In line with information shared by Wu Blockchain, over $5.8 billion in crypto choices expired right now, with Ethereum main the motion.

A complete of 41,000 BTC choices and 240,000 ETH choices reached expiry on July 18, marking one of the important supply days this quarter.

Ethereum dominance emerges in choices expiry

Ethereum clearly took the highlight. It noticed a complete notional worth of $880 million expiring right now, with a Put/Name Ratio of 1.0 and a max ache level of $2,950. Notably, ETH has damaged decisively above $3,650 in latest days, triggering renewed bullish sentiment. The uninterrupted rally—with no significant pullbacks—has invigorated merchants, with ETH implied volatility (IV) for main phrases now spiking to as excessive as 70%.

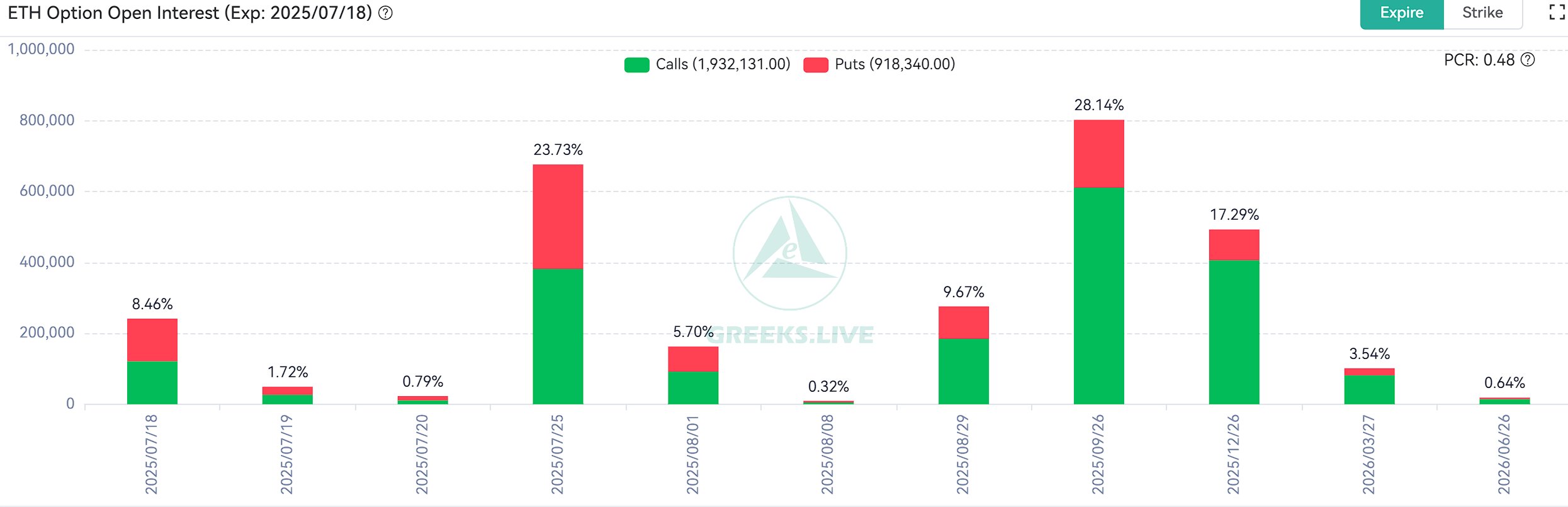

ETH possibility open curiosity information from Greeks.Stay reveals a robust skew towards bullish bets past the July 18 expiry, particularly for the July 25 and September 26 phrases. Calls proceed to dominate, with the general ETH Put/Name Ratio sitting at simply 0.48, signaling sturdy upside bias in future positioning.

Bitcoin stays sturdy however calm, max ache at $114K

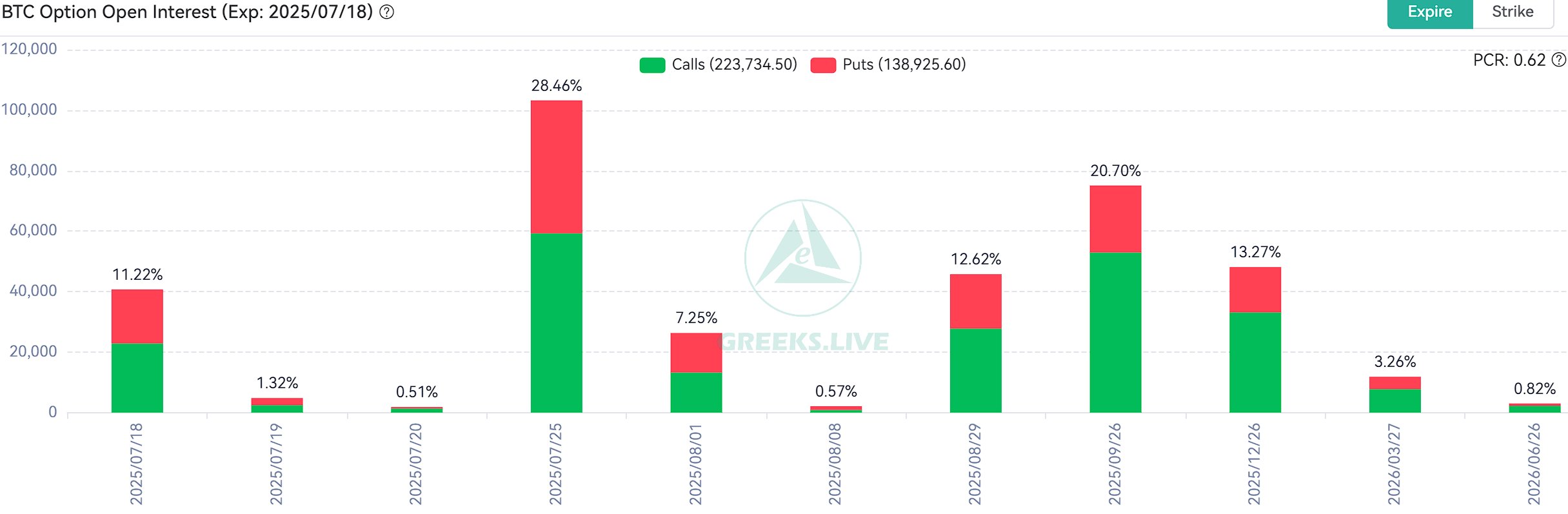

Whereas Ethereum soared, Bitcoin remained extra secure. The 41,000 BTC choices that expired right now had a mixed notional worth of $4.93 billion, with a Put/Name Ratio of 0.78 and a max ache level of $114,000. Regardless of briefly touching its all-time excessive round $120,000, BTC has primarily ranged tightly.

What’s subsequent?

With July 18’s large expiry behind us, merchants will flip their focus to the July 25 and September 26 expiries. Ethereum’s sharp rise and possibility market dominance counsel bullish momentum could persist within the quick time period. Nevertheless, with elevated IV and excessive name concentrations, volatility might surge if sentiment shifts. For now, the market is tilting optimistic—however warning could return rapidly if ETH stumbles.