It’s barely weeks into the second half of 2025, and it’s truthful to say that the Bitcoin and world monetary markets have nearly seen all of it this yr. From world commerce wars to precise disputes between nations (involving severe army motion), the markets have been topic to completely different types of exterior stress all year long.

Because of this, the world has seen a sheer quantity of correlation and direct relationship between the standard monetary markets and the crypto market. Whereas the US equities market and Bitcoin haven’t significantly moved in tandem in current months, there is no such thing as a denying the existence of a relationship between the asset lessons.

What Does The Falling Conventional Volatility Imply For BTC?

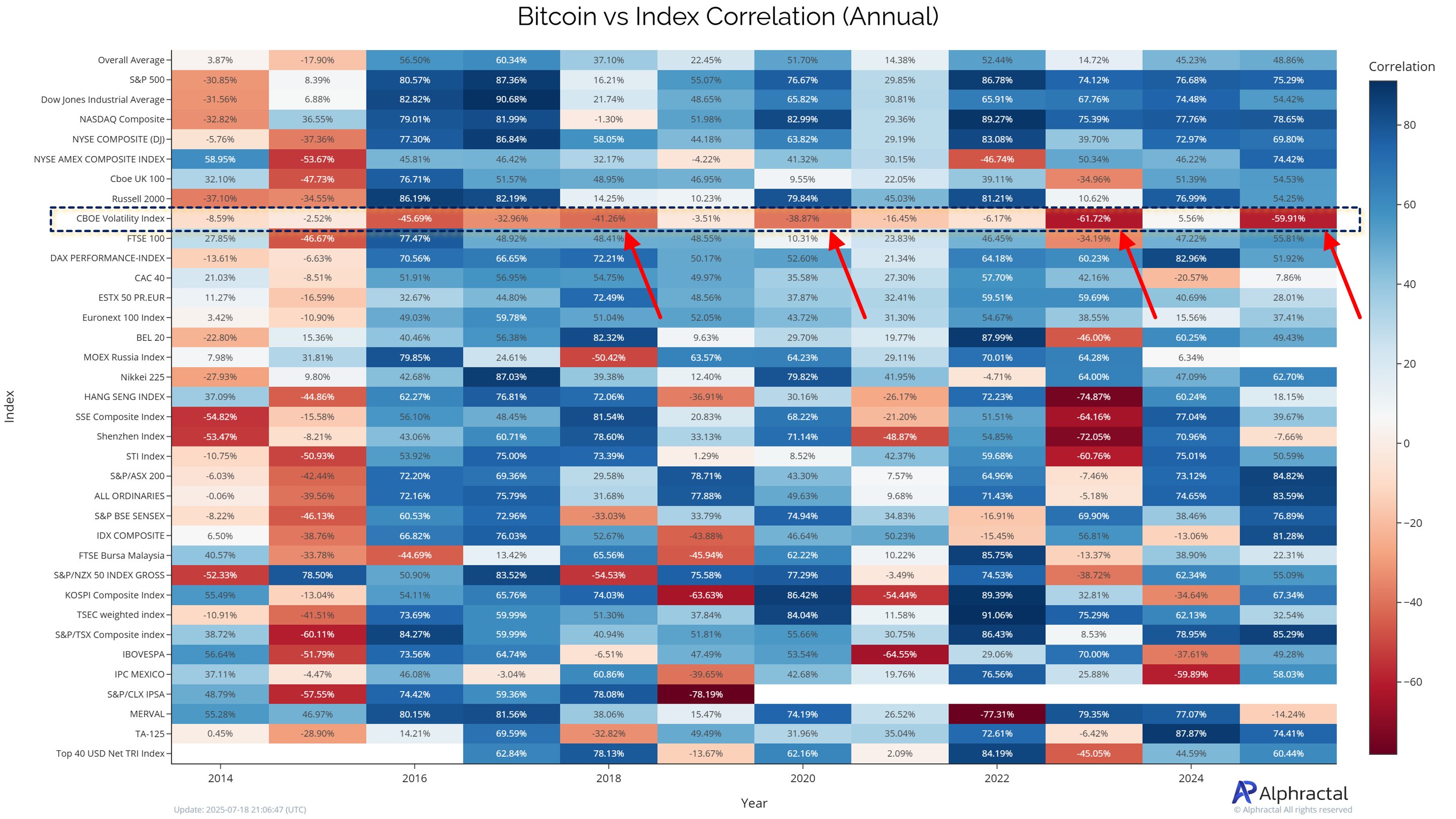

In a brand new publish on social media platform X, Alphractal CEO and founder Joao Wedson delved into the connection between Bitcoin and the US equities market (by way of the S&P 500 index). In response to the crypto knowledgeable, the premier cryptocurrency is exhibiting low correlation with the CBOE Volatility Index (VIX), which tracks the market’s expectations for the volatility of the S&P 500 Index.

For context, volatility refers to how shortly costs change inside a brief interval and is commonly seen as a option to gauge market sentiment. Wedson talked about that the VIX Index, often known as the worry index, is extensively used as a threat thermometer amongst contributors within the conventional monetary markets.

In response to Wedson, the worth of Bitcoin traditionally tends to maneuver extra independently and considerably within the following yr every time it’s negatively correlated with the S&P 500 Index, particularly in periods of low VIX. This elevated volatility has typically translated into important value rallies up to now, based on the analyst.

Wedson mentioned:

In different phrases: don’t waste hours analyzing BTC vs. S&P 500 when BTC’s correlation with the VIX is low or destructive — that’s often when BTC has a better likelihood of coming into an explosive part.

Supply: @joao_wedson on X

The on-chain analyst mentioned that on the flip aspect, when the VIX is excessive, it’s value trying on the relationship between Bitcoin and US equities markets, as worry within the latter can affect the conduct of the previous. Nonetheless, Wedson famous that the VIX is at present declining, and as such, the S&P 500 Index won’t provide a lot assist in analyzing Bitcoin’s subsequent transfer.

Wedson concluded that the extra BTC dissociates from conventional volatility (VIX), the stronger it’s as an unbiased asset. Finally, this might be a optimistic signal for the Bitcoin value and current recent alternatives for buyers seeking to get into the market.

Bitcoin Worth At A Look

As of this writing, BTC is valued at round $117,888, reflecting no important value motion up to now 24 hours.

The worth of BTC on the every day timeframe | Supply: BTCUSDT chart on TradingView

Featured picture from iStock, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.