Bitcoin (BTC) has entered its fourth consecutive month of positive factors. Nonetheless, it simply ended the primary pink weekly candle of July.

Whereas many analysts consider the bullrun might not be over but, some regarding alerts have begun to emerge, hinting at a doable value correction or consolidation.

After 4 Months of Features, Is Bitcoin Due for a Breather?

These warning indicators don’t essentially imply Bitcoin will reverse, however they function early indicators that demand consideration earlier than stronger strikes or main volatility happen.

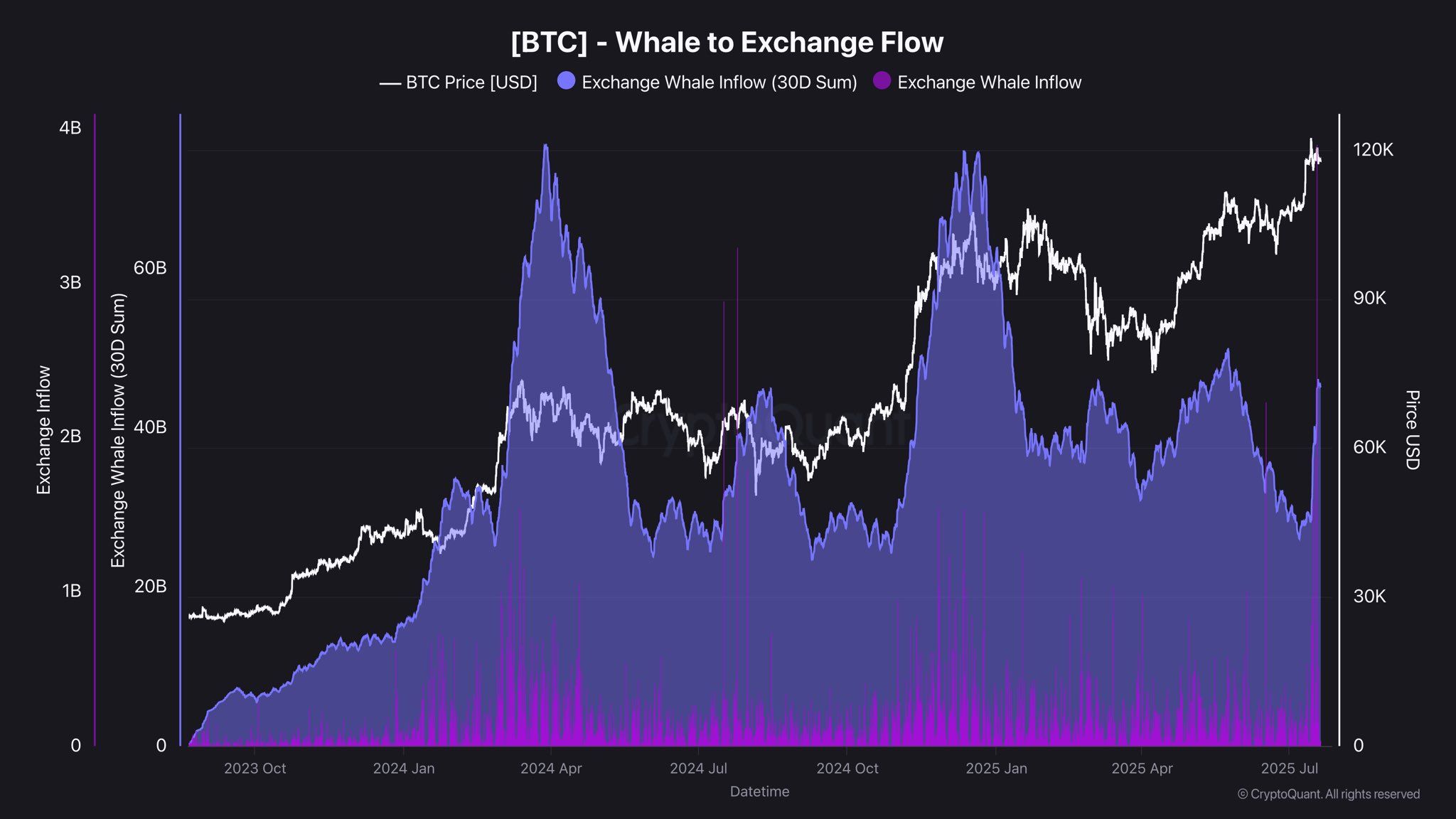

1. Bitcoin Whale-to-Change Move Spikes

First, Bitcoin Whale-to-Change Move knowledge exhibits a major improve in July. This metric displays the quantity of BTC giant holders (whales) ship to exchanges, often implying an intention to promote.

In accordance with analyst Darkfost, within the final two market peaks, whale capital inflows exceeded $75 billion, marking the start of a correction or consolidation part. Between July 14 and July 18, 2025, the determine has already reached $45 billion. This sharp rise signifies elevated exercise from giant buyers.

“[This whale activity] needs to be carefully monitored, since whales can exert important promoting stress, simply as they did over the last two tops,” Darkfost mentioned.

Darkfost’s view aligns with current on-chain observations from Lookonchain. As we speak, Lookonchain reported {that a} savvy Bitcoin whale despatched 400 BTC (price $47.1 million) to Binance to take earnings, with complete realized positive factors reaching $91.5 million.

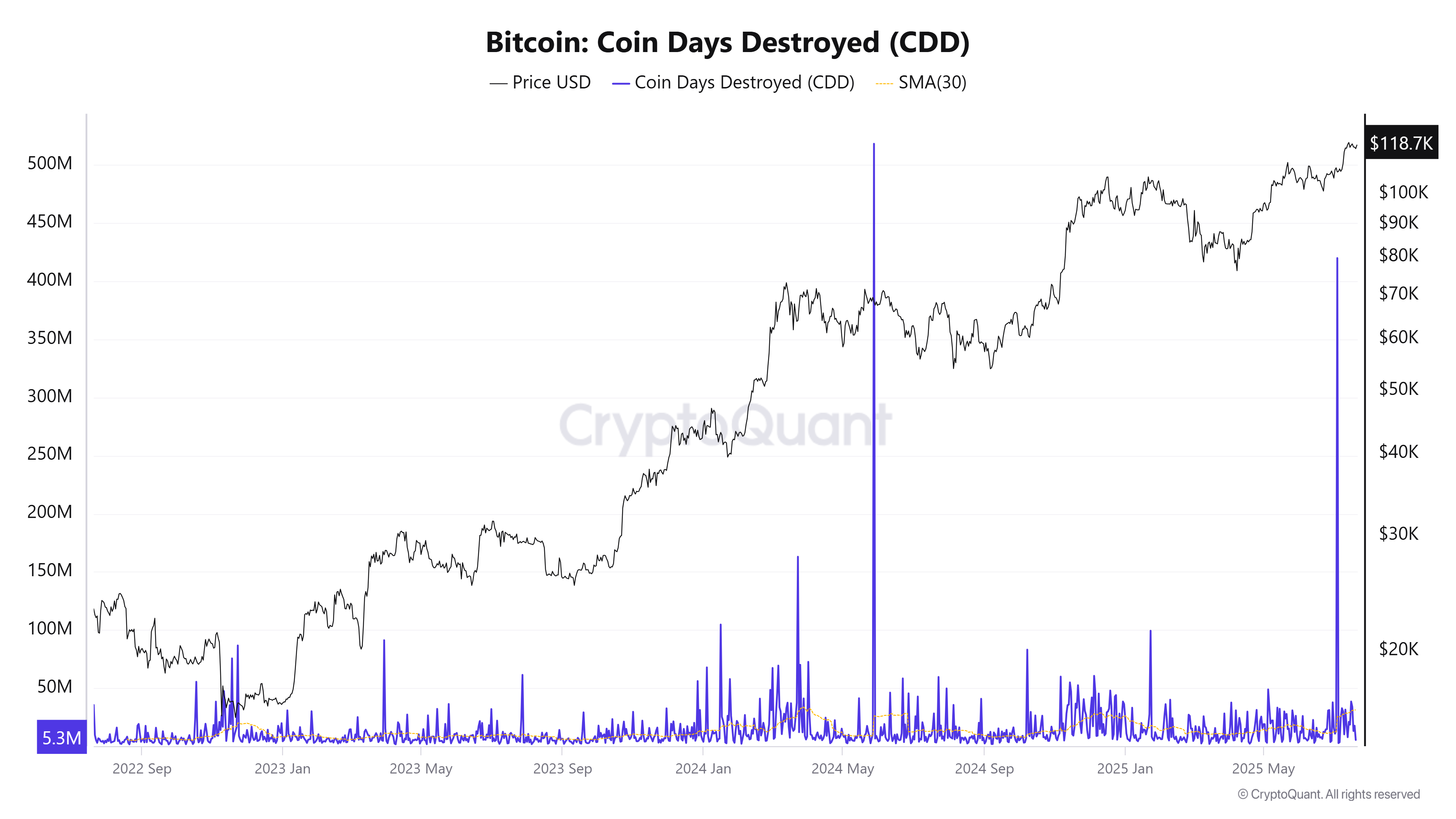

2. Bitcoin Coin Days Destroyed (CDD) Hits Yearly Excessive

Past whale flows, on-chain knowledge exhibits one other sign: Bitcoin’s Coin Days Destroyed (CDD) in July reached a one-year excessive.

CDD measures how lengthy cash have been held earlier than being moved. It displays the sentiment and habits of long-term holders. A excessive CDD worth suggests long-term holders are transferring their cash and are more likely to promote them.

In accordance with CryptoQuant, the 30-day common CDD in July surpassed 31 million, the best since April 2024. A earlier report from BeInCrypto famous {that a} spike on this metric typically precedes main market corrections. Nonetheless, on the constructive facet, it can be seen as a redistribution to new buyers.

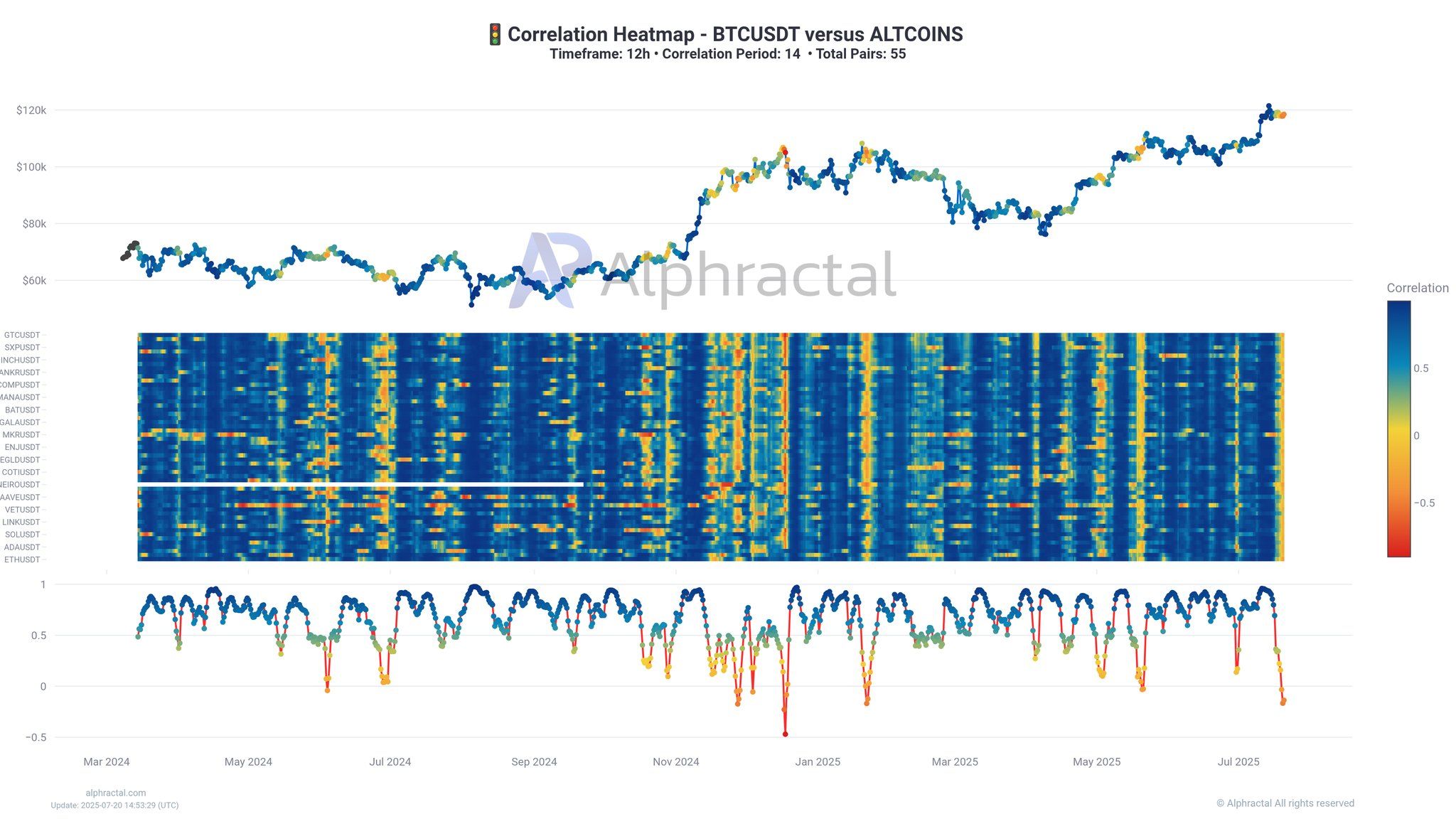

3. Altcoin-Bitcoin Correlation Turns Destructive

Lastly, adjustments within the correlation between altcoins and Bitcoin have raised additional concern.

In accordance with Alphractal, the Altcoin-Bitcoin Correlation Heatmap not too long ago dropped beneath zero. This shift implies that altcoins have outperformed Bitcoin in current days.

Nonetheless, historic knowledge exhibits {that a} low correlation between Bitcoin and altcoins is commonly a pink flag.

Because the begin of 2025, this indicator has turned detrimental thrice. The primary was in January, adopted by a drop in Bitcoin’s value from $110,000 to $74,900. The second time was in Might, when BTC fell from $112,000 to $98,500. Now, we’re seeing the third incidence.

“Traditionally, low correlation is a pink flag. It typically precedes durations of excessive volatility and mass liquidations — whether or not from shorts or longs,” Alphractal warned.

A current report from BeInCrypto additionally highlighted one other regarding sign. The Coinbase Premium has decoupled from the Kimchi Premium. This disconnection suggests an uneven bullrun throughout international areas, primarily pushed by robust institutional demand within the US.

Disclaimer

In adherence to the Belief Venture tips, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to offer correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.