Bitcoin is going through a pivotal second because it hovers just under the $123,000 all-time excessive. Whereas bulls stay in management, value motion has stalled beneath this key resistance, exposing a scarcity of decisive momentum. After a powerful 20% rally since late June, the market now waits for a breakout affirmation to increase the uptrend.

Sentiment stays overwhelmingly bullish, pushed by elevated adoption, authorized readability within the US, and favorable macroeconomic developments. Nevertheless, current on-chain and trade information present a noticeable decline in spot shopping for stress. This divergence between sentiment and actual demand means that bulls could also be hesitating to enter at present ranges, presumably attributable to expectations of a correction or profit-taking close to the highs.

The value construction stays bullish so long as BTC holds above the $115K help zone, however the incapacity to interrupt $123K raises issues a couple of doable short-term reversal or continued sideways motion. For now, Bitcoin’s development stays intact, however a transparent surge in quantity and shopping for exercise will probably be required to reclaim new highs and keep bullish momentum.

Bitcoin Sentiment Stays Bullish, However Shopping for Strain Fades

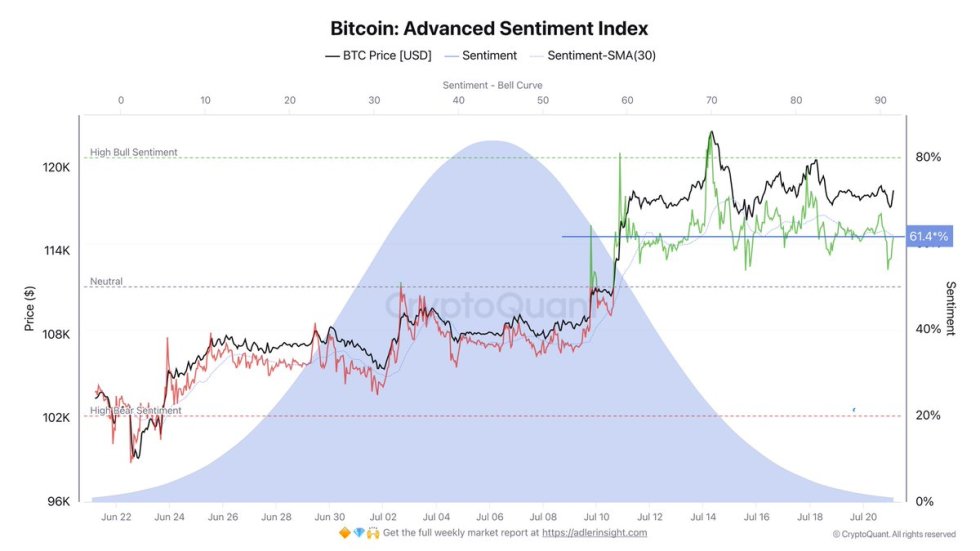

Prime crypto analyst Axel Adler just lately shared an replace on the Bitcoin Superior Sentiment Index, providing key insights into the present market psychology. Based on Adler, the index presently reads 64%, signaling that sentiment stays solidly bullish. Nevertheless, he famous a vital caveat: whereas the market leans towards shopping for, bulls seem to lack the aggression wanted to push Bitcoin decisively above its all-time excessive of $123,000.

This hesitation is in step with what’s unfolding within the charts. After a pointy rally of over 20% since late June, Bitcoin is now consolidating in a good vary between $115K and $120K. Whereas this construction suggests power, the shortage of follow-through shopping for at larger ranges displays warning amongst traders. It seems that market individuals are ready for a transparent catalyst earlier than positioning extra aggressively.

The present compression in value motion may precede a big transfer, as durations of low volatility at elevated ranges typically do. Merchants ought to put together for a breakout in both course. Whereas the general development and sentiment favor upside continuation, the potential of a correction stays in play, notably if sentiment begins to fade or macro circumstances shift unexpectedly.

BTC Consolidates Close to All-Time Highs

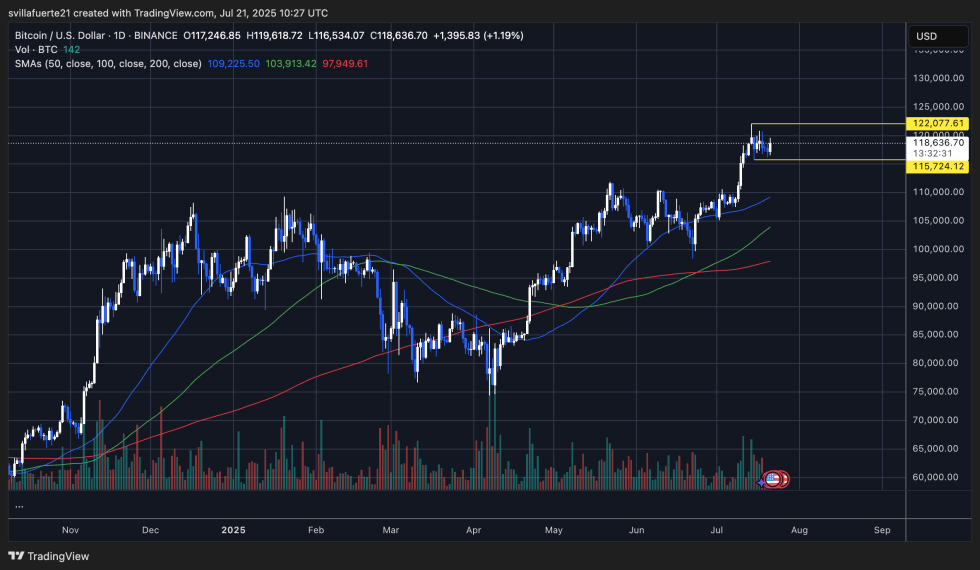

The day by day chart reveals Bitcoin consolidating just under its all-time excessive of $123,000, buying and selling at $118,636 on the time of writing. The current value motion suggests robust bullish management, however the lack of a decisive breakout above the $122,077 resistance has launched short-term uncertainty. The construction stays clearly bullish, with BTC forming larger highs and better lows because the rebound from the March lows close to $97,000.

Notably, Bitcoin is holding properly above the 50-day ($109,225), 100-day ($103,913), and 200-day ($97,949) transferring averages. These ranges now function layered help, reinforcing the long-term bullish development. The continuing consolidation above $115,724 means that bulls are defending this zone with conviction.

Nevertheless, quantity has not adopted by way of as strongly throughout this consolidation section, an indication that some market individuals are ready for affirmation earlier than committing new capital. If BTC breaks above $122,077 with robust quantity, it may set off a breakout and value discovery towards larger ranges. On the flip aspect, a break beneath $115,724 may result in a deeper retracement towards the 50-day MA.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.