- SUI dropped 7.5% to $3.77, with quantity down 26% and bearish sentiment rising after failing to carry $4.20 resistance.

- Merchants are closely shorting, with a protracted/quick ratio of 0.87 and main liquidations stacked close to $3.67 and $3.88.

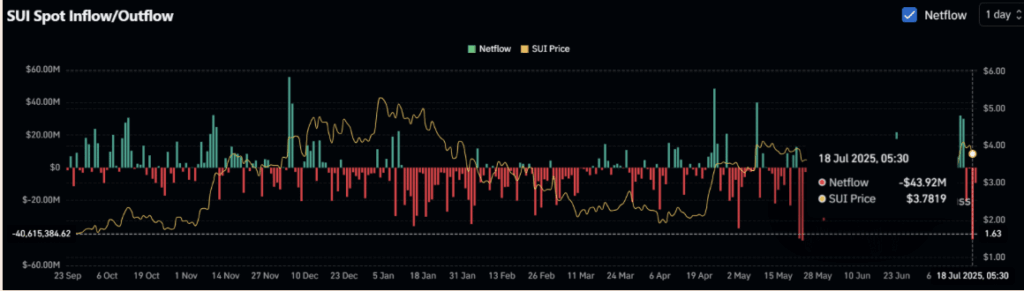

- Regardless of the dip, over $50M in SUI left exchanges, hinting at quiet accumulation and long-term optimism.

After pumping almost 34% in only a month, Sui (SUI) may lastly be shedding a little bit of steam. The memecoin-turned-layer-1 darling had a stable breakout previous the $4.20 stage just lately—however now, issues are wanting… a bit shaky.

SUI’s bullish momentum hit the brakes arduous. A dip under help has merchants questioning—was that it, or is that this only a breather earlier than one other push increased?

Momentum Stalls, Merchants Again Off

In the mean time (yep, press time), SUI is floating round $3.77. That’s after a 7.5% drop within the final 24 hours—kinda tough, not gonna lie.

Much more telling? Buying and selling quantity has dropped off a cliff—down 26% in the identical span. That form of drop normally screams profit-taking, and actually, after that 34% pump, who can blame ’em?

It additionally appears like some capital may be rotating out of SUI into different ecosystem performs like XRP and even AVAX. Gotta chase the following hype wave, proper?

Value Motion: Hazard or Detour?

In accordance with charts from AMBCrypto, SUI’s current worth sample broke down after struggling to remain regular above $4.20. That was a giant resistance zone—and it simply didn’t stick.

If the bearish vibes hold rolling, a ten% drop could possibly be on the desk. That places $3.40 as the following main help to look at. And if bulls need to regain management? They should reclaim $4.20 and shut above it. No fakeouts. No wicks. Only a clear, sturdy each day shut.

The RSI is one other clue right here—it’s cooled all the way down to 61, slipping out of the overbought zone. That doesn’t scream bearish, but it surely does level towards some sideways chop or a minor pullback.

Merchants Betting Quick, However Accumulators Aren’t Sleeping

Coinglass information reveals the bears are positively stepping in. The lengthy/quick ratio sits at 0.87, which suggests extra of us are stacking quick positions anticipating additional draw back.

Massive liquidation zones are forming too—$3.67 is vital on the low finish, and $3.88 above. There’s about $14.4M in lengthy liquidations and over $20M in shorts sitting round these marks. In different phrases, the following worth transfer may not be quiet.

However right here’s the place issues get fascinating…

At the same time as short-term merchants hit the brakes, long-term holders appear to be shopping for the dip. Coinglass reveals almost $50M price of SUI has left exchanges these days—normally a bullish sign. That kind of motion suggests good cash is accumulating whereas everybody else panics.