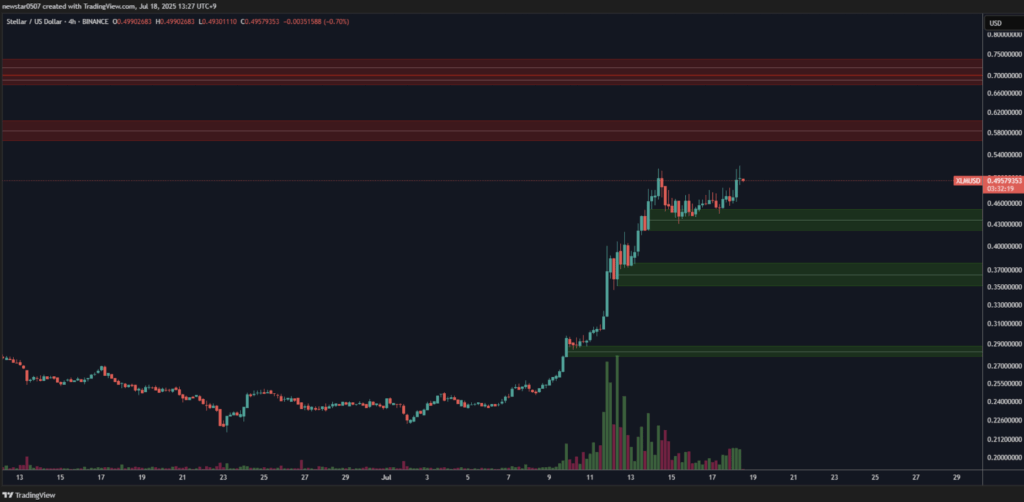

- Stellar (XLM) is consolidating round $0.47 with sturdy quantity and assist, however dealing with powerful resistance at $0.58.

- Technical indicators are combined—MACD leans bearish whereas value construction continues to be printing greater lows.

- A breakout might goal $0.65–$0.75, however failure to push by means of could ship it again to check decrease assist ranges.

Proper now, Stellar (XLM) is buying and selling at about $0.47, up 1.24% over the previous day. Over the previous week although, it’s seen a strong leap—almost 28% in positive aspects. Buying and selling quantity’s ticked up too, by about 1.26%, reaching $14.62 billion, which could not be large, but it surely’s sufficient to trace that individuals are paying consideration once more.

Market individuals appear to be warming again as much as XLM, with extra trades flowing in. That normally suggests a bit of extra religion within the challenge—although it’s nonetheless early to name it a full-on development shift simply but.

Resistance at $0.58: The Wall No One’s Cracked (But)

Crypto analyst CW famous that Stellar’s eyeing a key resistance at $0.58. That’s the place the promote wall hangs, and it’s been holding tight. If bulls handle to punch by means of it cleanly, we might see extra upside. On the flip facet, there’s a pleasant purchase wall slightly below the place the value is now—which means assist is robust sufficient to assist hold issues from slipping too far if sellers leap in.

So it’s form of boxed in, for now. However in a great way. Stability like this typically builds strain—a technique or one other.

Buying and selling Exercise Picks Up, However MACD Turns Tender

CoinGlass information reveals a spike in market participation. Quantity jumped 24.3% to $3.2 billion, and Open Curiosity rose 2.4% to $554 million. The funding fee’s sitting at 0.0377%, which tells us merchants are leaning lengthy—however not with wild leverage.

In the meantime, technical indicators are giving off combined alerts. RSI is at 42.5, so… impartial territory. It’s slid a bit, which might recommend that bullish vitality is petering out for the second. Nonetheless not oversold although.

The MACD is the place issues begin to tilt a bit bearish. The MACD line is now unfavourable, and a bearish crossover seems prefer it’s forming. If that performs out, we would see some sideways chop or a short-term dip earlier than any transfer up.

Eyes on the Breakout (or Breakdown)

Veteran dealer Peter Brandt chimed in saying the setup nonetheless seems bullish, however provided that Stellar holds above its April low. To essentially flip the narrative although, he says we want a clear shut above $1. That’s a giant ask for now, but it surely reveals how excessive some of us are aiming.

Within the meantime, XLM’s chart is printing greater lows, which is… one thing. Assist at $0.47 seems strong for now. If bulls keep in management and break by means of that $0.58 ceiling, targets like $0.65 and even $0.75 aren’t out of the query.

However nothing’s assured. If that breakout fails, value might pull again, possibly even re-test the identical zones it bounced from. With excessive quantity and Open Curiosity, merchants are positively watching carefully—somehow, the following few classes may be the deciding second.