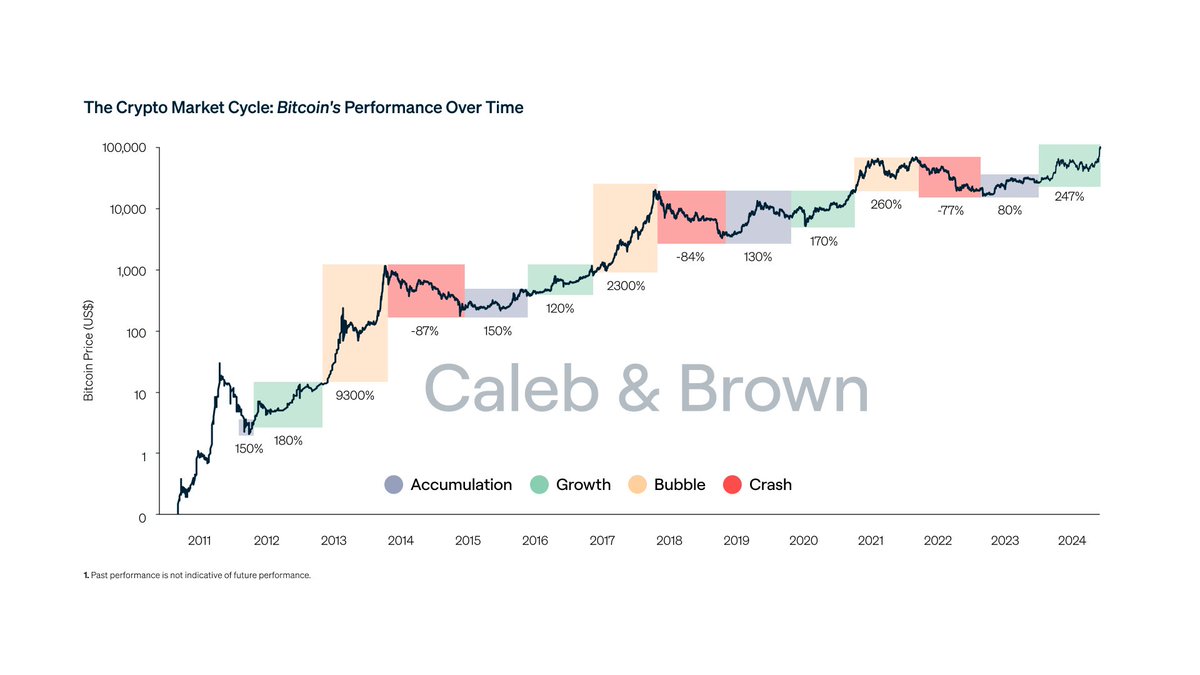

In accordance with crypto analyst Atlas, the normal four-year cycle that after outlined Bitcoin and altcoin market habits is now out of date.

In accordance with crypto analyst Atlas, the cryptocurrency market has undergone a elementary transformation. The acquainted four-year cycle construction—as soon as thought-about a dependable framework for predicting bull runs and altseasons—is not legitimate. In an in depth thread, Atlas outlines the important thing shifts that now outline this new period, formed by macroeconomic forces, institutional adoption, and altering capital flows.

Bitcoin has develop into a macroeconomic asset

Atlas argues that Bitcoin is not a speculative tech funding, however slightly a $2 trillion macro asset class embraced by establishments and sovereign actors. Main gamers like BlackRock now deal with BTC as digital gold, with demand more and more pushed by ETFs, custody options, and derivatives markets. Sovereign curiosity can be rising, with the U.S. constructing strategic reserves, Center Jap nations quietly accumulating, and Germany’s BTC gross sales reinforcing its function as a nationwide asset.

This shift, Atlas says, locations Bitcoin firmly within the class of belongings influenced by rates of interest, inflation, and international liquidity cycles—elements beforehand overseas to crypto buyers.

The previous altseason rotation is damaged

In previous cycles, capital would usually rotate from Bitcoin to Ethereum, then into large-cap altcoins and finally into meme cash. Atlas claims this sample not applies. As a substitute of flowing predictably by means of the ecosystem, liquidity now both exits the market solely or chases rising narratives with better pace and volatility. Legacy altcoins—as soon as core to altseason expectations—have develop into “liquidity traps,” providing little cause for capital to rotate into outdated tasks with no traction.

Narratives now drive efficiency

Retail-driven meme cash have emerged as essentially the most constant outperformers, regardless of providing no conventional fundamentals. Atlas notes that efficiency is more and more dictated by consideration and narrative energy slightly than utility or know-how. The market now rewards tasks that align with viral themes like AI, tokenized belongings (RWA), and different hype cycles. Property with out a compelling narrative—even in bull markets—are prone to be ignored.

Merchants should adapt to outlive

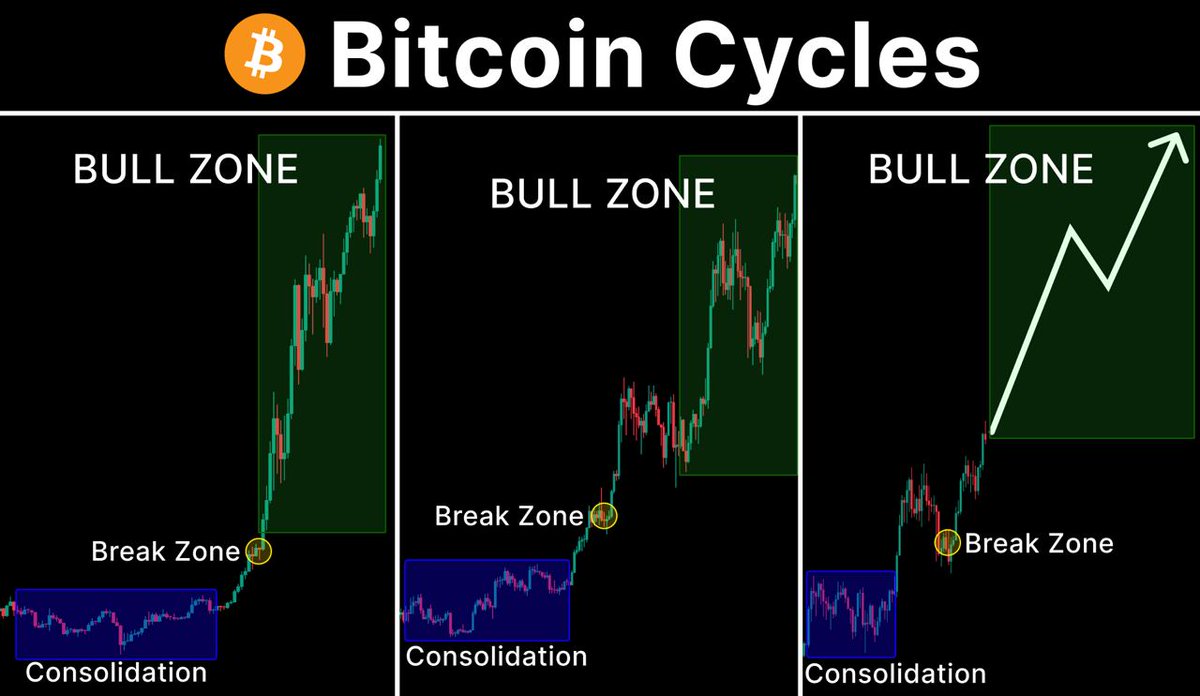

In accordance with Atlas, success on this new construction requires a shift in mindset. Merchants should deal with BTC as a macroeconomic instrument, shortly rotate between narratives as they emerge, and keep away from holding onto outdated altcoin positions. Whereas market cycles nonetheless exist, they’re not tied to predictable halving timelines or four-year resets. As a substitute, volatility is larger, predictability is decrease, and adaptableness is the important thing differentiator between winners and people left behind.