At present, The Smarter Net Firm (AQUIS: SWC | OTCQB: TSWCF) introduced it has added 325 extra Bitcoin to its treasury, investing £27.1 million at a mean value of £83,525 per BTC. This brings the corporate’s complete Bitcoin holdings to 1,600 BTC, acquired at a complete price of £127.3 million and a mean value of £79,534.

It reviews a year-to-date BTC yield of 39,258% and a 30 day yield of 419%, with roughly £4 million in money nonetheless obtainable for additional Bitcoin acquisitions. The acquisition is a part of SWC’s 10 Yr Plan, a long run technique that features holding Bitcoin as a core treasury asset.

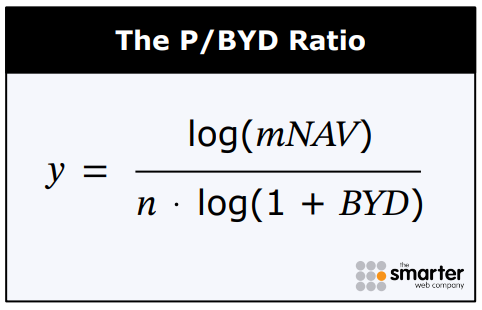

“The P/BYD ratio goals to allow buyers and analysts to know higher why a public firm would maintain Bitcoin as a treasury asset, in an analogous technique to the P/E ratio generally used when evaluating conventional equities,” mentioned the corporate in a press launch.

“General, an investor who re-allocates BTC into Smarter Net seems to be “overpaying” 5.58x for Bitcoin,” the P/BYD doc famous. Nonetheless, assuming a continued charge of BTC Yield supply, buyers must wait simply 0.09 years (~32 days) to earn cumulative Bitcoin equal to their funding as we speak.”

The corporate launched its Bitcoin targeted technique in April 2025 with the launch of its 10 Yr Plan, establishing Bitcoin as a cornerstone of its long run monetary technique. Shortly after, on April 25, 2025, The Smarter Net Firm went public on the Aquis Inventory Trade Development Market, elevating as much as £2 million by a mixture of institutional and retail subscriptions. The IPO additionally featured retail participation through the Winterflood Retail Entry Platform (WRAP), enabling UK buyers to affix with a minimal funding of 500 euros.

“Since 2023 The Smarter Net Firm has adopted a coverage of accepting fee in Bitcoin,” the corporate acknowledged. “The Firm believes that Bitcoin types a core a part of the way forward for the worldwide monetary system and because the Firm explores alternatives by natural progress and company acquisitions is pioneering the adoption of a Bitcoin Treasury Coverage into its technique.”