In response to knowledge from DeFiLlama, the full worth locked (TVL) in decentralized finance (DeFi) protocols has surged to its highest level since Could 2022.

This marks a serious turning level for the sector, reflecting rising investor confidence, rising adoption, and a renewed urge for food for on-chain monetary companies. It additionally doubtlessly signifies a serious bullish cycle for the market.

DeFi TVL Jumps 57% Since April Low to $137 Billion

As of press time, DeFiLlama knowledge reveals that DeFi protocols maintain over $138 billion in whole worth locked (TVL). This represents a 57% improve from the April low of $87 billion.

This sharp rise displays a broader shift in sentiment as each retail customers and institutional gamers revisit DeFi amid a wider crypto market rally.

DeFiLlama’s knowledge reveals that Ethereum continues to dominate the DeFi ecosystem. It accounts for about 60% of the full worth, or roughly $80 billion.

Different main networks, together with Solana, Tron, Binance Good Chain, and Bitcoin, contribute between $5 billion and $9 billion every.

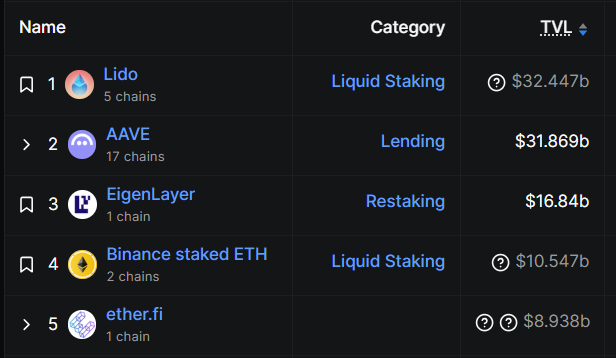

In the meantime, three key sectors—lending, liquid staking, and restaking—are driving the business’s present surge. That is evident within the development of DeFi protocols corresponding to Aave, Lido, and EigenLayer.

For context, Aave not too long ago surpassed $50 billion in cumulative deposits, reinforcing its place as a core infrastructure layer in DeFi.

On the similar time, Lido, the highest liquid staking platform, maintains a large share of Ethereum staking, whereas EigenLayer has gained traction within the rising restaking market. Mixed, these platforms account for practically $50 billion in locked property.

“Capital is flowing in the direction of structured yield, and TradFi gamers like Fintechs are beginning to concentrate to DeFi once more. This can be a very completely different DeFi than what we noticed in 2021,” DeFi analyst DeFi Kenshi stated.

Regardless of these protocols’ substantial development, DeFi TVL continues to be 30% beneath its all-time excessive of $177 billion from November 2021.

Crypto analyst Wajahat Mugha identified that the present market reveals a number of bullish indicators that might assist it outperform the earlier peak.

These embrace stronger Bitcoin efficiency, a 50% bigger stablecoin market, and the entry of modern protocols like Ethena Labs. He additionally emphasised the sturdiness of older platforms like Aave and the fast rise of Solana DeFi.

“[There is] nonetheless one other 30% to go to interrupt final cycles excessive. Fascinating that ETH is 30% away from it’s personal ATH too – there’s a powerful correlation right here contemplating how lots of the prime DeFi protocols TVL relies on ETH,” he added.

The submit Defi Protocols Surge To a 3-12 months Excessive in TVL – The Final Bull Market Signal? appeared first on BeInCrypto.