Ever since Robinhood co-founder Vlad Tenev bounded onto the stage in Cannes two weeks in the past, channeling old-time film star David Niven in his white go well with and cravat, everyone’s been speaking about tokenized shares.

It actually looks as if an enormous deal for mainstream adoption of crypto. Robinhood is a TradFi equities platform with 26 million retail prospects tokenizing shares on Arbitrum and providing them to EU customers by way of its user-friendly app interface.

There aren’t any crypto wallets or seed phrases required — and Tenev suggests it’s a check run for a wider integration of crypto, an illustration of “what Robinhood itself may appear to be, constructed totally on blockchain know-how.”

That very same week, Gemini launched its personal tokenized shares on Arbitrum within the EU, and 60 of Backed’s xStocks went dwell on Solana, supported by Kraken, Bybit, Bitrue and Gate.io.

Tokenized shares could also be simply months away from launching within the US too, after dShares issuer Dinari was awarded a broker-dealer license and Ondo Finance acquired Oasis Professional to utilize its licenses.

Coinbase has wished to launch tokenized equities within the US since 2018 and is reportedly looking for the Securities and Change Fee’s permission to lastly accomplish that. Chief regulation officer Paul Grewal known as tokenized equities “the way forward for finance, and an enormous precedence” for the corporate.

However this isn’t the primary time tokenized equities have been tried, and the taking part in subject is affected by the our bodies of issuers from the final cycle.

And whereas tokenization brings many benefits, there are appreciable downsides to the fashions Robinhood and Kraken use to tokenize shares. Listed here are the professionals and cons of tokenized equities in 2025.

Con: Tokenized shares will not be actually shares in any respect

Critics argue that the tokenized fairness provided by xStocks and Robinhood is only a artificial illustration of a share held in a vault someplace and doesn’t confer any shareholder rights and protections that include actual possession.

In Robinhood’s case, the tokenized shares are thought-about derivatives beneath EU rules, even when the mannequin makes use of licensed US broker-dealers who challenge tokenized shares and custody the underlying belongings. Tenev calls it “a spinoff that’s backed by the true share.”

Backed’s xStocks tokens are additionally backed 1:1 by a Particular Function Car in Liechtenstein. Even when Kraken or Bybit collapses, the underlying belongings theoretically stay secure. The token will be redeemed for the offchain worth when the market opens.

Alan Keegan, the DeFi portfolio supervisor at M31 Capital, says that is midway to the aim. “We’ve solved the difficulty of issuing a declare for an offchain asset onchain, through tokenizations,” however provides that there’s nonetheless an extended approach to go.

“There are regulatory questions and authorized infrastructure to be constructed to get to a spot the place an onchain transaction of a safety truly represents a switch of that safety,” he says.

“Constructing the infrastructure to unravel that drawback requires a fantastic diploma of authorized know-how, conventional finance know-how, blockchain sophistication, and (talking frankly) cash to spend.”

The closest instance thus far is Securitize’s Exodus token on Algorand, which represents direct authorized possession of the safety on Securitize’s shareholder registry

“It’s going to take time, however native tokenization is the mandatory first step,” Securitize CEO Carlos Domingo tells Journal.

“You’ll be able to’t decentralize inventory possession except the inventory is represented onchain in a compliant, legally legitimate approach. Securitize is likely one of the solely platforms within the US that may do that right now.”

Neutral: Tokenized shares are in a authorized grey space

Tokenized shares function in a authorized grey space, with Robinhood and xStocks pushing the envelope in an identical approach to how Uber did with its ridesharing app a number of years in the past.

Robinhood’s tokenized shares are solely obtainable within the EU for now, however because it’s a listed firm working with a US-listed broker-dealer to supply US securities, US regulators may resolve to close it down.

The Securities Trade and Monetary Markets Affiliation (SIFMA) has already urged the SEC to reject buying and selling fashions that fall outdoors the Regulation Nationwide Market System for equities.

Nevertheless, new SEC chair Paul Atkins has expressed in-principle assist. “Tokenization is an innovation. And we on the SEC must be centered on how we advance innovation within the market,” Atkins advised CNBC.

JUST IN: 🇺🇸 SEC Chair Paul Atkins says “tokenization is an innovation” and the company is dedicated to advancing it. pic.twitter.com/lcuq7X2oIb

— Fiat Archive (@fiatarchive) July 2, 2025

OpenAI has additionally highlighted authorized points with Robinhood promoting tokens tied to its non-public inventory, noting the corporate must approve any switch and has not completed so. The Financial institution of Lithuania subsequently opened an investigation.

Rob Hadick, basic accomplice at Dragonfly, mentioned on X that the danger for tokenholders is that non-public corporations find yourself “simply cancelling fairness gross sales altogether for many who violate their shareholder agreements.”

However for each SpaceX or OpenAI that isn’t eager on the tokenization of its non-public shares, there are a lot of extra who see it as an enormous alternative, based on Tenev.

“A lot of non-public corporations have been reaching out to me and asking… when can we get our personal non-public inventory tokenized?” he advised podcaster Camila Russo not too long ago.

The larger authorized challenge round promoting tokenized non-public inventory to the general public is that it primarily does an finish run across the disclosure and transparency guidelines governing publicly listed corporations.

If corporations can promote non-public inventory and lift funds with out having to undergo the expense and compliance necessities of an preliminary public providing, why would anybody go public?

Learn additionally

Options

68% of Runes are within the crimson — Are they actually an improve for Bitcoin?

Options

Unlocking Cultural Markets with Blockchain: Web3 Manufacturers and the Decentralized Renaissance

Professional: 24-hour a day buying and selling for tokenized fairness and use in DeFi

Conventional markets are closed for round 81% of the hours in a given 12 months, which means tokenized shares that commerce across the clock could have an enormous benefit.

xStocks and Robinhood’s tokenized fairness are initially obtainable 24/5, however Tenev says that might be altering quickly.

“The place it begins to get actually attention-grabbing is once we begin plugging it into Bitstamp, which is when 24/7 buying and selling turns into potential. And at that time, the inventory tokens begin to behave like different cryptos, Bitcoin and Ethereum,” Tenev mentioned. The subsequent section might be to combine the belongings in DeFi.

“So you possibly can think about swapping collateralized lending and borrowing and actually self-custody, which I feel can be very highly effective for shares as a result of it will untether your inventory tokens from any particular person brokerage or crypto supplier.”

Keegan agrees that 24-hour a day performance, decrease prices, extra dependable execution and quicker settlements are huge benefits, together with the potential for composability within the DeFi ecosystem.

Professional: Blockchain platforms might outcompete TradFi platforms

Galaxy Digital’s evaluation argues that 24/7 buying and selling of tokenized fairness on Bitstamp is an enormous risk to conventional markets just like the New York Inventory Change:

“This immediately challenges the deep focus of liquidity and exercise that offers main TradFi exchanges (e.g. NYSE) their aggressive benefit […] extra brokerages adopting a blockchain-based technique for buying and selling may put immense strain on conventional exchanges.”

However Securitze’s Domingo argues there’s a approach to go but.

“To succeed in a degree the place whole markets function 24/7 on crypto rails, we want three issues,” says Domingo.

“Regulatory readability that allows onchain buying and selling venues to exist beneath a modified framework. Liquidity and infrastructure — market makers, secondary markets and settlement methods — that perform reliably outdoors of conventional hours [and] institutional belief and adoption.”

TradFi isn’t going quietly both, with conventional markets already providing pre- and after-market buying and selling that helps cowl about 16 hours of the day.

The New York Inventory Change’s digital Arca change additionally in February acquired approval to supply buying and selling 22 hours a day, 5 days every week, with the prolonged buying and selling anticipated to kick off this 12 months.

Con: After-hours volatility of tokenized shares

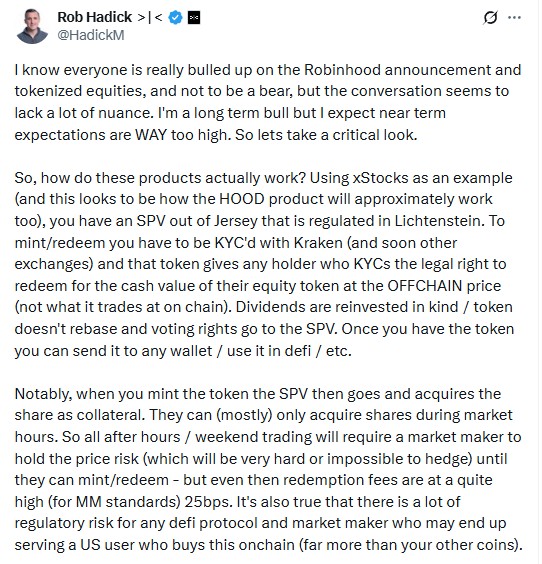

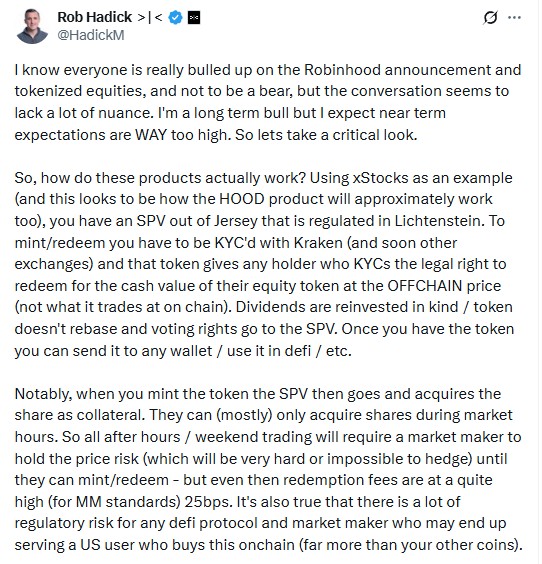

Hadick from Dragonfly factors out that buying and selling outdoors of market hours might create a plethora of points.

Utilizing xStocks for instance, he says that when traders purchase a token after hours, the SPV has to accumulate that inventory when the market opens, exposing the market maker to pricing dangers.

This may imply greater spreads, and market makers might find yourself pulling liquidity totally throughout instances of market stress. “Which, if these items permeate DeFi lending and [derivatives], will create main cascading liquidation danger,” he says.

He additionally notes the token solely entitles the holder to the offchain worth, which means shares might quickly return to that worth when markets open.

“Which means when individuals purchase in instances of that low liquidity euphoria on weekends/after hours, however the equities market then opens decrease than token patrons anticipated, you will notice fast, fast losses at open, which can primarily be borne by retail,” says Hadick.

“Functionally, which means these are simply not good merchandise […] They can’t serve a complicated, actual, and world equities market. They usually possible gained’t even serve the wants of the skilled crypto merchants who know they’ll get considerably higher pricing and fewer danger elsewhere.”

Con: Fragmented liquidity accompanies inventory tokenization

Having a number of issuers tokenize shares may also fragment liquidity. Think about a future the place it’s a must to select between “rTSLA, cTSLA, sTSLA, xyzTSLA, ethTSLA, solTSLA or hyperTSLA,” as crypto VX Mike Dudas joked.

Johann Kerbrat, Robinhood’s crypto chief, concedes that it is going to be an issue.

“I hate the thought of getting a Tesla-Kraken token and a Tesla-Robinhood token,” he mentioned. “As a substitute of really transferring ahead and creating a greater monetary system, we’re splitting [up] liquidity.”

Domingo wryly requested on X, “Isn’t that precisely what Robinhood is doing?” Having a number of tokenized inventory issuers additionally tremendously will increase the possibility that one of many issuers will blow up one way or the other, resulting in tokenholders being overlooked of pocket.

Learn additionally

Options

Dorsey’s ‘market of algorithms’ may repair social media… so why hasn’t it?

Options

An Funding in Data Pays the Greatest Curiosity: The Parlous State of Monetary Training

Con: Tokenized shares failed in 2021

Final cycle, Synthetix provided artificial tokens providing worth publicity to shares similar to Tesla in 2021. sTSLA noticed a grand whole of simply 798 transactions earlier than being phased out that very same 12 months.

Low liquidity performed an element, but it surely’s additionally potential that DeFi degens most popular to invest on altcoins with a possible 10X upside, slightly than a inventory which may transfer a number of % in a month.

Mirror provided artificial shares too, however collapsed alongside Terra. Binance additionally provided inventory tokens for a number of months in 2021 earlier than delisting them following regulatory pushback within the UK and Germany.

Essentially the most “profitable” issuer final cycle was FTX, which provided tokenized shares with 1:1 backing through CM Fairness. It peaked at nearly $1 billion in quantity in October 2021. However after FTX collapsed the next 12 months, it emerged that CM Fairness had withdrawn from the settlement in December 2021, casting doubt on the backing of the tokens. Tokenized stockholders misplaced their funds within the collapse.

There’s one survivor from these darkish days, nonetheless. Securitize tokenized the shares of pockets supplier Exodus in 2021, and with a market cap of $294.7 million, it accounts for 78% of right now’s whole tokenized fairness market by itself.

Domingo factors out it’s not 2021 anymore, with a good regulatory atmosphere and the involvement of asset managers like BlackRock, Apollo and Hamilton Lane. “The credibility that top-tier asset issuers present is now increasing from tokenized treasuries and personal credit score to different belongings similar to tokenized equities,” he says.

How will tokenized shares have an effect on crypto costs?

Because the chain with the most important quantity of stablecoins and RWAs, Ethereum stands to profit from the broader adoption of tokenized shares. Robinhood’s selection of Ethereum L2 Arbitrum was seen as an enormous vote of confidence within the ecosystem and L2 roadmap.

Keegan says monetary establishments can tailor-make L2s to adjust to KYC and privateness necessities, together with transaction rollbacks.

“Essentially the most thrilling characteristic of the L2 scaling infrastructure is that L2s can inherit the decentralization and credible neutrality ensures of Ethereum whereas additionally being constructed to go well with the wants of a selected use case (together with regulatory compliance).”

For the reason that announcement, Ethereum’s worth has elevated by 1 / 4. Solana has additionally demonstrated over the previous two years that it’s extremely popular with retail merchants, so it additionally stands to profit from the broader adoption of xStocks.

Some argue that tokenized shares will compete for a similar capital that’s at the moment being unfold amongst altcoins. However Domingo argues {that a} halo impact is extra possible.

“We don’t view tokenized shares and altcoins as essentially competing for capital. As a substitute, we’re seeing conventional monetary establishments embracing blockchain infrastructure, using the identical rails that energy DeFi. That’s undeniably bullish for endurance and enlargement of the broader crypto ecosystem.”

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with greater than 25 years expertise, who has been masking cryptocurrency since 2018. He spent a decade working for Information Corp Australia, first as a movie journalist with The Advertiser in Adelaide, then as Deputy Editor and leisure author in Melbourne for the nationally syndicated leisure lift-outs Hit and Switched on, printed within the Herald-Solar, Each day Telegraph and Courier Mail.

His work noticed him cowl the Oscars and Golden Globes and interview a number of the world’s greatest stars together with Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Previous to that he labored as a journalist with Melbourne Weekly Journal and The Melbourne Instances the place he gained FCN Greatest Function Story twice. His freelance work has been printed by CNN Worldwide, Impartial Reserve, Escape and Journey.com.

He holds a level in Journalism from RMIT and a Bachelor of Letters from the College of Melbourne. His portfolio consists of ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.