- Tether minted $2B in new USDT on Ethereum, with $1B despatched to Binance amid surging buying and selling exercise.

- USDT’s market cap has crossed $160B, with important issuance on Ethereum and Tron.

- Tether now holds over $127B in U.S. Treasury publicity, rating 18th globally if it have been a nation.

Tether, the issuer of the biggest stablecoin on this planet, minted an extra $2 billion value of USDT on July 16, additional boosting its position as crypto’s liquidity spine. CEO Paolo Ardoino clarified that the mint was a part of an “stock replenish” course of, which means the tokens aren’t instantly coming into circulation however shall be used for future issuance and blockchain swaps.

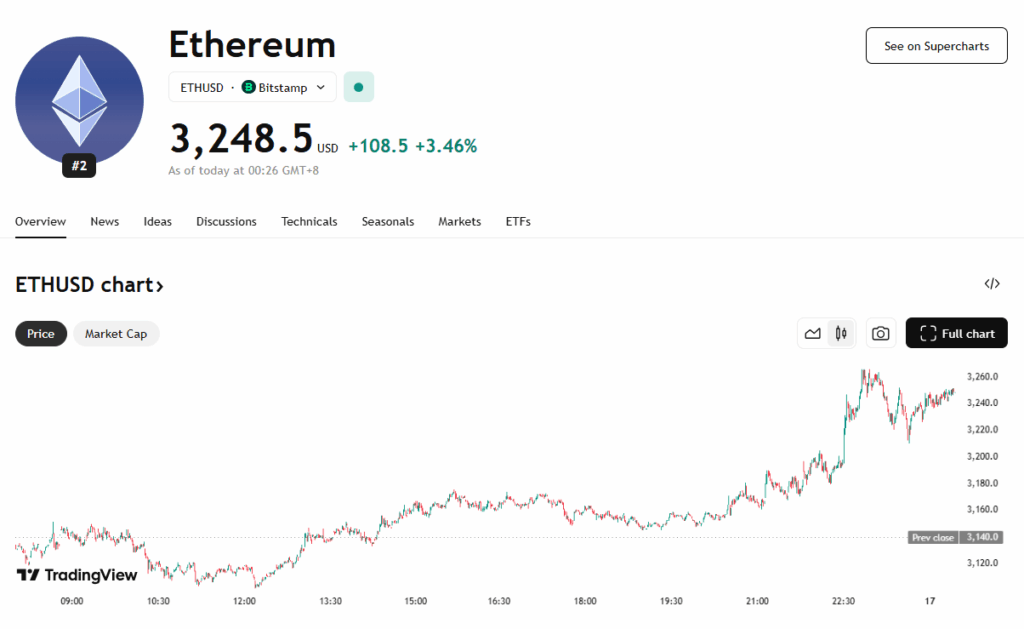

A considerable $1 billion chunk of this new USDT batch was despatched to Binance, pointing to a spike in buying and selling exercise throughout the crypto market, particularly after Bitcoin’s newest breakout previous $120,000. Tether’s aggressive minting comes amid heightened demand for liquidity on exchanges, as merchants reposition round new all-time highs.

USDT Provide Hits Report $160 Billion as Adoption Surges

This newest transfer brings Tether’s complete market cap above $160 billion for the primary time, setting one more document. Ardoino known as it a “mind-blowing milestone,” highlighting USDT’s utility throughout growing economies the place it more and more acts as a digital greenback various.

In keeping with Tether’s personal knowledge, $74 billion of the overall USDT provide has been issued on Ethereum, with one other $81 billion on Tron. Smaller however rising footprints embrace Solana ($2B), TON ($530M), and Avalanche ($480M), displaying Tether’s push towards multichain enlargement.

Tether’s Treasury Holdings Might Rival Nations

When it comes to backing, Tether continues to emphasise its reserves are totally collateralized. The corporate revealed that as of Q2 2025, it holds over $127 billion in publicity to U.S. Treasurys by way of direct holdings, cash market funds, and reverse repo agreements. That might place Tether because the 18th-largest overseas holder of U.S. debt—increased than many nations.

This scale of publicity and market penetration underscores USDT’s dominance not simply in crypto, however in world monetary flows, notably in areas underserved by conventional banking infrastructure.