Veteran Bitcoiner Willy Woo has completed the unthinkable and cashed out most of his stack.

“I’ve offered most of my Bitcoin now,” the legendary onchain analyst cheerfully tells Journal.

However what on earth possessed the business’s best-known onchain analyst to surrender on the toughest cash identified to man? Has he gone mad?

It seems that Woo believes he can earn more money promoting shovels through the gold rush, than shopping for gold, with many of the proceeds of his Bitcoin gross sales reinvested into “Bitcoin infrastructure.”

The co-founder of crypto quant fund Crest explains that Bitcoin’s market capitalization is round $2 trillion, which implies it in all probability has at greatest “50x development” to $100 trillion, which he believes can be “close to the ceiling.”

Woo’s thesis is that early-stage Bitcoin startups have the potential for even higher returns from right here on in.

“For those who had been to have a look at a Bitcoin enterprise, you’ve bought, you already know, a great enterprise is 100 to 1,000x return,” he says.

And even when they crash and burn, many infrastructure corporations nonetheless supply oblique publicity to Bitcoin by means of their Bitcoin holdings.

“In the event that they’re not profitable, they’re holding Bitcoin. So it de-risks that funding,” he says.

“It simply is smart that good cash would go into Bitcoin infrastructure. It’s now the picks and shovels sequence.”

The place is Bitcoin at proper now, Mr Woo?

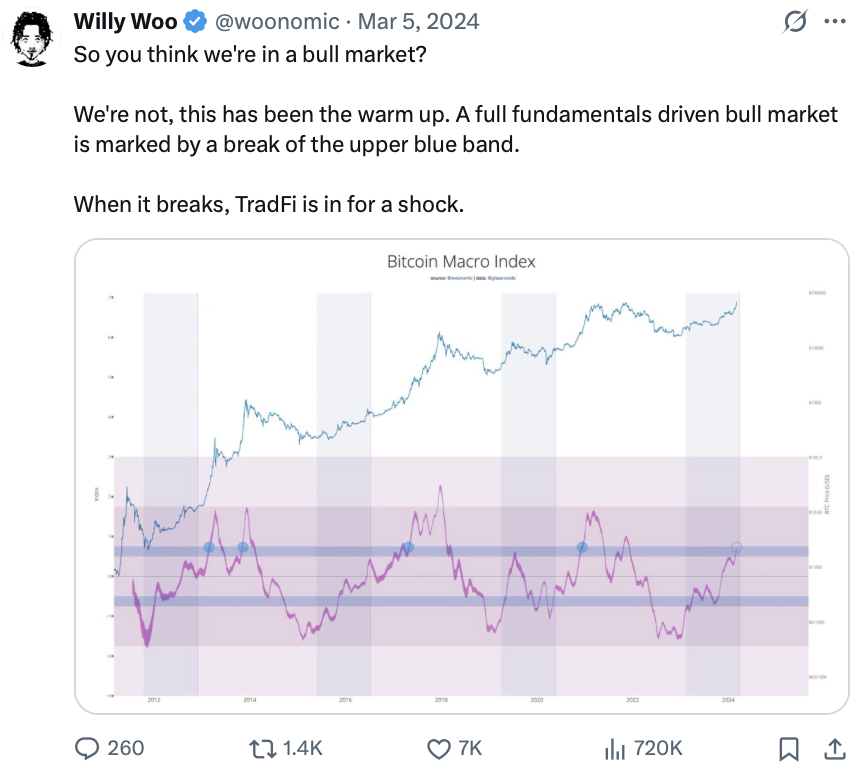

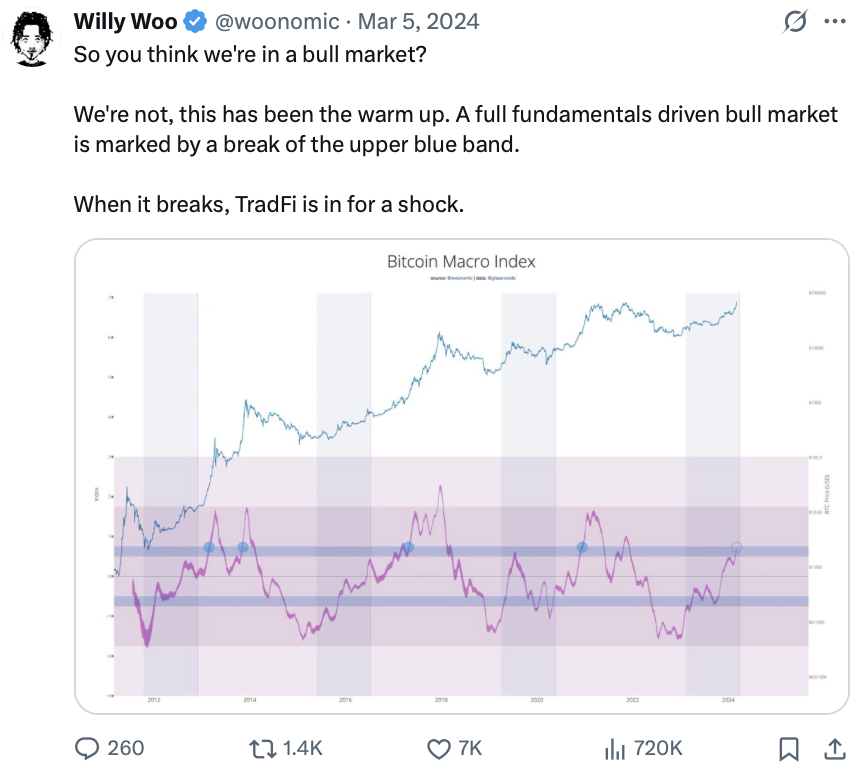

That stated, Woo nonetheless retains a detailed eye on Bitcoin’s worth and says market contributors are “overestimating Bitcoin” due to a misunderstanding of present worth motion.

Regardless that Bitcoin not too long ago reached new all-time highs, Woo has a principle about why the worth hasn’t been climbing as quick as individuals anticipated, regardless of billions being snapped up each week by treasury corporations and Bitcoin ETFs.

“There’s a number of OGs which can be systematically promoting into each bull market,” he says.

Woo says when Bitcoin OGs promote Bitcoin they purchased for beneath $1,000 at, say, $100,000, practically all of that cash, $99,000, is coming from new patrons.

Which means a number of new capital is required simply to deal with their promoting.

“It’ll take time for this capital to return in, and immense quantities of capital to rotate a budget patrons out,” he says.

The bullish half is that with Bitcoin breaking into worth discovery this week, it suggests the cash is certainly flowing in, and the OG sellers are drying up.

Additionally learn: Will Robinhood’s tokenized shares REALLY take over the world? Professionals and cons

Who’s Willy Woo?

Born in Hong Kong and raised in New Zealand, Woo has developed a popularity as the very best onchain analyst in Bitcoin since shopping for his first Bitcoin in 2013. He’s since constructed up a following of over 1.1 million on X due to his broadly revered insights.

This interview had been a very long time coming for Journal. We first reached out to Woo in early 2024 and had an preliminary dialog, throughout which Woo respectfully shared his causes for staying away from interviews.

He had stepped away from being a Bitcoin and crypto X movie star to start out a household and spend time along with his children. There was additionally an unwelcome improve in real-world recognition.

“Oh, are you actually Woo?” he remembers being requested greater than as soon as out in public.

“At one level, somebody ran into me, and so they stated, ‘Oh, how previous is your daughter?’ he says, including that he was even requested one time what college she attended.

“Then all of the sudden you’ve bought toddlers round and the whole lot…I simply felt like I needed privateness for my household,” he provides.

“I assumed that the final cycle my profile bought in all probability extra attain than I needed. And I simply needed to chill it down a bit.”

It undoubtedly wasn’t how he imagined issues would go when he first immersed himself within the Bitcoin business after randomly stumbling into an area Bitcoin meetup in Bali again in 2014.

He was rapidly orange-pilled and helped to run the native Bitcoin occasion in Bali, even difficult himself to point out up every time with a contemporary matter to share.

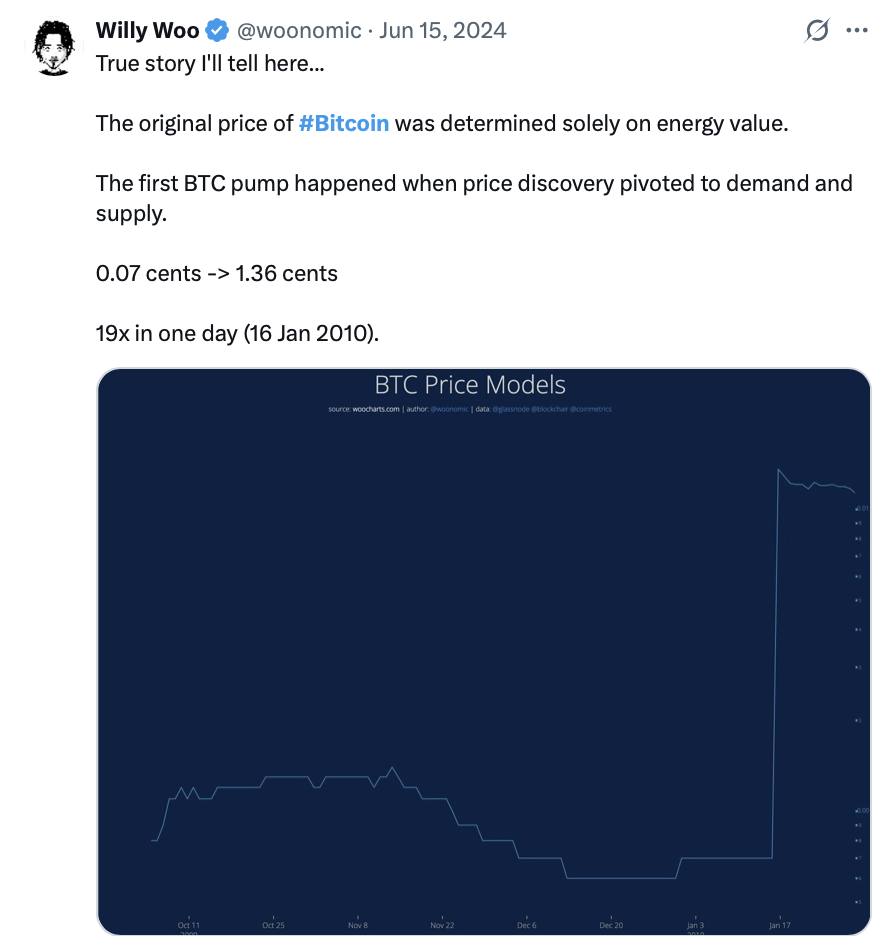

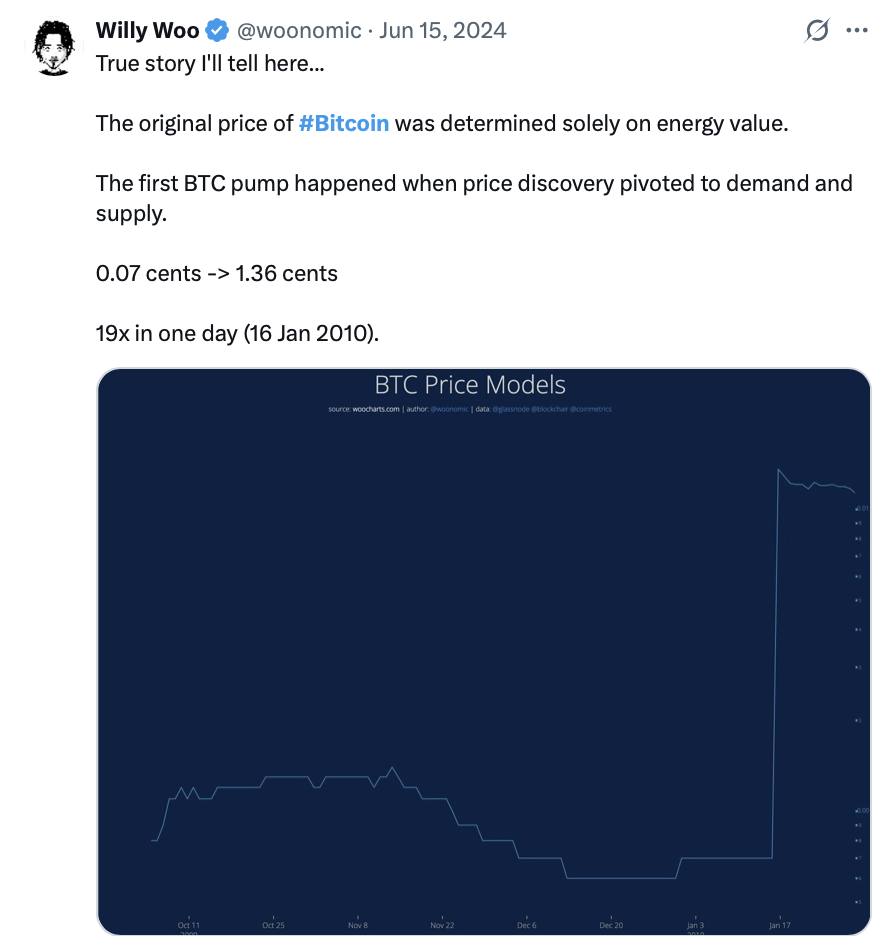

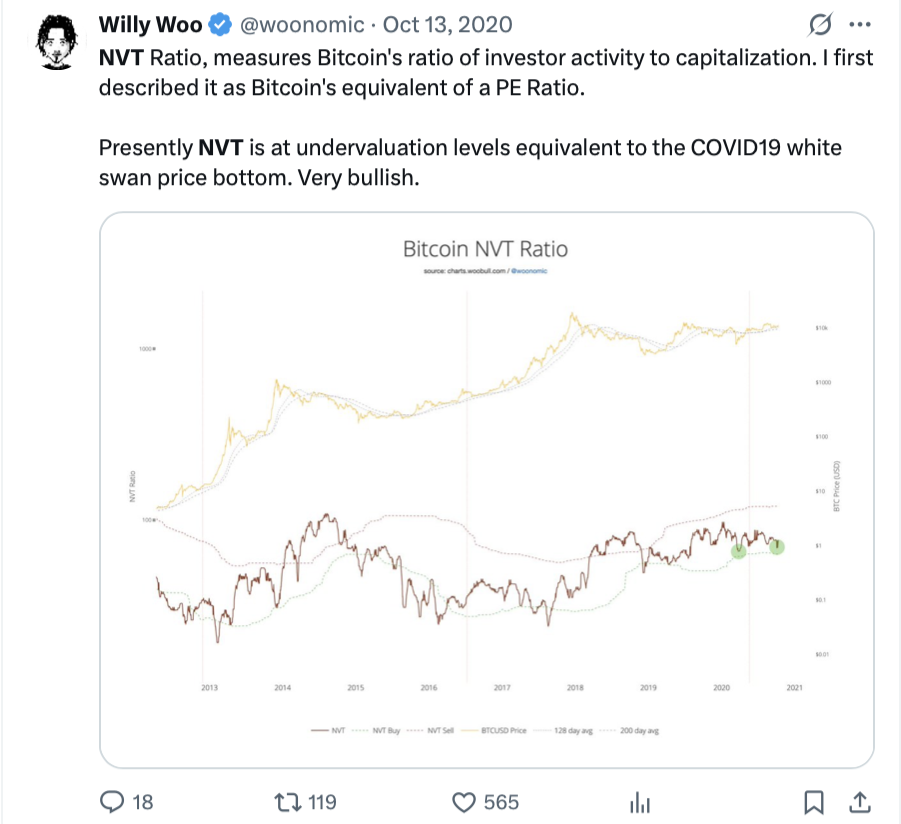

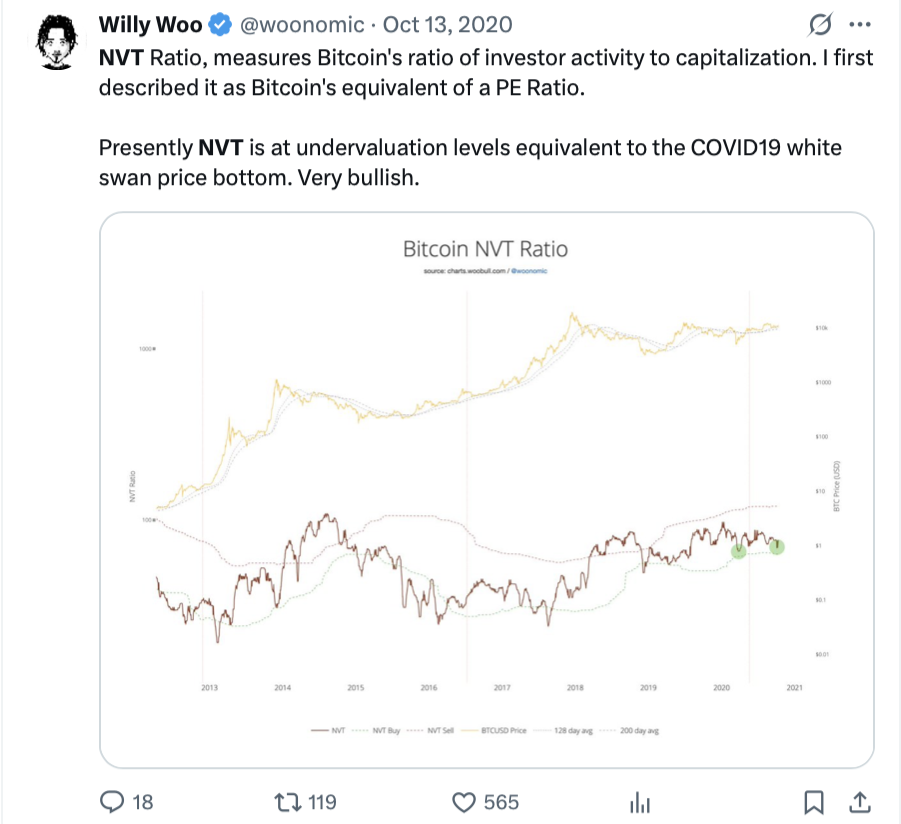

Through the years, Woo developed a number of of Bitcoin’s well-known onchain valuation metrics.

One he’s greatest identified for, the Community Worth to Transactions (NVT) ratio — which compares Bitcoin’s market cap to its transaction quantity — was created again in early 2017 after being requested on social media what the closest factor to a price-to-earnings ratio can be for Bitcoin, on condition that it isn’t an organization.

After creating the NVT ratio, Woo began getting observed within the international Bitcoin business.

Crypto information retailers started reporting on his posts on X extra typically, which made his follower depend climb even sooner

Then in 2021, he launched the “Provide Shock” valuation mannequin, which he used to accurately predict that yr’s Bitcoin rally to $55,000.

His web site is loaded with charts and metrics now broadly used within the Bitcoin business, creatively named “Woo Charts.”

Woo’s strategic transfer will not be for everybody

So Woo in all probability is aware of what he’s doing along with his decisive pivot towards Bitcoin enterprise tasks.

“I’m investing in issues that long-term will profit the Bitcoin cohort.”

Learn additionally

Asia Categorical

ETH whale’s wild $6.8M ‘thoughts management’ claims, Bitcoin energy thefts: Asia Categorical

Options

‘Deflation’ is a dumb strategy to strategy tokenomics… and different sacred cows

However earlier than you begin dreaming about quitting your job and doing likewise, Woo warns that investing in these sorts of tasks just isn’t straightforward. “It’s important to be strategic for the startup to convey you onto the funding cap desk,” he says.

“The valuations are very low, usually between 4 and 20 million for the entire worth, and hopefully it turns into a unicorn,” he provides.

The payoff may be huge. One massive winner for Woo was the crypto pockets supplier Exodus Pockets. “In 2016, they did a crowdfunding. I had a seed spherical in there, and it was the one pockets that had a extremely good UX on the time, and it had a great enterprise mannequin as properly,” he says.

Exodus raised $4 million within the spherical and listed on the NYSE American in December 2024 and now trades at a market cap of slightly below a billion {dollars}.

It wasn’t all the time true that early crypto tasks had been higher investments than Bitcoin. Woo says that if you happen to had invested in Coinbase’s early funding rounds in 2012, the returns by its 2021 IPO would have been underwhelming in comparison with merely holding Bitcoin over the identical interval.

“You’d underperform Bitcoin by 50%, such as you would have misplaced half your Bitcoin,” he says.

“Bitcoin was rising so robust in these early days. However immediately it’s extra dependable to outperform Bitcoin with a enterprise,” he provides.

Woo can also be happier not having to self-custody an enormous stack of Bitcoin anymore. “As soon as individuals know you’ve bought Bitcoin, that turns into a safety challenge,” he says.

In a means, it’s a return to Woo’s roots, as he was investing in early ventures earlier than Satoshi Nakamoto even launched cryptocurrency in 2009. “I’ve been within the startup area since means earlier than Bitcoin, and I like investing within the subsequent technology of founders,” he provides.

Bitcoin treasury firm increase is just like the “2017 ICO bubble”

Woo isn’t a fan of Bitcoin treasury corporations, though he’d take a place in Michael Saylor’s Technique throughout a bull market.

“I’ve stepped except for a number of this treasury stuff, like the newest wave jogs my memory of the 2017 ICO bubble, with insiders getting the early entry and so forth,” he says.

“I believe a number of them could have points on the bear facet,” he says. He’s not alone in considering this, with Glassnode lead analyst James Test not too long ago sharing that his “intuition is the Bitcoin treasury technique has a far shorter lifespan than most anticipate.”

Learn additionally

Options

‘Deflation’ is a dumb strategy to strategy tokenomics… and different sacred cows

Options

AI didn’t kill the metaverse, it should construct it — Alien Worlds, Bittensor vs Eric Wall: AI Eye

Woo not too long ago invested in Bitcoin lending platform Debifi, which permits Bitcoiners to maintain maintain of their personal key whereas borrowing fiat.

“The massive core a part of their know-how is a multi-key {hardware} kind of escrow for all of the events,” he says.

“I prefer it, as a result of it very a lot promotes self-custody,” he says earlier than admitting that sounds hypocritical given he’s not a “self-custody man.”

Woo says he has no issues with a various group of corporations holding belongings on his behalf.

“Every firm has a pockets with in all probability extra safety practices than a single particular person would ever have, even when they’re good at it.”

Woo is skeptical of Bitcoin getting “ridiculous quantity of FOMO”

Woo doesn’t suppose retail buyers are going to pile in and push Bitcoin to ludicrous new heights any time quickly.

“I’m not solely satisfied that we’re going to get this ridiculous quantity of FOMO,” he says.

Even when they got here in , he questions how a lot of a distinction it could actually make. “Does retail have the, you already know, the a number of billions per day to make a distinction?” he says.

“Clearly, Michael Saylor has been like the largest affect proper now along with his near 600,000 Bitcoin stack, in a short time,” he says.

$1M Bitcoin is ‘fairly pessimistic decrease sure’

When requested about when Bitcoin will attain $1 million, Woo says individuals should be clear whether or not that’s in immediately’s {dollars} or future {dollars}.

“I wish to know first, is that like inflation-adjusted?” he says.

Woo says that with inflation, a $1 million Bitcoin worth in 10 years actually simply means $500,000 in immediately’s cash.

“After we go lengthy vary, I believe we’ve to say, is that immediately’s cash or tomorrow’s cash?” he says.

However Woo confidently predicts that within the subsequent 10 to twenty years, Bitcoin can be buying and selling between $1 and $10 million in “immediately’s worth.”

“I believe 5 might be a pleasant candy spot,” he says, including that $1 million can be “fairly pessimistic decrease sure.”

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Ciaran Lyons

Ciaran Lyons is an Australian crypto journalist. He is additionally a standup comic and has been a radio and TV presenter on Triple J, SBS and The Undertaking.