The White Home on Thursday confirmed that President Donald Trump stays dedicated to carving out a de minimis tax secure‑harbor for on a regular basis Bitcoin and different cryptocurrency funds, a coverage his financial crew believes will let digital cash perform “as merely as shopping for a cup of espresso.”

Trump Backs Bitcoin And Crypto Tax Exemption

Press Secretary Karoline Leavitt made the remarks in the course of the each day briefing after Bitcoin Journal correspondent Frank Corva pressed the administration on whether or not the president nonetheless stands behind the $600 threshold he first floated earlier this 12 months. “The president did sign his help for a de minimis exemption for crypto, and the administration continues to be in help of that,” Leavitt stated, including that the Treasury and Congress are “exploring legislative options to perform that.”

Leavitt argued the measure would take away the micro‑accounting burden that presently forces customers to calculate capital‑positive aspects tax each time they spend appreciated digital property. “Proper now that can’t occur, however with a de minimis exemption maybe it may sooner or later,” she informed reporters, framing the carve‑out as important to Trump’s pledge to make the United States “the crypto capital of the world.”

The exemption is anticipated to floor in comply with‑on tax laws later this 12 months, however it already has momentum on Capitol Hill. The Home on Wednesday superior the bipartisan Genius Act, the primary complete federal framework for stablecoins, and a separate invoice that might write a de minimis normal instantly into the Inner Income Code. The Genius Act cleared the chamber 308‑122 and is scheduled for a Rose Backyard signing ceremony on Friday, Leavitt stated.

Trump’s push picks up a debate that started in 2022, when senators Pat Toomey and Kyrsten Sinema launched the Digital Forex Tax Equity Act to exempt positive aspects of as much as $200 per transaction—far beneath the $600 ceiling now backed by the White Home. Business teams equivalent to Coin Middle and the Blockchain Affiliation have lengthy argued that parity with overseas‑forex guidelines is crucial for retail crypto adoption.

Leavitt additionally reiterated that the president “opposes a central‑financial institution digital forex,” noting Trump’s January govt order barring the Federal Reserve from issuing one and endorsing congressional efforts to codify that ban. She portrayed the mixed bundle—stablecoin oversight, securities‑readability guidelines, an anti‑CBDC statute and the forthcoming de minimis repair—as “a regulatory basis that can unleash American management in digital property for many years.”

A $600 exclusion would dramatically cut back friction for low‑worth crypto spending whereas leaving massive transfers absolutely taxable, hanging a steadiness between usability and income safety. Whether or not the ultimate threshold lands at $200, $600 or is listed for inflation will hinge on Senate negotiations later this summer season, however the White Home endorsement offers the measure its strongest tail‑wind but. As Leavitt summed up: “The president appears to be like ahead to signing every bit of professional‑crypto laws Congress can ship him.”

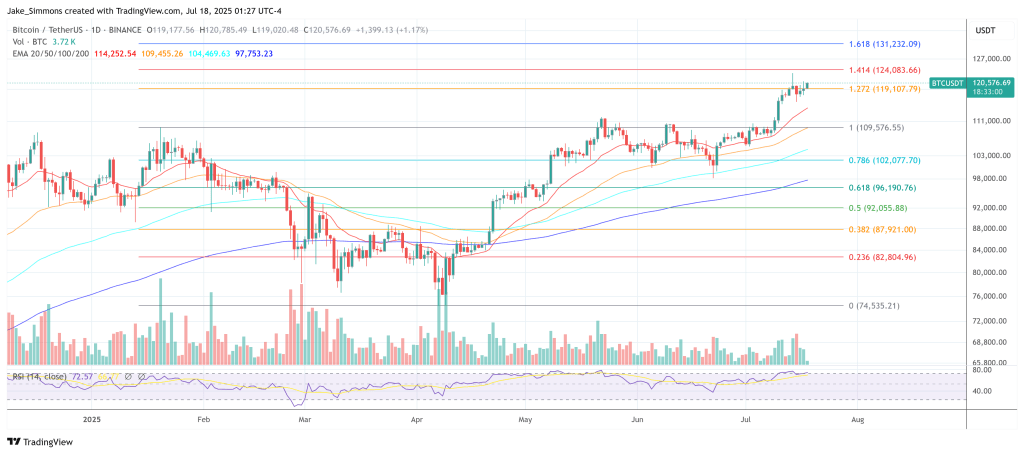

At press time, Bitcoin traded at $120,576.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.