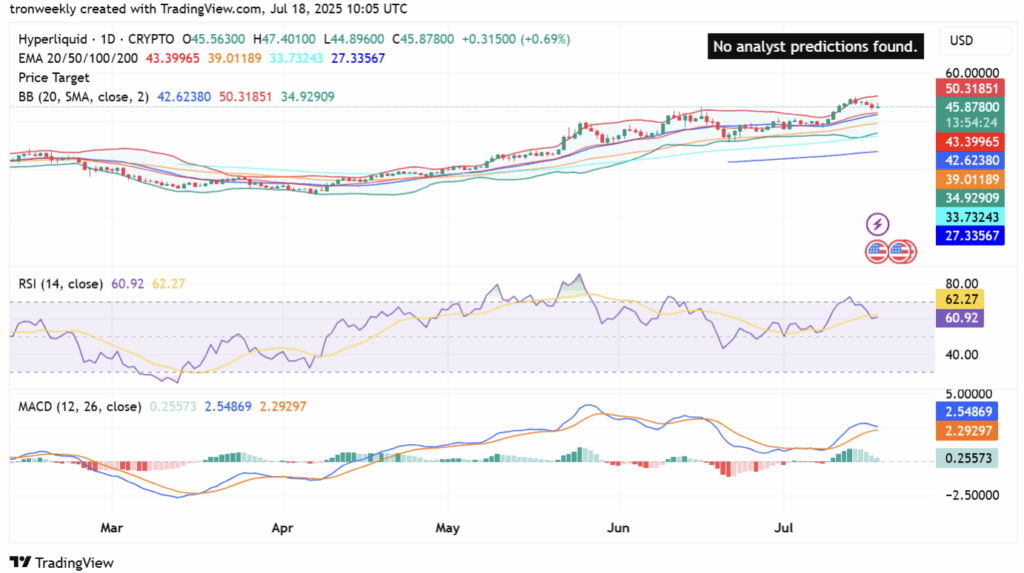

- HYPE’s steady close to $46, quantity strong, market cap ~$15.4B.

- Sitting above main EMAs, with a little bit of strain close to the $50 mark.

- RSI and MACD recommend gentle bullish development, however warning is essential earlier than the subsequent massive transfer.

Hyperliquid (yep, $HYPE) is hanging in there—buying and selling regular round $46, even after a gentle 1.54% slip over the previous day. Nothing wild, however sufficient to get of us watching.

Quantity’s nonetheless strong, sitting slightly below $598 million, and with a market cap round $15.4 billion, this factor is unquestionably nonetheless drawing eyes. It’s not mooning, not dumping—simply kinda… brewing?

Caught Between Assist and Resistance, for Now

Over the past week, HYPE’s been largely boxed in. It pushed up from about $45.50 to faucet simply above $49.50—seemed good for a second—then bam, resistance hit. Traditional stall-out.

Since then? It’s been transferring in a decent little channel. Between $46 and $48 largely, although it briefly dipped under $45.50 earlier earlier than bouncing proper again like nothing occurred. That bounce confirmed patrons aren’t asleep… simply cautious.

Proper now, HYPE’s struggling to clear $46 convincingly. That resistance wall at $50’s casting a shadow, and the market’s clearly ready for extra indicators earlier than making an actual transfer in both route.

Nonetheless Holding Up Technically

Zooming in on the day by day chart, HYPE’s truly nonetheless trying wholesome. It’s chillin’ above all its main EMAs. EMA 20’s at $43.39 and EMA 50’s down at $39.01—so there’s cushion beneath.

It’s been buying and selling close to the higher Bollinger Band at $50.31, which frequently means we’re in barely overbought territory—however hey, it additionally says momentum’s alive and properly. As for draw back, the center and decrease Bands—round $42.62 and $34.93—might be good security nets if we see a small dip.

Momentum’s There… however Not Surging

Indicators are giving combined vibes. RSI’s at 60.92, which is first rate—exhibits there’s some bullish push left. However it’s dipped a bit under its sign line, which suggests issues might be cooling off short-term.

MACD’s nonetheless technically bullish too, however the histogram’s fairly weak. Nothing screaming energy or collapse—simply… hovering.

So yeah, the momentum’s nonetheless hanging round, but it surely’s not precisely roaring anymore.

What Comes Subsequent?

At this level, HYPE appears prefer it’s coiling beneath the $50 psychological stage. It might pop greater, or simply chill sideways a bit longer. Bulls must maintain an eye fixed out—both for that breakout second or for probabilities so as to add if costs pull again slightly.

Mainly, it’s a type of “don’t go to sleep, however don’t ape in both” setups. The chart’s received potential, simply ready for affirmation.