Hedera’s native token HBAR is dealing with promoting strain after an explosive 49% month-to-month surge, dropping over 5% prior to now 24 hours at time of writing.

Regardless of holding above $0.22, technical alerts and derivatives market dynamics counsel the altcoin may face extra volatility within the brief time period.

Overbought alerts set off sharp correction

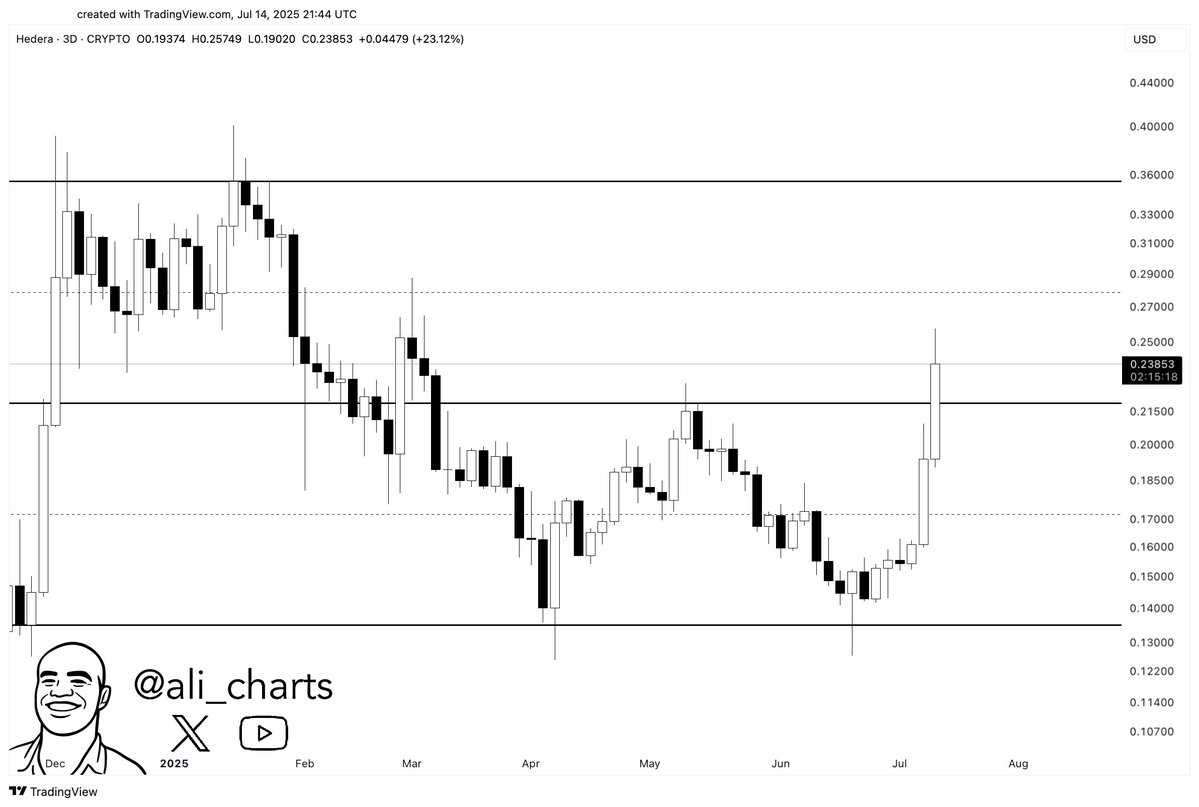

HBAR’s Relative Energy Index (RSI) hit excessive ranges—87.9 on the 7-day and 79.8 on the 14-day—indicating overbought circumstances. Traditionally, such ranges have usually preceded worth corrections. The token was additionally buying and selling 30% above its 50-day transferring common, making it susceptible to imply reversion.

Assist close to $0.225, based mostly on Fibonacci retracement (23.6% stage), failed to carry throughout Tuesday’s pullback. The subsequent key assist is round $0.206, similar to the 38.2% Fibonacci stage.

Market-wide headwinds add strain

HBAR’s underperformance got here amid a 1.8% drop within the total crypto market cap and an increase in Bitcoin dominance to 63.12%. This alerts capital rotation towards BTC and away from riskier altcoins. In the meantime, the Crypto Worry & Greed Index stays at 70, a historically contrarian sign warning of potential draw back.

Nonetheless, distinguished analyst Ali Martinez sees bullish potential if HBAR breaks above the $0.36 resistance. For now, merchants are watching whether or not institutional adoption narratives can offset technical headwinds—particularly if Bitcoin stabilizes above $117,000.

Key ranges to look at: $0.206 assist, $0.265 resistance, and Bitcoin’s $117.4K macro pivot.

Futures market exhibits indicators of overheating

Open curiosity in HBAR futures climbed to a file $450 million, in line with Coingape, intensifying volatility. Inside 24 hours, lengthy positions price $7.1 million have been liquidated because the token failed to interrupt resistance within the $0.233–$0.263 zone.

Buying and selling quantity additionally dropped 43% to $834 million, indicating fading momentum. The spot-to-perpetual ratio sits at 0.46, implying worth actions are being pushed largely by speculative derivatives quite than natural demand.