- Home handed Readability Act – lets decentralized blockchains develop into commodities (not securities)

- Cardano doubtless qualifies – 3,000+ stake swimming pools, on-chain governance, no entity owns >10%

- If accepted = ETFs, institutional cash, regulatory readability – ADA already up 16%

WASHINGTON — The U.S. Home of Representatives handed landmark cryptocurrency laws on July 17, 2025, doubtlessly clearing the trail for Cardano (ADA) to realize commodity standing alongside Bitcoin and Ethereum. The Digital Asset Market Readability Act (H.R. 3633) handed 294-134, establishing new standards that would essentially change how digital property are regulated.

Breaking Down the Readability Act

The bipartisan laws, sponsored by Rep. J. French Hill (R-Arkansas), creates a transparent distinction between cryptocurrencies regulated as commodities by the CFTC and people categorized as securities underneath SEC oversight. The important thing innovation: establishing “mature blockchain methods” that qualify for lighter regulatory therapy.

“This laws gives the regulatory readability our trade desperately wants,” mentioned Rep. Hill following the vote. The Act defines mature blockchains as decentralized networks “not managed by any particular person or group of individuals underneath widespread management.”

Regardless of viral social media claims, the Act doesn’t explicitly identify Cardano as “Possible Mature.” As an alternative, it establishes goal standards together with:

- No entity controlling greater than 20% of token provide

- Open-source improvement

- Decentralized governance

- Operational stability over time

Cardano’s Sturdy Place

Business analysts imagine Cardano stands well-positioned to fulfill these standards. The community operates over 3,000 impartial stake swimming pools, with no single entity controlling greater than 10% of ADA provide. Its September 2024 Chang arduous fork launched absolutely decentralized governance, permitting ADA holders to vote on protocol modifications straight.

“Cardano’s decentralization metrics are among the many strongest within the trade,” famous blockchain researcher Sarah Chen. “The College of Edinburgh ranked it as essentially the most decentralized blockchain in 2023, even surpassing Bitcoin in a number of measures.”

Nonetheless, questions stay concerning the continued involvement of founding entities—the Cardano Basis, Enter Output World (IOHK), and Emurgo. Whereas their affect has diminished considerably, regulators will scrutinize whether or not they represent “widespread management.”

Market Reacts Positively

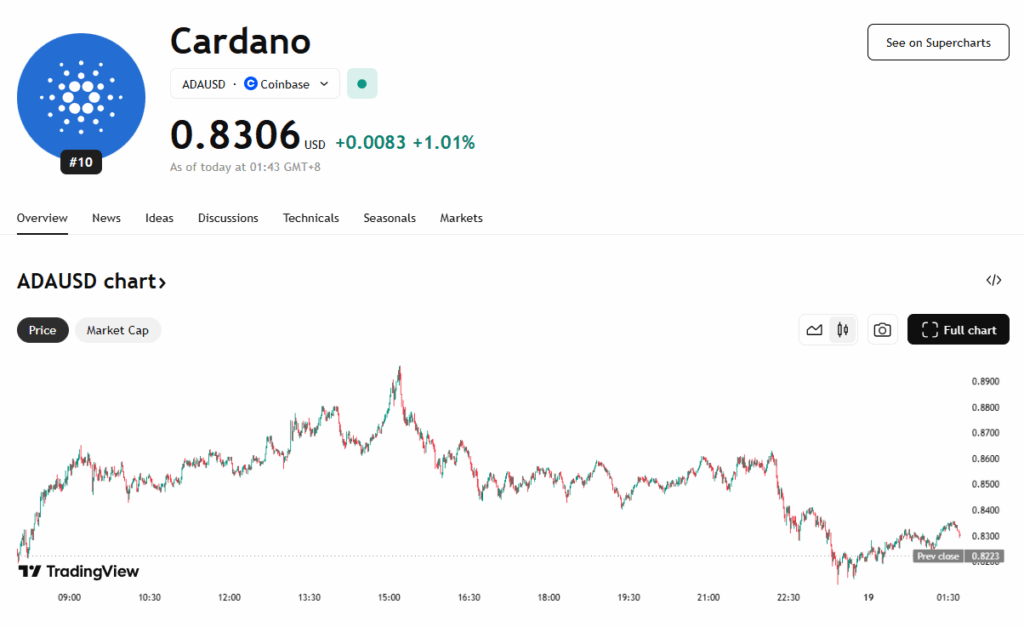

ADA surged 16% following the Home vote, reaching $0.89 as buying and selling quantity spiked to $3.09 billion every day. Whale wallets accrued 120 million ADA tokens in latest weeks, suggesting institutional positioning forward of potential regulatory readability.

Charles Hoskinson, Cardano’s founder, predicted a “gigachad bull run” pushed by the laws. “Regulatory certainty will unlock trillions in institutional capital at present sitting on the sidelines,” he said throughout a latest livestream.

The pending Grayscale Cardano ETF utility, at present underneath SEC assessment with an October 2025 deadline, may gain advantage considerably from commodity classification. Banks and monetary establishments would face fewer restrictions providing ADA custody providers underneath CFTC moderately than SEC oversight.

What Occurs Subsequent

The Senate should now contemplate its model of crypto market construction laws. Banking Committee Chairman Tim Scott goals to finish hearings by September 30, with the Trump administration signaling sturdy assist by way of crypto czar David Sacks.

As soon as enacted, implementation would proceed quickly:

- 30 days: SEC/CFTC start joint rulemaking

- 60 days: Preliminary frameworks revealed

- 180 days: Full implementation

Present blockchains can apply for maturity certification, with automated approval if the SEC doesn’t object inside 60 days—a provision designed to forestall regulatory delays.

Ecosystem Momentum Builds

Cardano’s ecosystem reveals sturdy progress amid regulatory optimism. Complete Worth Locked in DeFi protocols reached $349 million, up 13% quarter-over-quarter. Main upgrades together with the Hydra scaling resolution and Midnight privateness sidechain are progressing on schedule.

“We’re seeing accelerated improvement as groups anticipate clearer regulatory frameworks,” mentioned John Martinez, CEO of Liqwid Finance, Cardano’s largest DeFi protocol. “Commodity standing would take away the authorized uncertainty that’s held again institutional participation.”

The Stakes for ADA Holders

For the 5.5 million ADA holders worldwide, commodity classification might show transformative. Analysts mission worth targets starting from $1.00 to $2.00 by year-end, although longer-term impacts might show extra vital.

“This isn’t nearly worth appreciation,” defined crypto legal professional Maria Rodriguez. “Commodity standing opens doorways to ETFs, company treasury adoption, and integration with conventional finance that securities classification prevents.”

Nonetheless, dangers stay. Cardano should display true independence from founding entities whereas competing networks additionally vie for favorable classification. The Senate might modify key provisions, and implementation particulars matter as a lot because the laws itself.

Trying Forward

The crypto trade watches intently as Cardano navigates this regulatory milestone. Success would validate the trail from centralized improvement to decentralized commodity, doubtlessly benefiting different blockchain networks.

“We’re witnessing the maturation of cryptocurrency regulation,” mentioned former CFTC Commissioner Brian Quintenz. “The Readability Act acknowledges that blockchain networks can evolve past their origins into really decentralized methods.”

Because the Senate prepares its deliberations, Cardano stakeholders are mobilizing to make sure their community meets all maturity standards. The subsequent six months will show decisive in figuring out whether or not ADA joins Bitcoin and Ethereum within the unique commodity classification membership—a improvement that would reshape all the cryptocurrency panorama.