- ONDO is main the tokenized asset wave with backing from BlackRock and robust regulatory positioning.

- HBAR is pushing into stablecoins and AI, gaining real-world traction with instruments like Stablecoin Studio.

- Matty leans barely towards ONDO for now on account of value vs. potential, however sees each as good long-term holds.

ONDO and Hedera (HBAR) have each been making waves currently, however the true query floating round—who’s received extra upside from right here? The Altcoin Buzz YouTube channel dove straight into it with analyst Matty laying out the case for every. It wasn’t about choosing a winner or loser precisely—it’s extra like determining which undertaking suits your model, your technique, or simply your intestine feeling.

Let’s break it down a bit. No monetary recommendation right here, only a nearer take a look at two very totally different crypto animals.

ONDO: RWA Rockstar With TradFi Backing

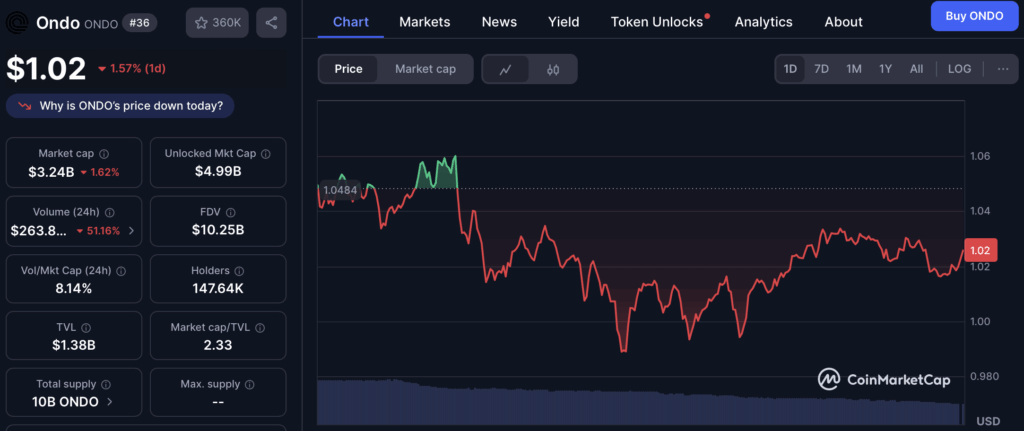

Matty kicks issues off by spotlighting ONDO, the native token of Ondo Finance. Over the past month, ONDO’s been on a little bit of a tear—up 40%—because it cements its standing as a frontrunner in actual world asset (RWA) tokenization. Mainly, they’re bringing issues like U.S. treasuries and bonds onto the blockchain. And that wave? It’s simply getting began.

What actually stands out is ONDO’s deep TradFi connections. BlackRock—the asset administration large—has its fingerprints throughout this one. They helped launch OUSG, a tokenized treasury product, and included ONDO of their BUIDL fund. That’s not nothing.

Regulatory readability can be giving ONDO a leg up. With the U.S. passing new acts like GENIUS and CLARITY, the fog round token guidelines is lifting a bit. If ONDO manages to hit full decentralization, it might fall underneath CFTC guidelines as an alternative of the SEC. That’s a giant deal for institutional traders, particularly these enjoying in FX and bonds.

ONDO’s buying and selling at round $1.05 as of the video—nonetheless approach beneath its December excessive of $2.14. That drop might look ugly, however Matty sees it as a stable entry level. The sector’s heating up, and ONDO’s bounced again properly from its April lows.

Hedera: Stablecoin Smarts and an Eye on AI

Then there’s Hedera, with its token HBAR. If ONDO’s the face of tokenized treasuries, HBAR’s carving out a distinct segment in stablecoins and AI infrastructure.

One massive purpose? Stablecoin Studio—a toolkit by Hedera that lets establishments mint, handle, and audit stablecoins with all of the bells and whistles like KYC and proof-of-reserves. Banks are already utilizing it. Shinhan Financial institution in Korea, as an illustration, is operating cross-border funds by way of Hedera. That’s the sort of real-world utility that units it aside out of your common Layer 1.

Hedera’s additionally dipping into AI. Their tech permits builders to outsource and confirm AI outputs—a rising want as AI fashions get greater and tougher to belief. It’s early days, however the basis’s there.

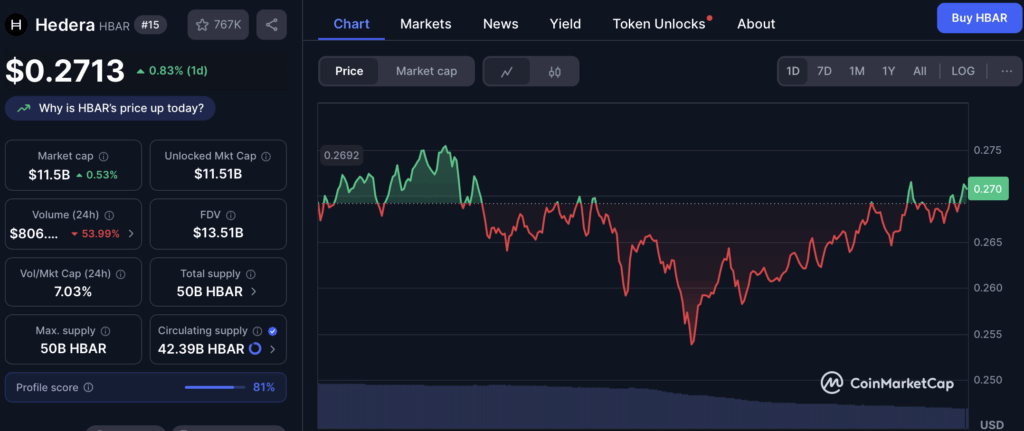

HBAR’s been on hearth currently—up 87% in only a month and over 260% within the final 12 months. Not unhealthy, particularly with the remainder of the altcoin market dragging its ft. With a $11.5B market cap, Matty sees it as having loads of runway left.

ONDO vs. HBAR: Which Means’s the Wind Blowing?

So… what’s the higher play? Is dependent upon your wager.

If you happen to’re bullish on the concept trillions in real-world belongings shall be tokenized quickly, ONDO’s your horse. It’s received regulatory momentum, deep-pocketed companions like BlackRock, and it’s buying and selling approach underneath its peak. There’s room to run.

However in the event you consider stablecoins and AI are the following massive factor in crypto, Hedera makes a powerful case. Between enterprise-grade instruments, precise adoption, and robust latest efficiency, it’s removed from a slouch.

Ultimate Take: Each Stable, However ONDO Has That Edge (For Now)

Matty wraps up saying it’s a troublesome name. He’s received love for each tasks and sees them as long-term portfolio picks. But when he had to decide on proper now? He’d lean ONDO. Why? Principally valuation. It’s sitting at a decrease degree regardless of massive progress and sector progress. And that backing from BlackRock? Not each undertaking will get that sort of nod.

Nonetheless, HBAR’s had its second—and will preserve rolling if enterprise adoption deepens.

Finish of the day, it’s not about going all in on one—it’s about catching the best narratives. Tokenized belongings, AI, stablecoins… these are the themes that may outline the following crypto cycle. Each ONDO and HBAR are driving these waves, simply from totally different angles.