U.S.-listed spot Bitcoin ETFs proceed to publish sturdy inflows, recording their ninth consecutive day of internet optimistic funding exercise on Tuesday.

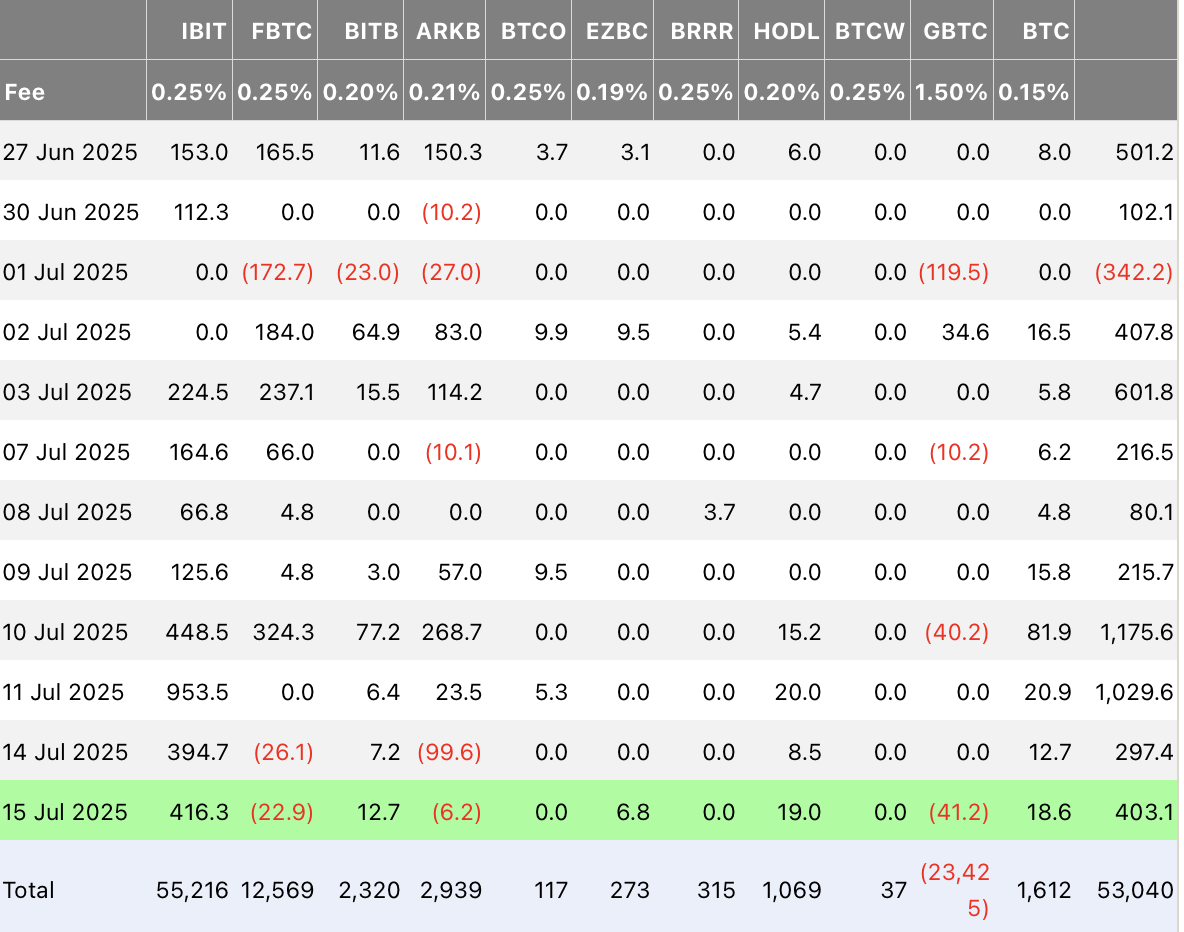

In response to information from Farside Buyers, the sector attracted $403 million in complete internet inflows, with BlackRock’s iShares Bitcoin Belief (IBIT) dominating the day.

IBIT led the surge with $416.3 million in internet inflows, reaffirming BlackRock’s place as a dominant pressure in institutional Bitcoin funding. VanEck’s HODL ETF adopted with a decent $19 million in optimistic flows, whereas Bitwise’s BITB and Grayscale’s Mini Bitcoin Belief additionally noticed reasonable inflows.

Nevertheless, the momentum was not evenly distributed throughout all merchandise. Three ETFs skilled internet outflows on the day—Grayscale’s GBTC misplaced $41.2 million, Constancy’s FBTC noticed $22.9 million pulled out, and Ark & 21Shares’ ARKB reported $6.2 million in outflows. Regardless of these losses, the general pattern for spot Bitcoin ETFs stays decisively bullish.

Cumulatively, spot Bitcoin ETFs have attracted $53 billion in internet inflows since launching earlier this 12 months. In simply the final 9 buying and selling days, $4.4 billion has poured into these funds. Since April, the sector has seen almost $17 billion in capital inflows, signaling rising institutional confidence in Bitcoin as a long-term asset.

This sustained demand comes as Bitcoin trades close to all-time highs, bolstered by a mixture of macroeconomic uncertainty, rising institutional participation, and optimism round regulatory readability. Analysts recommend the ETF momentum may persist if Bitcoin continues to carry above key psychological ranges, doubtlessly setting the stage for an additional leg increased in 2025.