Constancy Investments’ international macro director Jurrien Timmer says that the US greenback’s international supremacy might erode additional if one occasion happens.

In a brand new thread on the social media platform X, Timmer says that if the Fed is pressured to prop up the bond market, resembling by shopping for the debt securities, the US greenback index (DXY) might tumble even decrease.

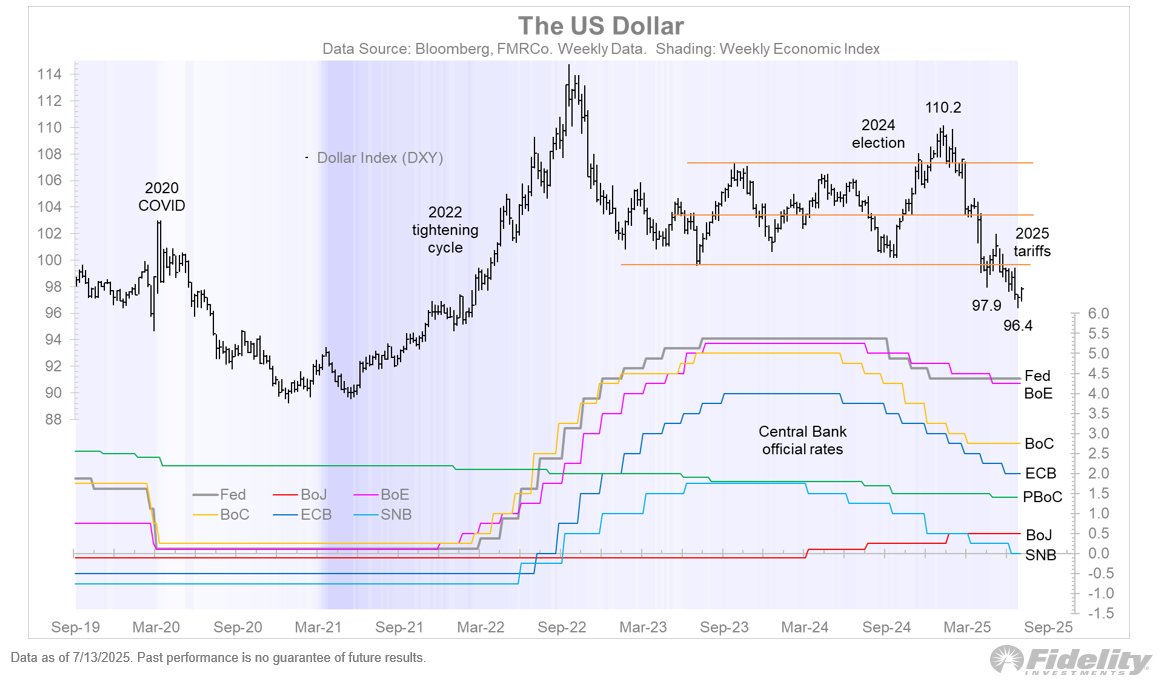

“If the Fed is pressured again into the bond market to carry down nominal and actual charges, the greenback might effectively lose extra of its supremacy premium. Currencies are the discharge valve for unsustainable fiscal coverage, as Japan discovered a number of years in the past. The identical is now true for the greenback, which continues to lose energy regardless of the Fed’s hawkish coverage stance.”

The DXY, a measure of the worth of the greenback relative to a basket of six different main currencies from main economies, is at the moment at 98, down over 9% on the yr.

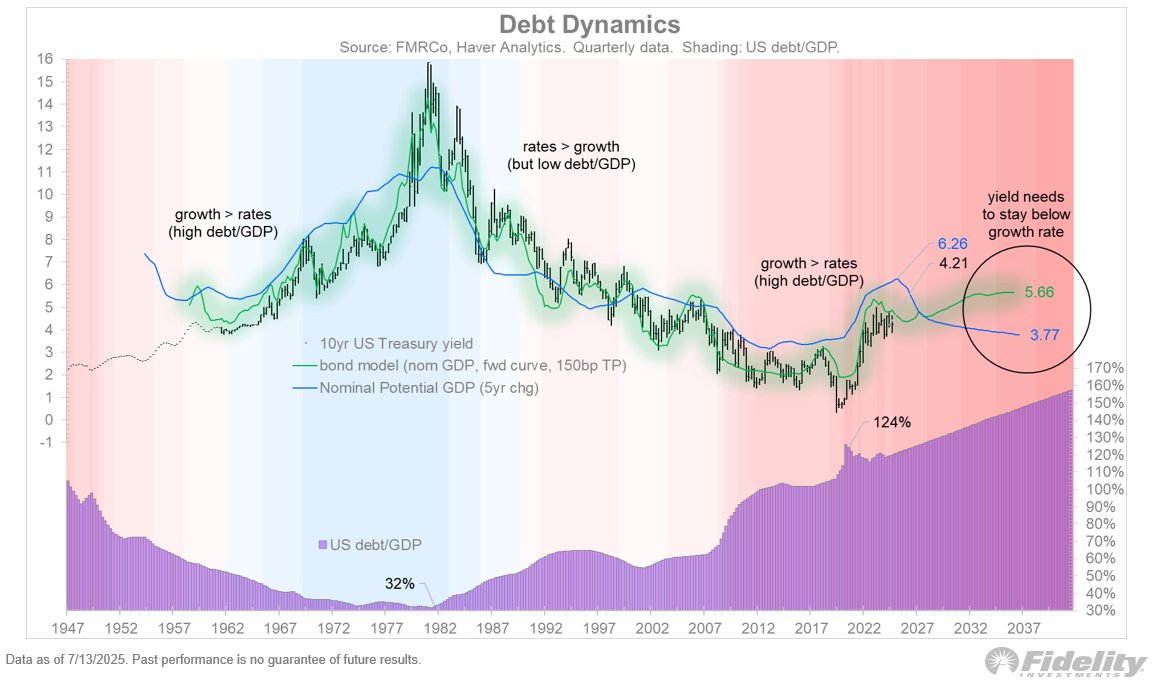

Timmer additionally says that if GDP development can not outpace the rate of interest paid on authorities debt, the Fed intervention within the bond market will possible need to happen.

“With the debt ceiling now handed, the debt is rising once more and the jaws between what the Treasury is promoting and what the Fed is shopping for proceed to widen. This can solely final for thus lengthy, for my part. We at the moment are in spherical two of fiscal dominance, with the primary $5 trillion helicopter drop happening throughout COVID and now the second about to get underway from the OBBB (One Massive Lovely Invoice Act).

The mathematics is straightforward however troublesome: so long as nominal GDP development outpaces the funding fee (10-year Treasury yield), the debt could be thought of sustainable. Hopefully, that occurs, as a capex cycle (capital expenditure) from each the OBBB and the AI (synthetic intelligence) growth will increase productiveness and subsequently the non-inflationary velocity restrict for the US financial system.

If not, and if the time period premium rises additional, in a number of years we may have an unsustainable debt spiral on our fingers, requiring the Fed to re-enter the bond market to suppress the time period premium as soon as once more.”

Observe us on X, Fb and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Verify Value Motion

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl usually are not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual danger, and any losses you could incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney