- BNB broke above $720, gaining 10% in July however lagging behind faster-rising altcoins.

- Community upgrades and token burns have strengthened fundamentals, however whale wallets are shrinking.

- Institutional curiosity is rising, with Windtree planning a $200M BNB treasury—but BNB nonetheless wants momentum to reclaim top-tier dominance.

Binance Coin is again above $700—for actual this time. After stumbling twice in Q2, BNB lastly pushed previous that ceiling and cruised as much as $720 on July 17 with a modest 4.17% every day pop. Not dangerous… however not precisely stealing the present both.

For July, BNB’s up round 10%, which sounds strong—till you go searching. Different high alts are sprinting forward, with features north of 20%. Almost $140B in contemporary cash simply flowed into the altcoin scene, pushing the whole cap to $1.47 trillion. Out of that, BNB solely pulled in $4B—nonetheless so much, however the smallest seize among the many high 5 cryptos.

Market dominance? Yeah, that’s slipping too. Right down to 2.60%, a five-month low, from 3.40% again in mid-March. The coin is shifting up, positive—however kinda getting left behind within the race.

Tech Upgrades and Actual-World Ambitions

Now, let’s not ignore the great things. The Maxwell improve on BNB Good Chain has been a game-changer—block occasions lower to 0.75 seconds, throughput doubled. That’s strong, particularly for devs constructing apps or tokenizing real-world property.

Additionally, the Zero Price Carnival’s been prolonged by way of July, which suggests no charges for USDT and USD1 transfers. That’s boosted community utilization. Oh—and tokenized shares are actually stay on BNB Chain because of Kraken and Backed Finance launching xStocks. So yeah, the chain’s evolving.

Establishments Eyeing In, Whales Easing Out?

Windtree Therapeutics needs to lift $200M to kick off a BNB treasury, they usually’re even eyeing a public inventory itemizing for it. That’s a giant transfer. Could possibly be the primary legit Wall Road-style entry for BNB.

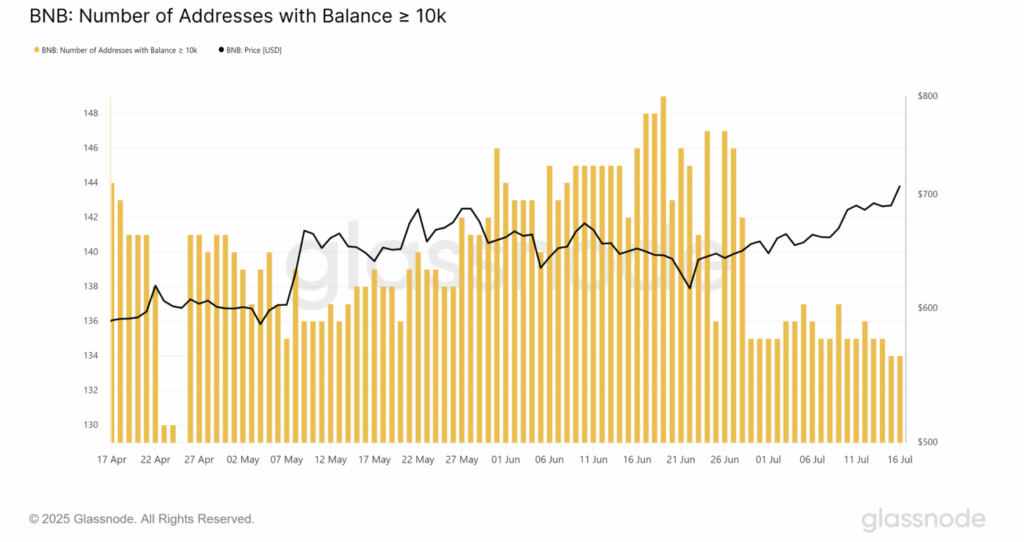

However right here’s the bizarre half—whales appear to be backing off. Wallets holding greater than 10,000 BNB hit a close to three-month low. Whereas different main cash are seeing huge pockets development (hey Solana), BNB’s massive holders are trimming.

Nonetheless, Binance simply completed its thirty second token burn, torching 1.59 million BNB price over $1 million. So provide’s nonetheless tightening, which helps the long-term image.

Present Setup and What’s Subsequent

Proper now, BNB’s buying and selling at $735.94. Momentum seems good on the charts—above key shifting averages, MACD’s flashing bullish at 17.25, and RSI’s at 78.82 (bit overbought, however not loopy but).

Help sits down at $643.71 and $601.25. Rapid resistance is correct at $736.56, with that 52-week excessive of $749.72 lurking simply above.

All in all, BNB’s technically wholesome, however in a sizzling alt market, it’s gotta do extra to face out. Different tokens are climbing sooner and drawing heavier capital. The query now: can BNB catch up—or is it slowly dropping its edge?