Bitcoin’s rally to a brand new all-time excessive above $123,000 earlier this week has triggered a wave of profit-taking. A number of the market’s largest gamers, together with miners and long-dormant whales, led the cost, based on CryptoQuant.

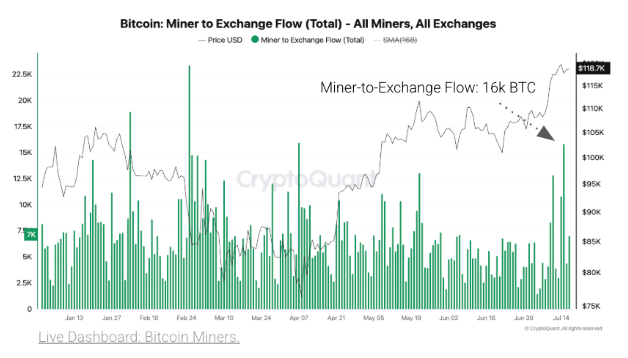

On July 15, Bitcoin miners transferred over 16,000 BTC to exchanges, making it the biggest single-day offload since April 7, after they moved 17,000 BTC.

Bitcoin Miners Offload 16,000 BTC in Largest Promote-Off Since April

In accordance with knowledge from CryptoQuant, this exercise triggered miner reserves to say no from 68,000 BTC to 65,000 BTC, a one-month low.

“All of the Bitcoin was transferred into exchanges, reinforcing the view that miners offered as Bitcoin reached the newest all-time excessive,” CryptoQuant acknowledged.

In the meantime, the promoting strain wasn’t restricted to miners, as different cohorts additionally sought to revenue close to market highs.

CryptoQuant reported that whole trade inflows surged to 81,000 BTC that day, up sharply from simply 19,000 BTC a couple of days prior. This spike was pushed largely by whales, whose trade transfers jumped from 13,000 BTC to 58,000 BTC.

Notably, one of many standout transactions on the day was a uncommon transfer from a Satoshi-era whale, an handle dormant since Bitcoin’s early days, which transferred 40,000 BTC to exchanges. The pockets initially held over 80,000 BTC.

Blockchain analytics agency Lookonchain flagged the switch as a probable sell-off. It steered that long-term holders could also be seizing the second to lock in features.

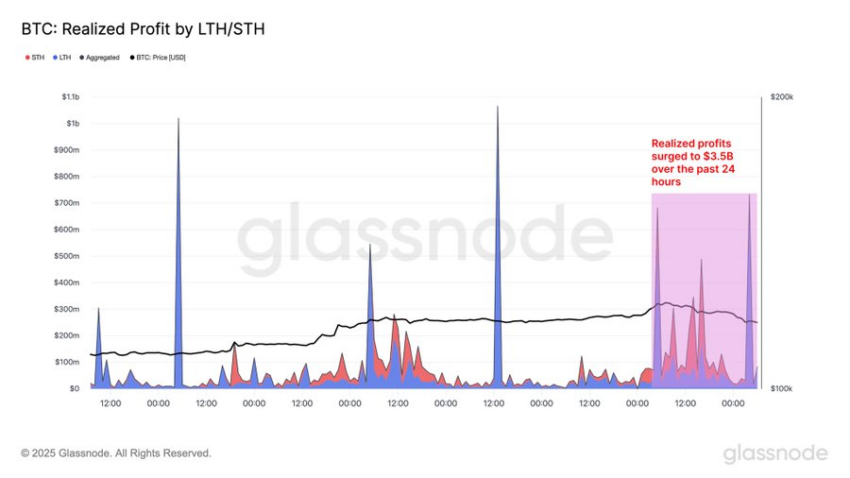

Unsurprisingly, the day’s heavy promoting translated into one of many largest profit-taking occasions of 2025.

In accordance with Glassnode, realized earnings surged to $3.5 billion, with long-term holders accounting for 56% of that whole, or $1.96 billion. Brief-term holders realized $1.54 billion in features.

Realized revenue is an on-chain metric that tracks the worth of cash offered at a worth larger than their final recorded transaction. It presents perception into investor conduct throughout unstable intervals.

On account of these heavy buying and selling actions, Bitcoin’s worth has since cooled to round $118,229 at press time, based on BeInCrypto knowledge.

Nonetheless, market observers stay optimistic about Bitcoin’s future worth potential. They spotlight latest pro-crypto laws within the US as a key driver of sentiment. Moreover, rising institutional curiosity worldwide suggests there’s nonetheless room for additional upside.

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nonetheless, readers are suggested to confirm information independently and seek the advice of with knowledgeable earlier than making any choices based mostly on this content material. Please observe that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.