Bitcoin’s derivatives market is heating up, with open curiosity climbing again to $42 billion whereas funding charges proceed to surge.

In line with knowledge shared by CryptoQuant, the market is experiencing a major uptick in leveraged exercise, suggesting each robust bullish sentiment and rising danger of liquidations.

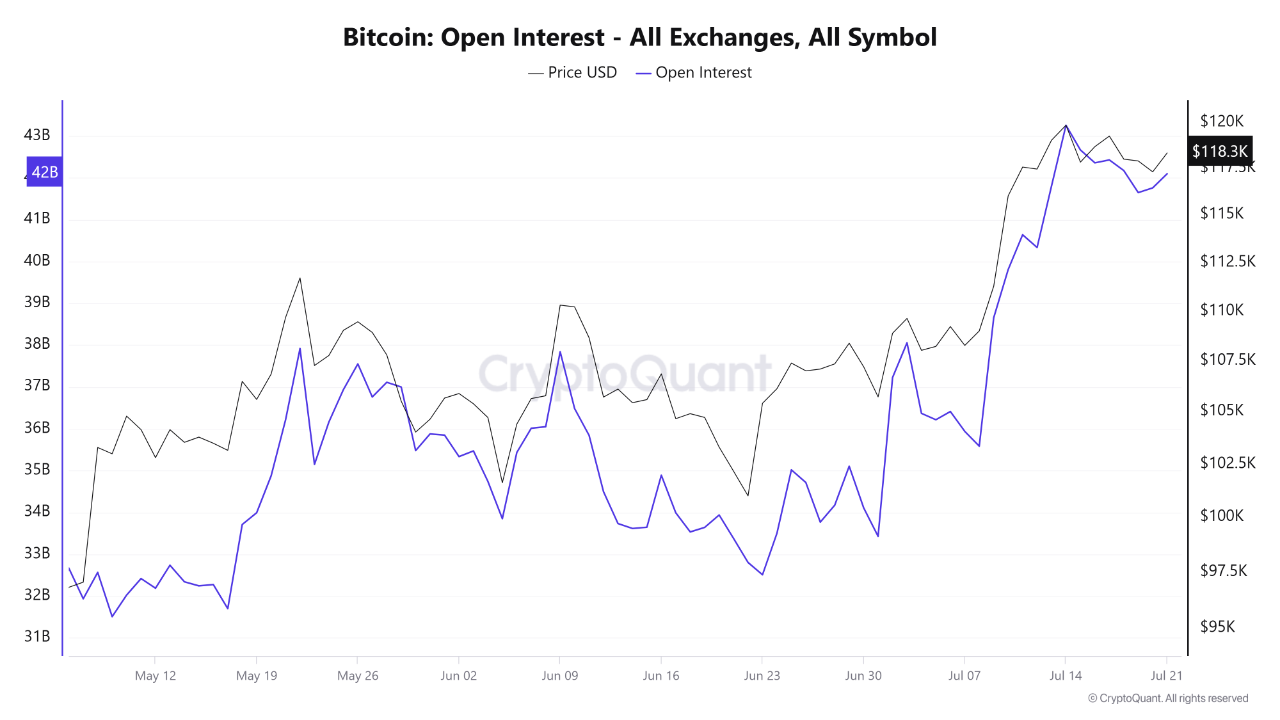

Excessive open curiosity indicators market momentum

Open curiosity in Bitcoin futures reached a latest peak of $43 billion and now sits simply barely decrease at $42 billion—nonetheless effectively inside traditionally elevated territory. This displays a big quantity of excellent contracts, indicating robust participation within the derivatives market. As BTC trades close to $118,300, the rising open curiosity suggests merchants are positioning aggressively forward of a possible transfer past the $120K resistance.

Traditionally, spikes in open curiosity coincide with elevated worth volatility. A build-up of leveraged positions—particularly in tight market situations—can result in speedy liquidations when costs swing sharply.

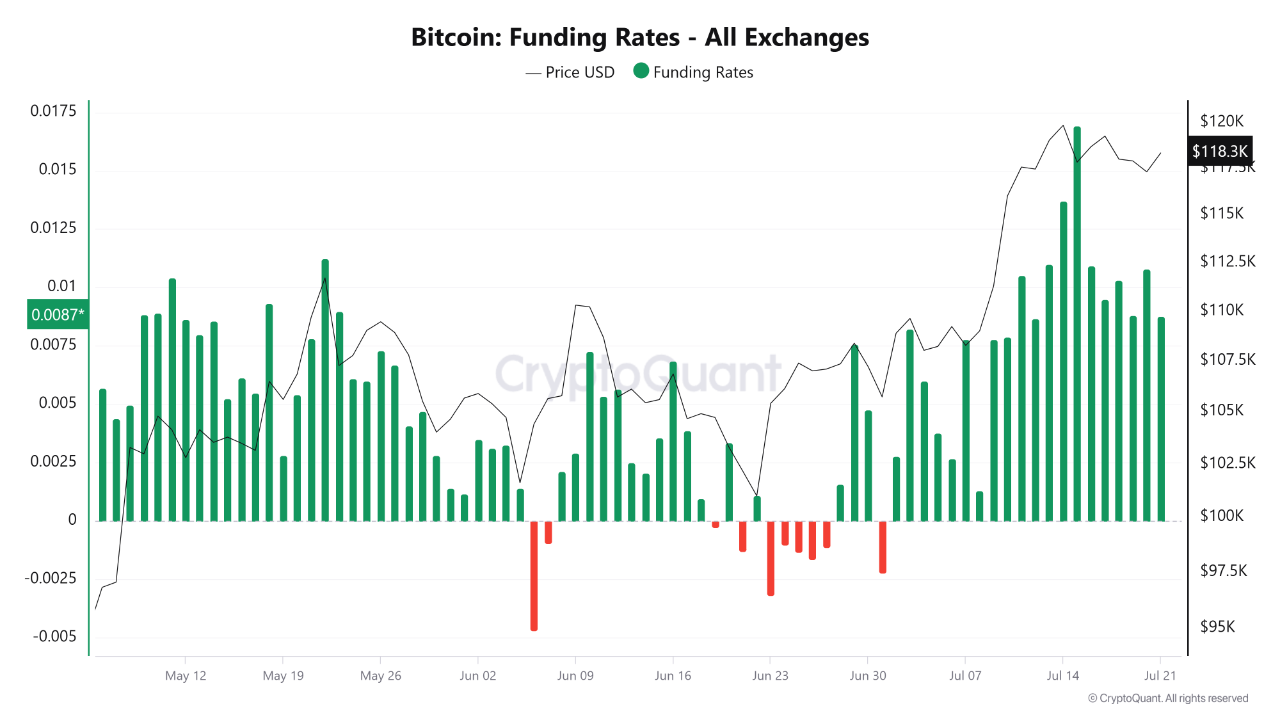

Rising funding charges mirror bullish bias

Funding charges throughout exchanges are trending larger, confirming that lengthy positions are presently dominating. The extra merchants are prepared to pay to take care of bullish bets, the extra upward stress there’s on funding ranges. CryptoQuant notes that elevated funding, when mixed with excessive open curiosity, typically displays extreme optimism.

This dynamic indicators a market in “greed mode,” the place merchants chase momentum. Nevertheless, it additionally raises warning flags, as crowded lengthy positions are susceptible to sudden corrections or liquidation cascades if the worth unexpectedly dips.

Leverage danger builds as merchants chase the rally

The present setup—excessive open curiosity and elevated funding—suggests merchants are aggressively deploying leverage to trip the rally. Whereas this could amplify short-term positive factors, it additionally will increase draw back danger. A sudden transfer in opposition to the dominant development might set off widespread pressured promoting and speedy place unwinds.

CryptoQuant analysts warn that exchanges might have to intervene by adjusting margin necessities or quickly limiting exercise if volatility surges. For now, Bitcoin stays close to $118K, however derivatives knowledge hints that the following large transfer—up or down—might come swiftly.