $0.35 zones—they’re the primary stable help. But when bulls wake again up and reclaim $0.50 with conviction? That might open the door to a brand new wave. Fibonacci targets counsel $0.55 or $0.60 might be subsequent.