In short

- XRP worth explodes above $2.90, crushing cussed resistance ranges in its approach.

- The regulatory image is now clearer for XRP following the decision of the SEC’s case towards Ripple.

- Spot XRP ETF hypothesis is hitting a fever pitch, and the charts all level to a bullish development.

Bear in mind the XRP military? Wherever they’re, they may get a kick out of this: XRP is at present the perfect performing crypto asset among the many prime 10 cash by market capitalization—after months of sideways buying and selling and consolidation.

The cryptocurrency market as an entire continues to navigate a posh panorama of institutional developments and regulatory breakthroughs. And whereas Bitcoin and Ethereum battle with resistance at key psychological ranges, the coin developed by the founders of Ripple has damaged free from its extended $2.00-$2.50 buying and selling vary, surging to $2.90 and marking a decisive shift in market dynamics.

Can it proceed its momentum and breakthrough to a brand new all-time excessive? Let’s zoom out:

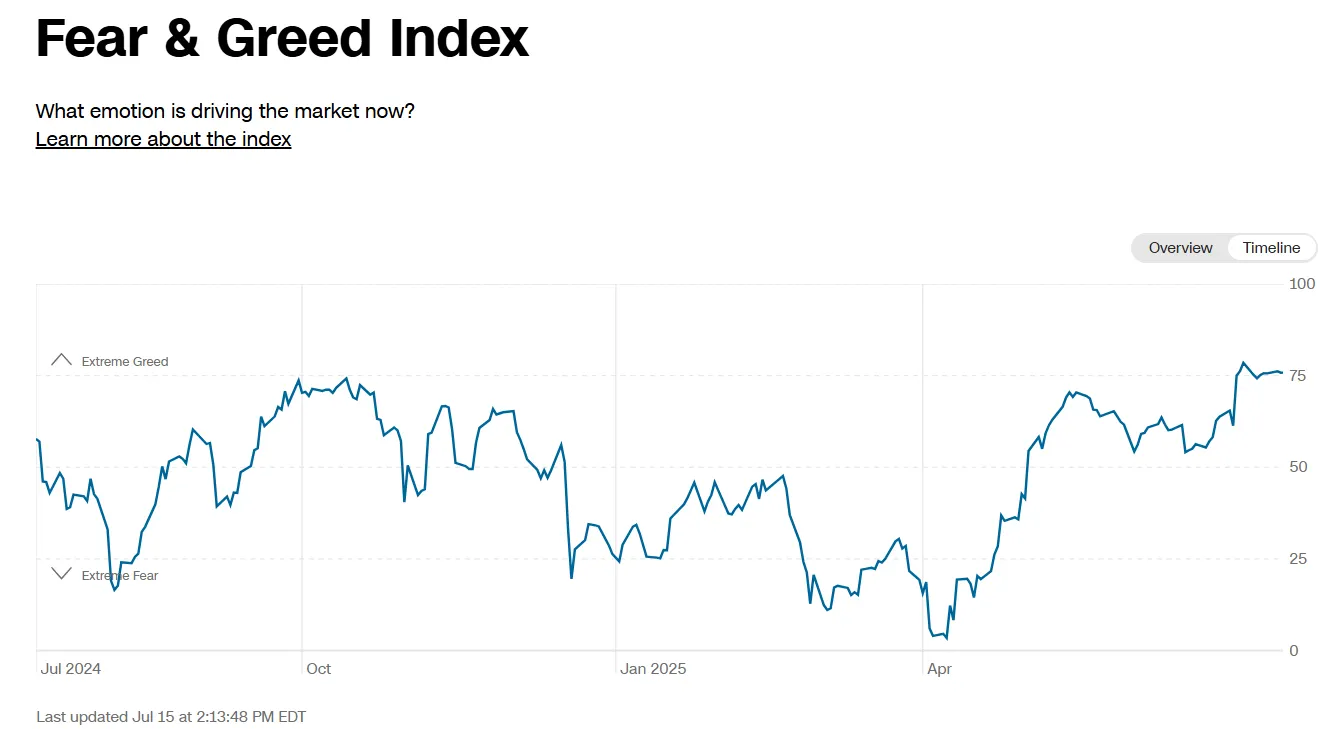

The broader crypto market maintains a cautiously optimistic tone, with whole market capitalization holding regular above $3.3 trillion, in line with Coinmarketcap. The Crypto Worry & Greed Index registers a bullish temper with a every day studying of 73 factors, only a bit under the temper for the general inventory market which registers 76 factors—in “excessive greed” territory and the very best it has been in over a 12 months.

Conventional markets proceed to affect crypto sentiment, with the S&P 500 sustaining its record-breaking trajectory above 6,200 and gold holding agency close to $3,400 per ounce. The U.S. Greenback Index’s weak point under 97 factors has supplied extra tailwinds for digital belongings, as traders search alternate options to fiat currencies amid issues concerning the $5 trillion debt ceiling improve and its inflationary implications.

The geopolitical panorama has stabilized following the June Israel-Iran tensions, eradicating a key threat issue that had beforehand weighed on threat belongings. This calmer atmosphere, mixed with rising institutional curiosity in crypto by way of varied ETF functions, has created favorable circumstances for breakout strikes in choose altcoins (that’s, crypto belongings apart from Bitcoin).

The basics of XRP’s bull run

XRP has captured market consideration with its explosive transfer to $2.9292, breaking decisively above the $2.60 resistance stage that had capped rallies all through most of 2025. The coin has reclaimed its long-lost spot because the third most useful cryptocurrency by market cap and is now eyeing its January excessive of $3.40, pushed by an ideal storm of regulatory readability, institutional developments, and technical momentum.

In a broader timeframe, the first catalyst igniting XRP’s rally is the decision of regulatory uncertainty that plagued the token for years. The SEC formally dropped its attraction within the Ripple case in late June, marking the tip of a four-year authorized battle. Choose Analisa Torres’s 2023 ruling that XRP’s programmatic gross sales by way of secondary exchanges weren’t securities violations stands as remaining, offering the regulatory readability institutional traders demanded.

As a reminder, the founders of the crypto funds firm Ripple additionally created XRP, held giant stashes of it, and periodically bought the token through the years to the tune of billions of {dollars}. The SEC sued Ripple in late 2020 alleging securities violations and wished mentioned billions disgorged. And, nicely, that’s throughout and carried out with now, with Ripple escaping with a small advantageous.

Extra not too long ago, Ripple’s July 2 utility for a federal financial institution constitution with the Workplace of the Comptroller of the Forex alerts a serious strategic shift. If permitted, Ripple would be a part of the unique ranks of crypto-native companies with nationwide belief financial institution licenses, enabling it to behave as a professional custodian and develop its monetary companies nationwide. The information despatched XRP up 3% initially, however momentum has accelerated as market members digest the implications.

ETF hypothesis has reached fever pitch with eleven main asset managers submitting functions for spot XRP ETFs. The launch of the ProShares Extremely Solana ETF (SLON) and the ProShares Extremely XRP ETF (UXRP) in all probability lead the pack as essentially the most impactful information, adopted by hypothesis about Grayscale’s efforts to have its personal XRP Belief transformed to an ETF (very similar to its Bitcoin and Ethereum Trusts).

Prediction market platform Polymarket reveals an 85% chance of an XRP ETF approval by finish of the 12 months whereas Myriad Markets, a prediction market developed by Decrypt’s mother or father firm Dastan, provides 70% odds of an XRP ETF being permitted earlier than a Litecoin ETF.

XRP worth: What the charts say

The every day chart reveals XRP buying and selling at $2.92, having damaged out of a large compression zone that had been forming since early 2025. This breakout above $2.60 represents a big technical achievement, as this stage had acted as cussed resistance all year long. The Common Directional Index, or ADX, which measures development power, reveals a studying of 34—nicely above the 25 threshold that signifies a robust trending market. Consider ADX like a speedometer for traits: under 25 means the market is transferring sideways or isn’t actually assured of what’s happening, above 25 reveals directional momentum, and above 40 alerts a really highly effective development.

The Exponential Transferring Averages, or EMAs, paint an more and more bullish image. The 50-period EMA (the faster-moving common that reacts shortly to cost adjustments) strikes above the 200-period EMA (the slower, extra important development indicator), which merchants largely interpret as bullish. Additionally, the hole appears to be increasing ever so barely because the starting of the month, which may level to even stronger bullish sentiment sooner or later if circumstances stay the identical.

The Relative Energy Index, or RSI, at present reads 81, firmly in overbought territory above 70. Whereas this would possibly sometimes sign a pullback is due, sturdy traits can stay overbought for prolonged durations. The RSI measures momentum by evaluating current good points to losses like a stress gauge exhibiting when shopping for may be getting too frenzied. At 81, it suggests highly effective upward momentum but in addition warns {that a} cooling interval may emerge.

This can be why XRP costs in the present day are struggling to maintain up the momentum, with the RSI suggesting it might be time for merchants to chill down as markets stabilize.

The Squeeze indicator reveals “off” standing with an extended sign (inexperienced), indicating volatility is increasing in an upward course. This device identifies when worth has been compressed (like a coiled spring) and is now releasing that vitality. The inexperienced sign confirms the breakout is prone to proceed quite than reverse.

Quantity construction reveals huge accumulation between $2.00-$2.40, seen as the big inexperienced and purple bands within the decrease chart above. This represents the place most buying and selling occurred throughout the consolidation part, now appearing as sturdy assist. The quantity spike accompanying the breakout above $2.60 confirms real shopping for curiosity quite than a false transfer.

Key XRP ranges to look at:

- Resistance: $3.00 (psychological), $3.40 (January 2025 excessive)

- Help: $2.40 (resistance breakout level), $2.20 (quantity level of management)

Disclaimer

The views and opinions expressed by the creator are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Day by day Debrief Publication

Begin each day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.