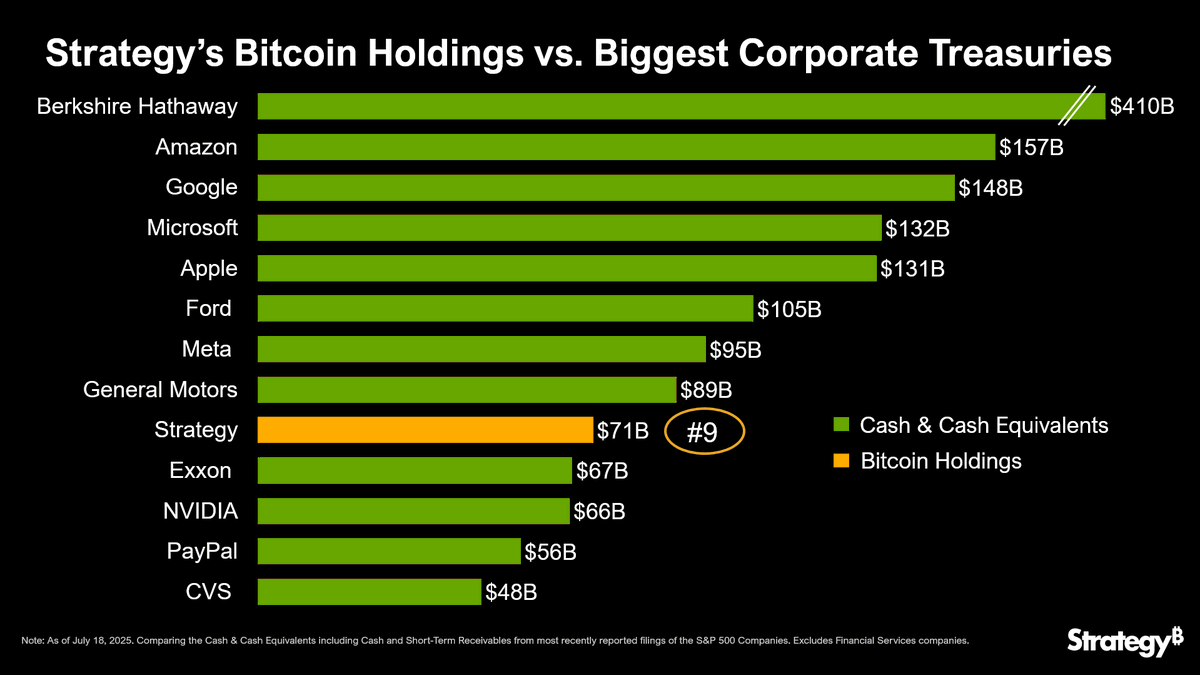

Looks like Technique has formally damaged into the highest 10 S&P 500 company treasuries with its huge $71 billion in Bitcoin holdings—rating ninth total and leapfrogging main companies like Exxon, NVIDIA, and PayPal.

The replace, visualized in a chart shared by Cointelegraph, compares Technique’s Bitcoin treasury instantly towards the money reserves of the largest U.S. corporations as of July 18, 2025.

Whereas conventional company treasuries are nonetheless dominated by money and equivalents, Technique stands out as the one agency within the high 10 whose reserve is completely held in Bitcoin. This locations it simply behind Common Motors ($89B) and Meta ($95B), and nicely forward of Exxon ($67B), NVIDIA ($66B), and PayPal ($56B). CVS rounds out the checklist with $48B in money.

A Bitcoin-Solely Treasury Strategy

Topping the treasury leaderboard is Warren Buffett’s Berkshire Hathaway with a staggering $410 billion in money, adopted by Amazon ($157B), Google ($148B), Microsoft ($132B), and Apple ($131B). These giants proceed to carry conservative liquid belongings, however Technique’s contrarian transfer into Bitcoin has not gone unnoticed.

The chart additionally highlights the diversification Technique brings to the S&P 500 monetary construction. With no short-term receivables or fiat money equivalents reported, the corporate’s total liquidity technique is constructed round Bitcoin—a daring sign of long-term conviction within the asset’s future efficiency and worth preservation qualities.

Institutional Crypto Adoption Beneficial properties Momentum

Technique’s place displays extra than simply aggressive crypto accumulation—it represents a strategic realignment of treasury philosophy. By changing giant parts of capital into Bitcoin moderately than conventional devices, the agency goals to hedge towards inflation and fiat depreciation whereas positioning itself as a Bitcoin-first enterprise.

The milestone additionally reinforces the rising institutional embrace of Bitcoin in 2025. As digital belongings acquire broader recognition, extra companies might comply with Technique’s instance—diversifying their steadiness sheets and gaining publicity to decentralized, scarce belongings with uneven upside potential. Whether or not this strategy will encourage imitators or stay a daring outlier stays to be seen, however for now, Technique has secured its place amongst America’s largest treasuries—with Bitcoin on the core.