Key Insights:

- Bitcoin is holding above $119,000 as cooling U.S. inflation helps threat property.

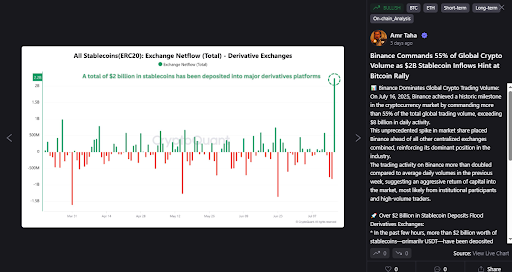

- Over $2 billion in stablecoin inflows throughout the derivatives markets reveals a rising urge for food for leveraged positions.

- Liquidity clusters close to $120,000 point out that Bitcoin might take a look at new highs quickly.

Bitcoin continues to point out resilience, and is sustaining assist above $119,000 amid cooling U.S. inflation information and a large $2 billion stablecoin injection. Market sentiment is shifting and liquidity is constructing. Due to this analysts see a doable value breakout towards $120,000 and presumably greater.

Inflation Knowledge Gives Reduction to Bitcoin Bulls

Bitcoin obtained a lift from the newest U.S. Producer Worth Index (PPI) information, which confirmed inflation cooling greater than anticipated in June.

Whereas the Shopper Worth Index (CPI) had stunned markets with a slight uptick the day earlier than, PPI numbers helped ease fears. The index rose 2.3% year-on-year, decrease than the forecasted 2.5%, offering bulls with a welcome reprieve.

Merchants had been fast to reply. Crypto analyst Matthew Hyland identified that the CPI miss was largely pushed by a brief rise in oil costs, which have since come down. “There isn’t a excessive inflation like practically all of the specialists claimed can be right here by now,” he wrote, suggesting that fears of a sustained inflation surge could also be overblown.

The world is slipping again in the direction of #deflation. Even the US reported zero #PPI.

Probably good for threat property #BTC and so forth as cash printing returns BUT long run, simply digging a DEEPER HOLE for the monetary system which is unsustainable.

They love kicking the can down the highway 🥹 pic.twitter.com/c0JD9EWajt— Matthew Dixon – Veteran Monetary Dealer (@mdtrade) July 18, 2025

Regardless of this, the market is just not but pricing in a Federal Reserve charge lower on the July 30 assembly. In line with the CME Group’s FedWatch Instrument, expectations for a charge discount are nonetheless low. Nonetheless, the cooling inflation figures have traditionally supported threat property like Bitcoin, which are inclined to carry out higher in a low-rate atmosphere.

Bitcoin Finds Help as Liquidity Builds Close to $120K

Bitcoin’s value motion has been coiling between $116,000 and $120,000. The cryptocurrency is now forming a good consolidation vary that usually comes earlier than main strikes. On the time of writing, BTC trades simply above $118,000, and is up 2.4% over the previous 24 hours.

Technical analysts are carefully watching a liquidity zone between $119,500 and $120,500.

To date, these ranges are thick with ask orders and are forming a magnet that would pull costs greater if momentum strengthens. In line with the Coinglass liquidation heatmap, these clusters are areas of curiosity for each merchants and automatic buying and selling techniques.

One other facet of the technical setup is the CME futures hole between $114,300 and $115,600. Traditionally, Bitcoin tends to revisit these “gaps,” however as dealer Rekt Capital famous, BTC is presently holding above that stage.

Appears to be like like Bitcoin is discovering assist simply above its Every day CME Hole$BTC #Crypto #Bitcoin https://t.co/QcNm4fopm7 pic.twitter.com/FWyxwX0lir

— Rekt Capital (@rektcapital) July 16, 2025

This means power and will delay any pullbacks within the close to time period.

$2 Billion Stablecoin Injection And Institutional Urge for food

One other main growth including gasoline to Bitcoin’s value efficiency is the sudden inflow of over $2 billion in stablecoins. That is particularly Tether (USDT), into main derivatives exchanges.

This spike is often seen as a precursor to huge lengthy positions from traders, and reveals that market confidence is at an all-time excessive.

In line with CryptoQuant analyst Amr Taha the transfer is a transparent signal that institutional gamers are establishing for a breakout. Tether’s minting of latest USDT tokens additionally factors to recent demand from giant traders.

Traditionally, such large-scale stablecoin deposits have a tendency to come back earlier than value rallies. Merchants use stablecoins to open futures contracts and perpetual positions, which will increase market leverage and kickstarts value motion.

The timing of this liquidity influx, mixed with Bitcoin’s consolidation close to a significant resistance stage units the stage for a presumably explosive upside transfer.