Welcome to the Asia Pacific Morning Transient—your important digest of in a single day crypto developments shaping regional markets and international sentiment.

Seize a inexperienced tea and watch this area. Institutional crypto adoption accelerates as Constancy backs MetaPlanet’s Bitcoin technique, Henry Chang wins WEMIX authorized vindication, and SharpLink amasses the world’s largest company Ethereum treasury place.

Nationwide Monetary Companies, Constancy Investments’ wholly-owned subsidiary, has emerged as MetaPlanet Company’s largest shareholder with a 12.9% stake price ¥130 billion as of June thirtieth. This strategic positioning by Constancy’s securities division indicators increasing institutional urge for food for Bitcoin-adjacent fairness publicity.

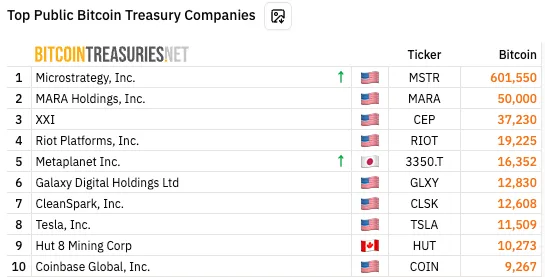

Referred to as “Asia’s MicroStrategy,” MetaPlanet has raised over ¥150 billion this 12 months to increase Bitcoin holdings, not too long ago including 797 BTC to achieve 16,352 whole bitcoins. The corporate now ranks fifth globally amongst publicly-traded Bitcoin holders, with acquisitions totaling ¥239.6 billion producing roughly ¥47 billion in unrealized positive factors at present ¥291.2 billion valuations.

This institutional backing displays evolving digital asset notion amongst conventional monetary giants.

Former Wemade CEO Henry Chang Acquitted in WEMIX Case

Seoul Southern District Courtroom delivered a not-guilty verdict for Henry Chang, former Wemade CEO and present Nexus head, concerning capital market legislation violations associated to WEMIX token liquidation statements. The court docket dominated that inadequate proof linked WEMIX worth actions to Wemade inventory efficiency.

Choose Kim Sang-yeon emphasised that “WEMIX pricing and Wemade inventory don’t essentially transfer collectively,” rejecting prosecution claims that Chang’s public statements about halting WEMIX liquidation whereas persevering with oblique operations constituted market manipulation.

The ruling highlighted basic variations between WEMIX tokens and Wemade shares, noting distinct authorized frameworks, issuance entities, and buying and selling mechanisms. Exterior elements like international gaming efficiency and liquidity enlargement higher defined Wemade’s inventory appreciation.

WEMIX trades round 7% increased at press time on international exchanges together with Bybit, Bitget, MEXC, and Gate.io, regardless of Korean platform exclusion. This primary-instance verdict awaits potential prosecution attraction following judgment evaluation.

SharpLink Gaming Turns into World’s Largest ETH Company Holder

Nasdaq-listed SharpLink Gaming (SBET) has emerged because the world’s largest company Ethereum holder, surpassing the Ethereum Basis with 280,706 ETH as of July thirteenth. The corporate acquired 74,656 ETH at a weighted common worth of $2,852 throughout July 7-13, funded by $413 million in fairness raises.

SharpLink has strategically allotted 99.7% of its holdings to staking protocols, producing 415 ETH in rewards since implementing its treasury technique in June. Further unreported purchases by Coinbase Prime expanded holdings to roughly 294,000 ETH, with a median acquisition value of $2,695.

The aggressive accumulation technique has generated roughly $92 million in unrealized positive factors at present market costs, whereas $257 million in uninvested capital positions the corporate for continued enlargement. SharpLink’s inventory surged 116% over the previous month, gaining a further 21.31% on Tuesday.

Shigeki Mori and Paul Kim contributed.

Disclaimer

All the data contained on our web site is revealed in good religion and for normal info functions solely. Any motion the reader takes upon the data discovered on our web site is strictly at their very own danger.