- BlackRock filed to permit staking in its Ethereum ETF, doubtlessly letting establishments earn yield on ETH holdings.

- ETH outperformed BTC this week with $720M in ETF inflows—$500M of that went to BlackRock’s fund alone.

- Different main gamers like Constancy and Grayscale additionally pushed for ETH staking, displaying TradFi is steadily embracing on-chain rewards.

In a transfer that feels kinda inevitable (however nonetheless fairly wild), BlackRock simply filed so as to add staking to its spot Ethereum ETF. Yep, that BlackRock—the $10 trillion asset administration behemoth that already dominates the BTC and ETH ETF house—is now eyeing on-chain yield. The Nasdaq submitted the formal rule change request to the SEC, looking for to permit the iShares Ethereum Belief (ETHA) to stake the ether it holds. If it will get the inexperienced mild, this might open up institutional staking like by no means earlier than.

The market didn’t precisely go nuts after the information. ETH costs barely flinched. Nonetheless, the asset’s been outperforming many of the majors recently—up 21% over the previous week in comparison with BTC’s 5.5%. And that’s not nothing. The ETH/BTC ratio simply popped to 0.029, its highest since February. Loads of this juice got here from record-breaking ETF inflows, too—$720 million yesterday alone, with a large 69% of that flowing into BlackRock’s fund. Quiet flex.

Huge Cash Retains Pouring Into ETH

All in all, U.S.-listed ETH ETFs have pulled in $6.5 billion thus far. However that quantity can be a complete lot increased if it weren’t for Grayscale’s ETHE bleeding out—over $4 billion in web outflows. BlackRock’s fund alone accounts for $7.1 billion in inflows, which is sort of insane. TradFi isn’t simply testing the Ethereum waters anymore—they’re diving in head first.

Then there’s the treasury shopping for. Huge time. SharpLink Gaming, the place Ethereum co-founder Joe Lubin sits as chairman, reportedly holds over $500M in ETH. In the meantime, BitMine dropped a bomb—its ETH treasury simply handed $1 billion. With that sort of backing, ETH doesn’t really want a pump tweet to remain related.

ETH Staking: Not Only a BlackRock Factor

Right here’s the kicker—BlackRock isn’t even first. Cboe and NYSE already filed so as to add staking choices to ETH ETFs from Constancy, Franklin, and Bitwise means again in March. Grayscale threw its hat within the ring too in April. So whereas this BlackRock information is making waves, it’s truly a part of a a lot larger, slower shift occurring behind the scenes.

It’s the TradFi-on-chain second. Quiet, regular, and in some way far more critical than it was in the course of the bull cycles. Vance Spencer from Framework Ventures mentioned it finest on X: “Perhaps you didn’t count on Lubin and Tom Lee to steer the tradfi bandwagon to ETH and BlackRock so as to add staking simply because the wheels begin to flip. However that’s what’s occurring.” Honest level.

What Comes Subsequent?

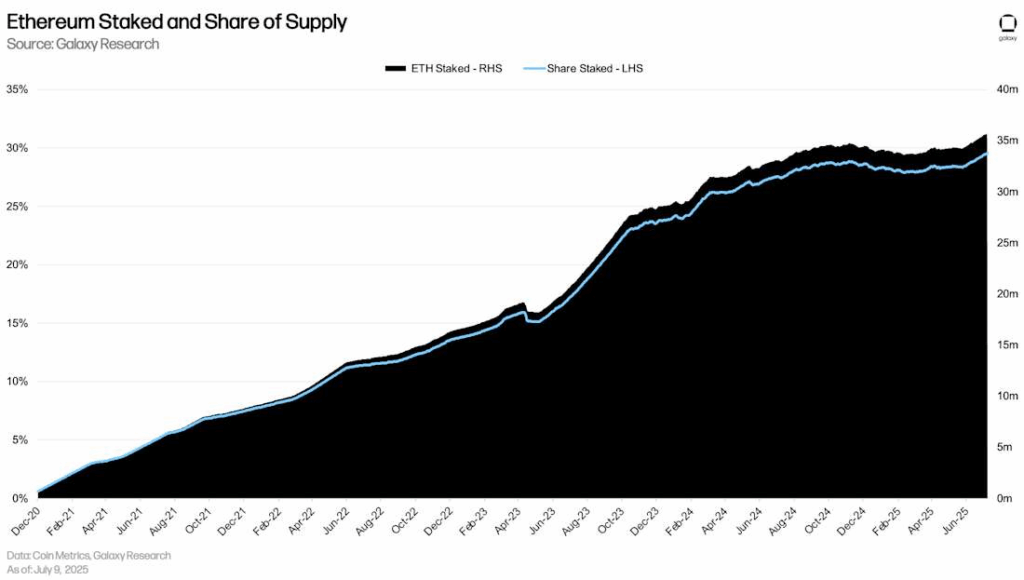

If the SEC indicators off on this, it could possibly be the beginning of one thing huge. Establishments amassing staking yield on ETH by way of regulated merchandise? That adjustments the sport. It provides utility, not simply hypothesis, to those funds—and which may appeal to a special sort of capital. Lengthy-term capital.

However there’s all the time that SEC wildcard. Even when this will get permitted, implementation might take a minute. And if it doesn’t? Properly, the momentum appears too robust to cease anyway. Between inflows, treasuries stacking ETH, and staking changing into a part of the ETF playbook—Ethereum’s getting extra intertwined with conventional finance by the week.