Welcome to the US Crypto Information Morning Briefing—your important rundown of a very powerful developments in crypto for the day forward.

Seize a espresso to learn how crypto markets are getting into a brand new section, with lawmakers in Washington shifting nearer to defining the trade’s regulatory future.

Crypto Information of the Day: CLARITY Act Could Create ‘On-the-Run’ Crypto Valuation Like Bonds, Matt Hougan

Two landmark payments handed the US Home on Thursday. The primary, the CLARITY Act, creates clear definitions for digital belongings and divides regulatory oversight between the SEC and CFTC.

In the meantime, the second, the GENIUS Act, is the primary federal crypto regulation in US historical past, setting nationwide requirements for stablecoin issuance and oversight. Institutional buyers and market analysts are starting to reimagine how digital belongings will likely be valued, traded, and structured sooner or later.

Following the votes, Bitwise Chief Funding Officer Matt Hougan weighed in on the implications for the digital asset market. In line with Hougan, the CLARITY Act, particularly, may usher in a brand new pricing dynamic for crypto belongings, akin to how bonds are valued in conventional finance (TradFi).

“The CLARITY Act and generic itemizing requirements for crypto ETPs will create an ‘on-the-run/off-the-run’ valuation aspect in crypto,” Hougan posted on X (Twitter).

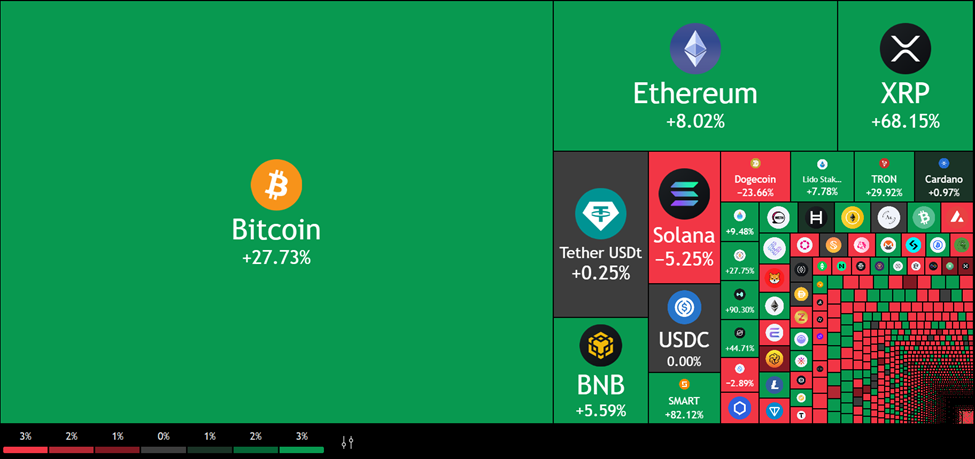

In line with the Bitwise government, that is already occurring, with the year-to-date (YTD) heatmap exhibiting giant market cap tokens outperforming the small-sized ones.

The surge in large-cap cryptos like Bitcoin, Ethereum, and XRP comes as buyers favor regulatory readability over riskier altcoins.

In fastened earnings markets, on-the-run securities consult with essentially the most just lately issued and liquid belongings. These belongings, comprising the newest US Treasury bonds, usually commerce at a premium, as a latest US Crypto Information publication signifies.

ETFs and Institutional Flows Are Concentrating on Blue Chips

Hougan suggests an analogous construction is rising in crypto, the place top-tier tokens like Bitcoin and Ethereum may command increased valuations and higher liquidity on account of favorable regulatory remedy and institutional inclusion in ETFs.

Certainly, because the begin of 2025, regulatory momentum within the US has helped drive institutional curiosity towards large-cap digital belongings, leaving smaller altcoins lagging.

A latest US Crypto Information publication indicated public firms pushing Ethereum to new highs. This bifurcation might widen with the introduction of clearer itemizing requirements and federal-level definitions. Such an final result would profit tokens perceived as “regulatory protected.”

After concluding its longstanding case with the US SEC, Ripple’s XRP might effectively match on this fold.

The Senate’s place on these payments stays unsure. However, trade leaders view the Home’s passage as a significant step towards unlocking broader capital flows and mainstream adoption.

“…it laid the inspiration for institutional-grade crypto finance,” one person wrote in a publish.

The CLARITY Act may develop into a basis for future crypto product improvement, ETF growth, and valuation fashions that mirror TradFi devices if handed into regulation.

Chart of the Day

This chart exhibits every day worth efficiency of main cryptocurrencies, with Bitcoin, Ethereum, XRP, and Dogecoin main features. In the meantime, smaller-cap tokens present combined or underperforming actions throughout the market.

Byte-Sized Alpha

Right here’s a abstract of extra US crypto information to comply with right now:

Crypto Equities Pre-Market Overview

| Firm | On the Shut of July 17 | Pre-Market Overview |

| Technique (MSTR) | $451.34 | $452.07 (+0.16%) |

| Coinbase World (COIN) | $410.75 | $419.36 (+2.10%) |

| Galaxy Digital Holdings (GLXY) | $26.04 | $28.84 (+10.75%) |

| MARA Holdings (MARA) | $19.97 | $20.10 (+0.65%) |

| Riot Platforms (RIOT) | $13.33 | $13.44 (+0.83%) |

| Core Scientific (CORZ) | $13.47 | $13.52 (+0.37%) |

Disclaimer

In adherence to the Belief Venture pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed data. Nonetheless, readers are suggested to confirm info independently and seek the advice of with an expert earlier than making any choices based mostly on this content material. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.