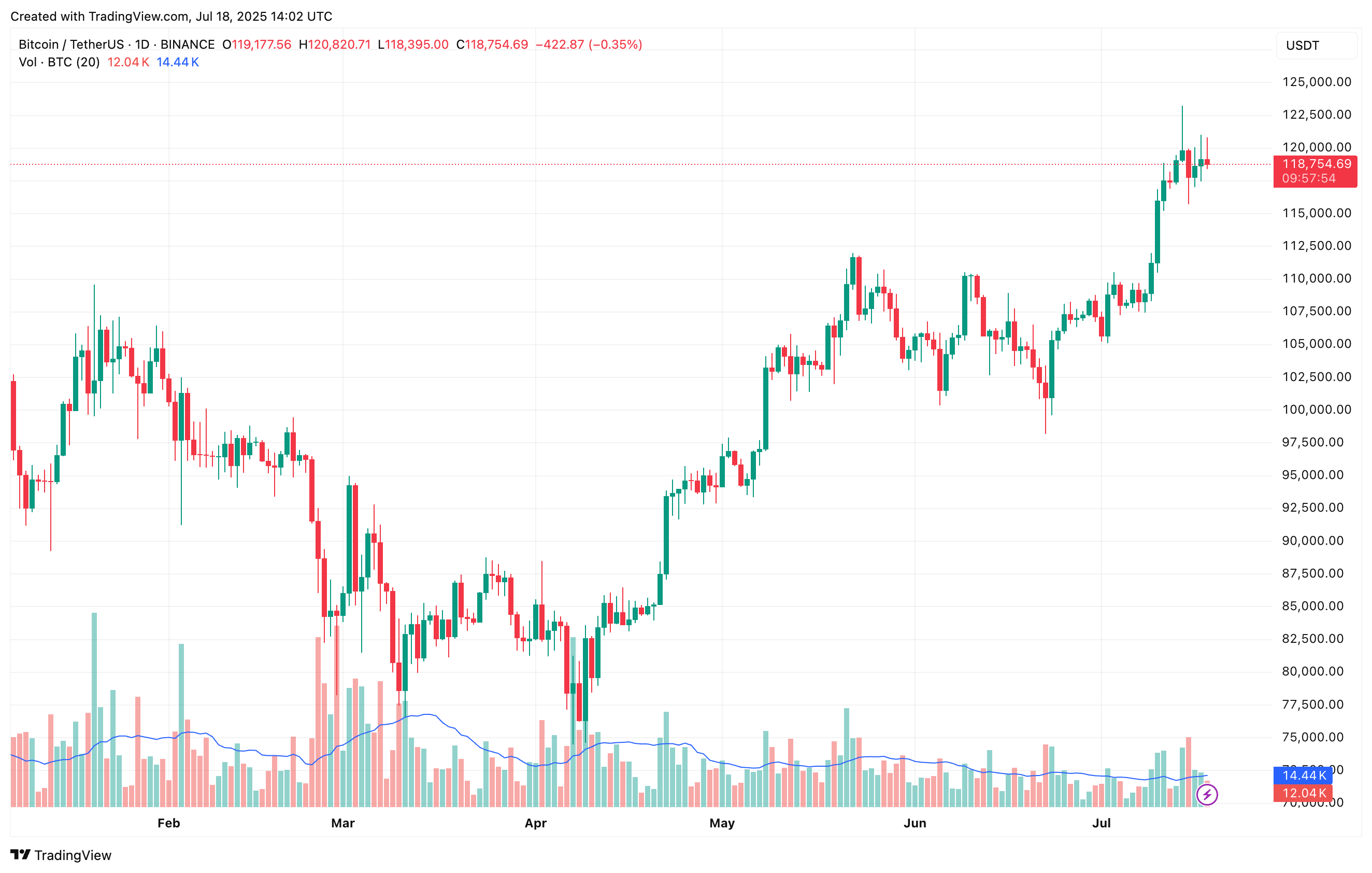

As Bitcoin (BTC) continues to set new all-time highs (ATH) – reaching $123,218 on Binance on July 13 – on-chain information reveals a shift in holder conduct that might threaten the cryptocurrency’s bullish momentum.

Bitcoin Holder Rotation Could Derail Rally

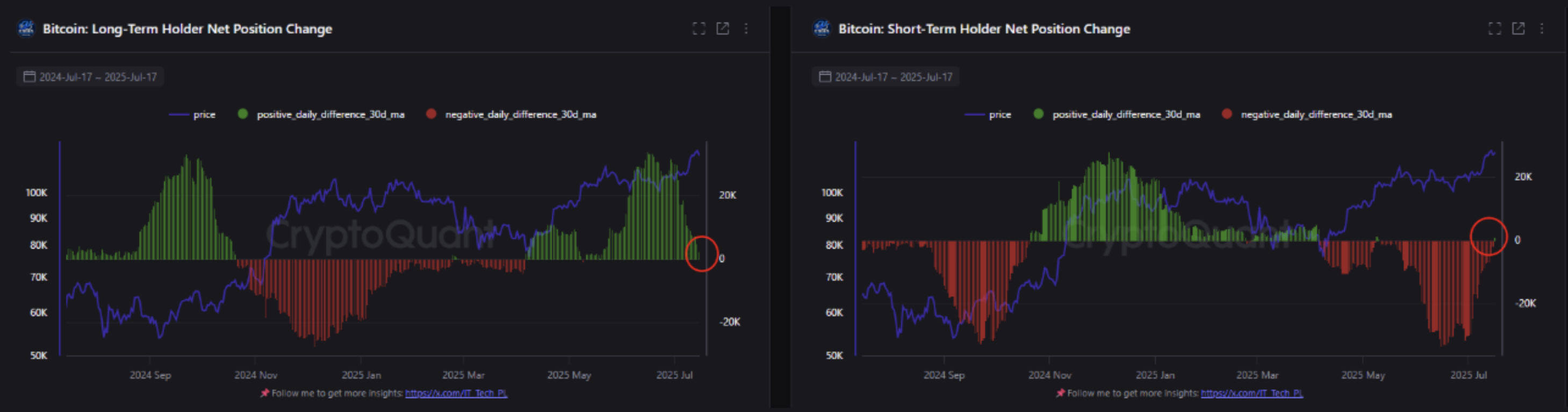

In line with a CryptoQuant Quicktake put up by contributor IT Tech, long-term Bitcoin holders (LTH) – these holding BTC for over 155 days – have transitioned into web distribution, suggesting seasoned buyers are partaking in profit-taking.

In the meantime, short-term holders (STH) – those that have held BTC for lower than 155 days — have just lately turned web constructive, indicating they’re shopping for into BTC’s present rally in anticipation of additional good points.

Historic information exhibits that comparable developments amongst LTH and STH had been noticed again in April 2021 and November 2023. Throughout each these situations, BTC witnessed a cooling part or an area high when spot demand light.

Associated Studying

Of their evaluation, IT Tech advised maintaining a tally of alternate inflows and funding charges for affirmation. If spot BTC inflows to crypto exchanges surge, it might trace that sell-pressure is prone to improve, which can derail the digital asset’s bullish trajectory.

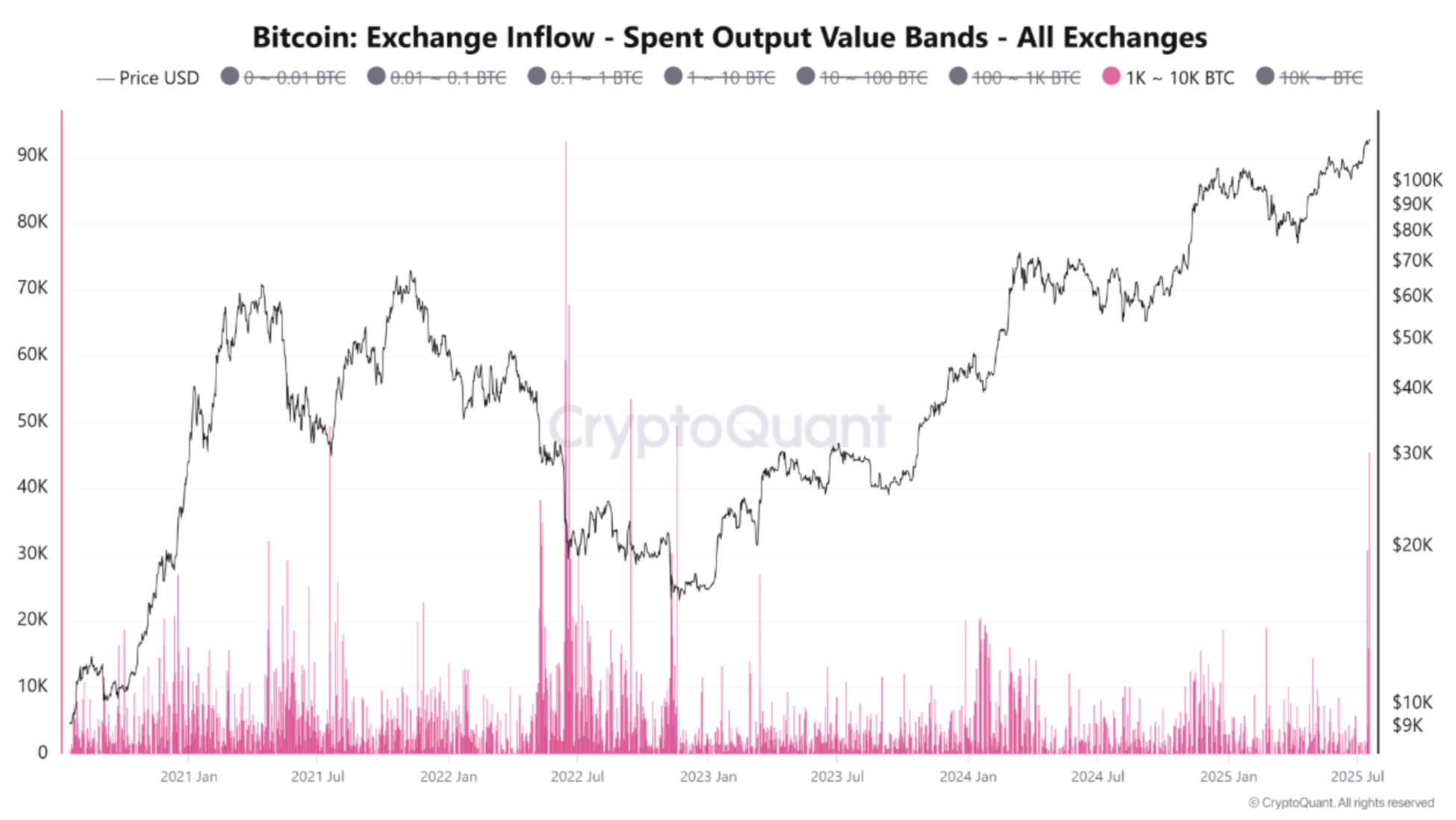

Supporting this view, CryptoQuant contributor Arab Chain famous that the Spent Output Worth Ranges (SOVR) indicator exhibits a spike in BTC transfers to exchanges from wallets holding 1,000 to 10,000 BTC – sometimes related to whales.

For the uninitiated, the SOVR indicator tracks on-chain BTC transfers by worth buckets to establish which investor segments are energetic. It helps reveal whether or not retail, mid-sized, or institutional gamers are driving market exercise.

This aligns with IT Tech’s observations on long-term holders. If promoting strain intensifies, BTC might appropriate all the way down to a assist degree close to $111,800.

Not All Analysts See Rally Exhaustion

Though Bitcoin LTH coming into distribution part, and whales rising their deposits to crypto exchanges could level towards a possible finish for the present rally, not all analysts share the identical sentiment.

Associated Studying

As an example, the STH Market Worth to Realized Worth (MVRV) suggests BTC should still be undervalued, indicating potential for additional upside. If that holds, Bitcoin might climb as excessive as $150,000 earlier than any main pullback.

Moreover, a contemporary injection of $2 billion in liquidity to main crypto derivatives platforms might assist reignite bullish momentum. Nevertheless, warning stays warranted.

The Bitcoin NVT Golden Cross has been climbing steadily, giving early indicators of an overheated market. At press time, BTC trades at $118,754, up 0.4% prior to now 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com