Bitcoin worth reached consecutive all-time highs in July, however two key indicators counsel the rally is closely US-driven.

A rising divergence between US and Korean buying and selling exercise is elevating questions on international participation — and market threat.

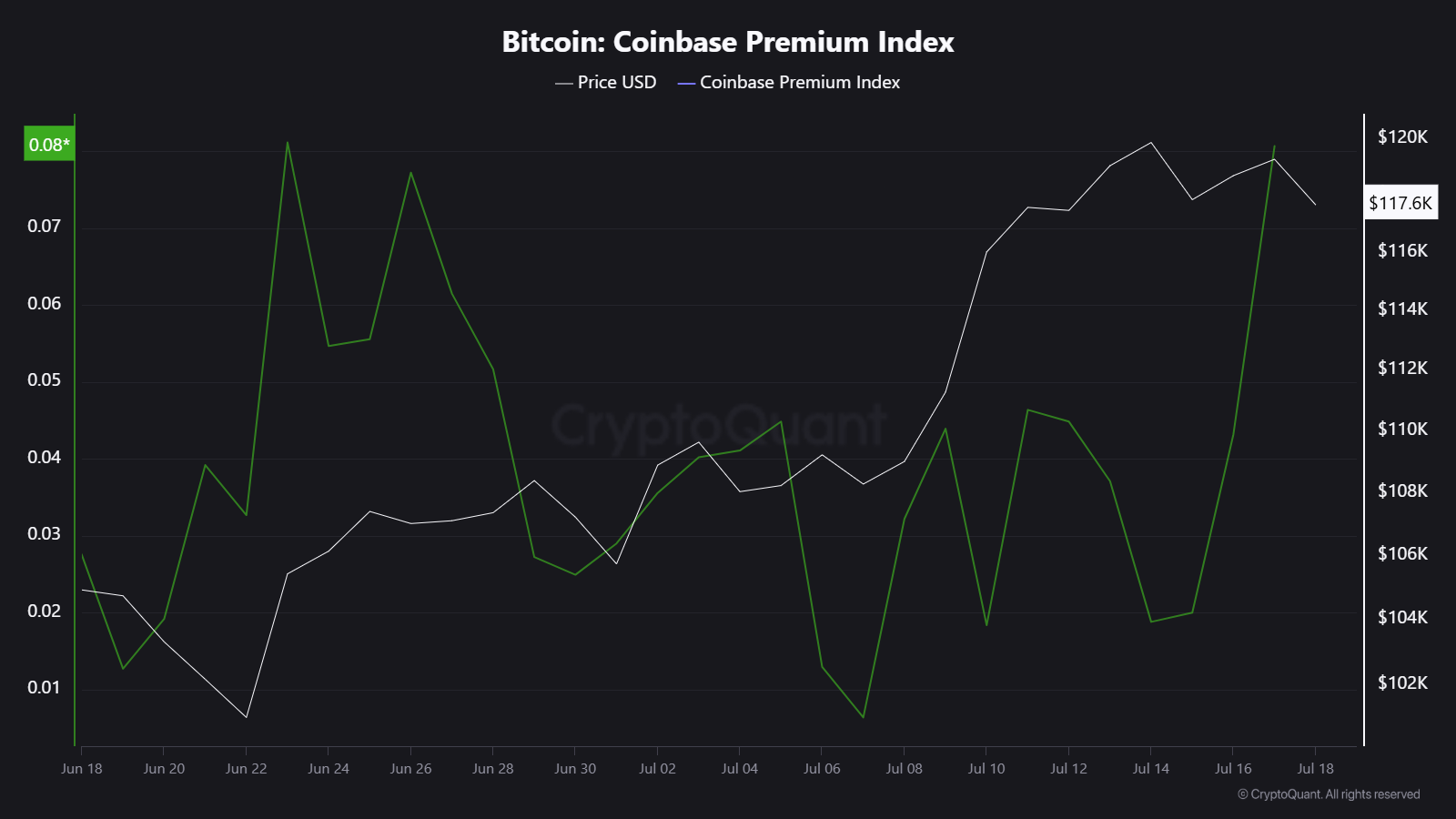

Coinbase Premium Surges Alongside US Bitcoin ETF Inflows

The Coinbase Premium Index, which tracks the value distinction between Bitcoin on Coinbase (USD) and Binance (USDT), has surged all through July.

This premium has climbed as excessive as 0.08%, signaling sturdy US shopping for strain.

Coinbase serves US institutional and retail buyers. A rising premium typically displays aggressive accumulation by American whales, ETF suppliers, or firms.

This aligns with current inflows of over $14.8 billion into US spot Bitcoin ETFs, pushing BTC to an all-time excessive close to $123,000.

These actions verify that US establishments are main the present cycle, supported by favorable regulation and capital entry.

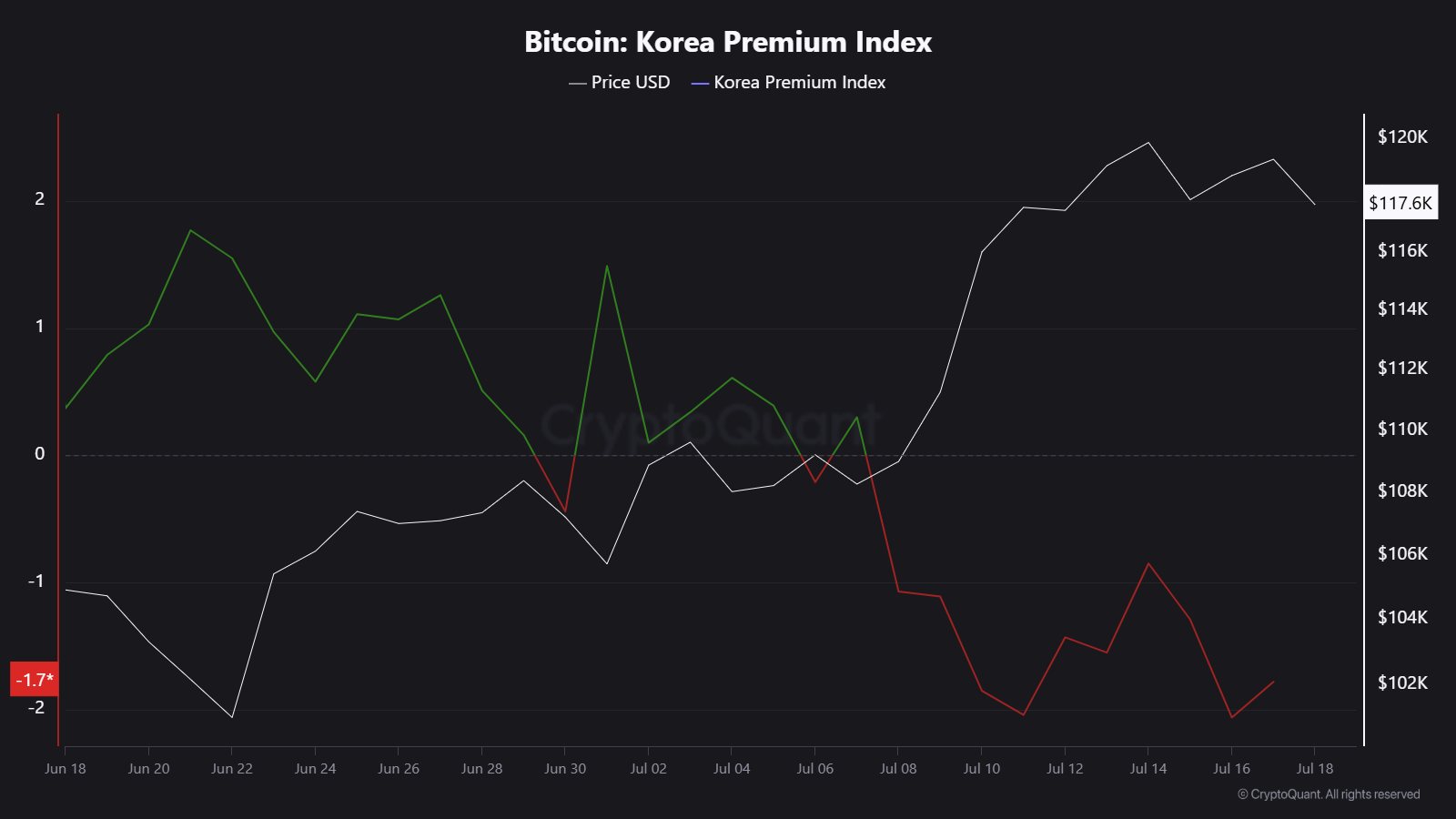

Korean Bitcoin Market Tells a Completely different Story

In sharp distinction, the Korea Premium Index — typically referred to as the “Kimchi Premium” — has dropped under zero.

This index tracks the value distinction between Bitcoin on Korean exchanges (e.g., Upbit, Bithumb) and international platforms.

As of mid-July, the premium stays round -1.7%, displaying Bitcoin trades cheaper in South Korea. A adverse Korea Premium suggests Korean retail demand is weak, with few new buyers coming into the market.

In earlier bull runs (2017, 2021), Korea typically noticed premiums of +10% or extra, pushed by speculative retail frenzy. That dynamic is absent at present.

Why This Divergence Issues

The break up in premium indices reveals Bitcoin’s present bull run just isn’t globally balanced. It’s centered within the US, with restricted retail enthusiasm from one in every of Asia’s most energetic markets.

Traditionally, broad-based retail participation has sustained and prolonged bull markets. With out it, there’s a threat the rally turns into too top-heavy, reliant on institutional flows alone.

This will likely additionally have an effect on altcoin momentum, which frequently depends on Korean change liquidity and retail-driven narratives.

General, the Coinbase Premium ought to keep constructive if US demand stays sturdy. But when it dips whereas Korea stays adverse, it might sign waning momentum.

A flip within the Korea Premium to constructive would counsel a retail re-entry, and will gasoline the following leg of Bitcoin’s rise.

Till then, Bitcoin’s worth motion will probably stay US-centric, led by ETFs, corporates, and wealth managers — not international retail buyers.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed data. Nevertheless, readers are suggested to confirm details independently and seek the advice of with knowledgeable earlier than making any choices primarily based on this content material. Please observe that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.